LTC holders could be over the moon thanks to this halving outcome

- Litecon bulls are taking advantage of the growing hype around the upcoming halving.

- A possible 200% rally could be on the cards for LTC after bouncing off support.

Litecoin [LTC] was showing some exciting signs of growth, especially in its price action which bounced off a major support. All the more reason to keep a close eye on its performance, as well as what is happening on-chain.

Read Litecoin’s [LTC] Price Prediction 2023-24

The upcoming Litecoin halving scheduled to take place in August is expected to be the biggest event coming to the network. As such, the excitement around this event has been building. But just how much of an impact will this event have on LTC’s price action? Perhaps past halvings might give us an idea of what to expect.

$LTC – Halvening in August

Historically, #LTC has rallied up to +200% leading up to its halving, and with #Litecoin set for its next halving in August, Santa is observing this very closely. ??

Likely a good idea to start buying spot $LTC in May, as history tends to rhyme… pic.twitter.com/jIJalxr749

— Crypto Santa (@Blockchainsanta) May 15, 2023

Based on BlockchainSanta’s analysis, Litecoin might be due for a potential 200% upside in the days leading up to the halving. This expectation is based on LTC’s historic performance during previous halvings. Litecoin might be worth over $250 if Litecoin lives up to its historic performance.

Litecoin’s rally outperforms top cryptocurrencies

LTC’s latest price action indicated that the rally has already begun. Its $89.27 press time price represented a 17% upside from its lowest level in the last four weeks. More importantly, the bounce occurred after an interaction with an ascending support line.

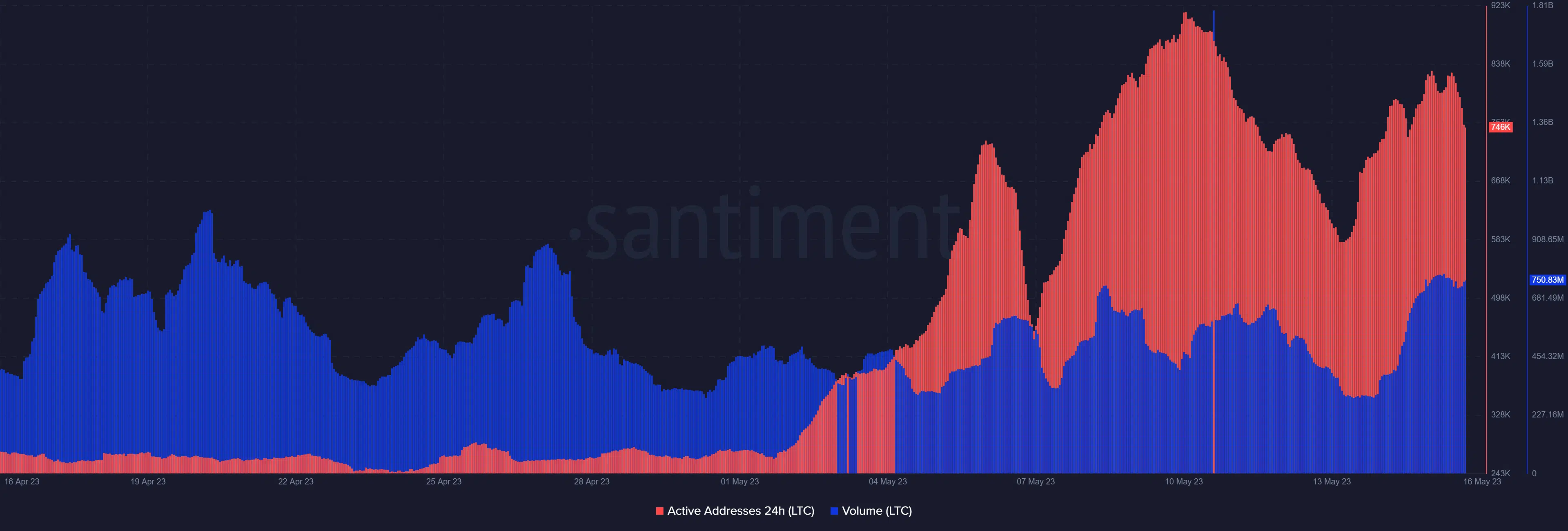

There was a significant likelihood that LTC may deliver that 200% upside in the next few weeks given the excitement surrounding the halving. This was clearly evident in some of Litecoin’s on-chain metrics. For example, daily active addresses were on the rise since the start of May.

Similarly, a rise in the on-chain volumes was also seen over the last few days.

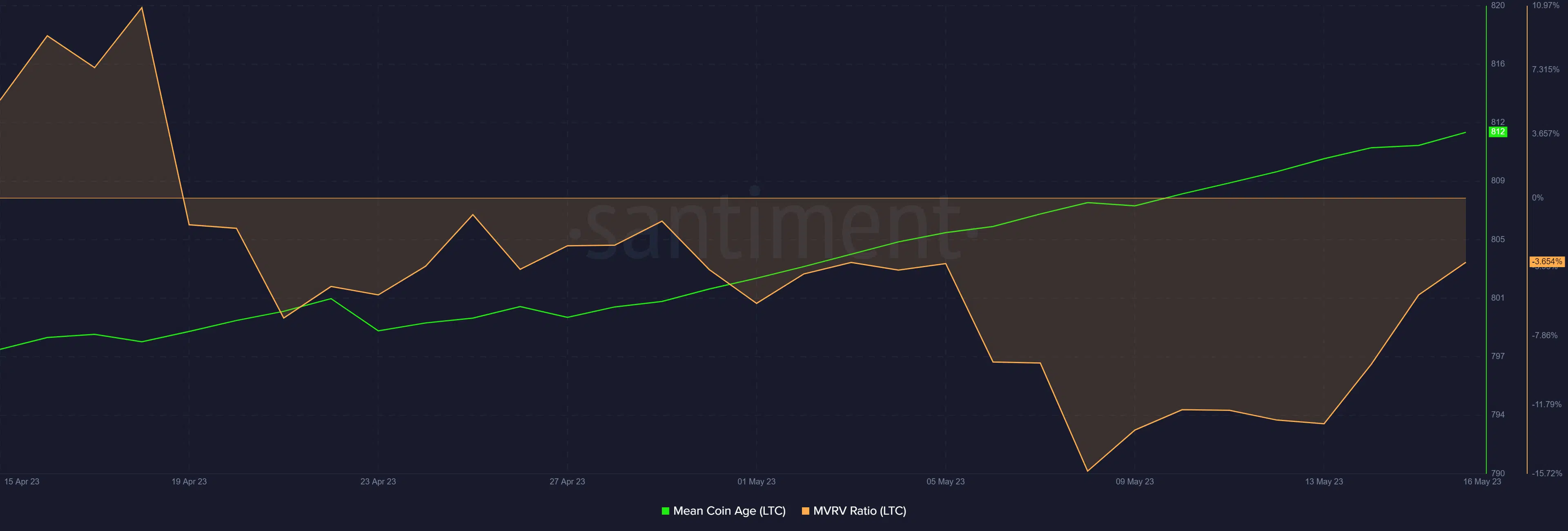

On-chain data also revealed that most of the buying was done by long-term holders. For instance, LTC’s mean coin age was seen on a steady upward trajectory in the last four weeks. This was an important observation because it underscores more probability of higher local lows. Nevertheless, it does not guarantee the absence of short-term sell pressure.

Litecoin’s MVRV ratio confirmed that there has been noteworthy short-term profit-taking during the last four weeks despite the higher mean coin age. It was also a more accurate representation of the price action.

Is your portfolio green? Check out the Litecoin Profit Calculator

The MVRV ratio has been on an upward trajectory since 8 May, indicating that most traders that purchased LTC since then, were in the money. Based on the above observations, Litcoin holders are shifting to a long-term focus and that may continue to lend favor to the bulls in Q2.