MATIC really depends on these holders; Here’s why…

- Polygon Developers announced the release of the Polygon Supernets’ latest test version with various features.

- At the time of writing, MATIC was seen in a position of recovery as its price action stood in the green.

Most altcoins were at their peak and operated in the green of the summer amid the ongoing altcoin season of 2023. Polygon [MATIC] too wasn’t far behind as it traded 5.03% higher in the last 24 hours as per data from CoinMarketCap.

That’s not all as Polygon did have something else in store. Polygon Developers, a Twitter account by the developers of Polygon announced the release of Supernets’ latest test version.

Read Polygon’s [MATIC] Price Prediction 2023-2024

As per the announcement, the test version would offer features including staking, bridge, EIP support, along with a few additional features.

We are thrilled to announce the release of Polygon Supernets' latest test version, v0.9 with features like staking, bridge, EIP 1559 support etc.

A major milestone towards the upcoming v1.0 production release ?https://t.co/4g8MVR2cHF pic.twitter.com/lCR4pK594a

— Polygon Developers (@0xPolygonDevs) May 17, 2023

The announcement also stated that this could be a significant move with regards to the upcoming v1.0 production release. But the question remains — did MATIC react positively to this? These metrics could offer some clarity.

To cheer or not to cheer?

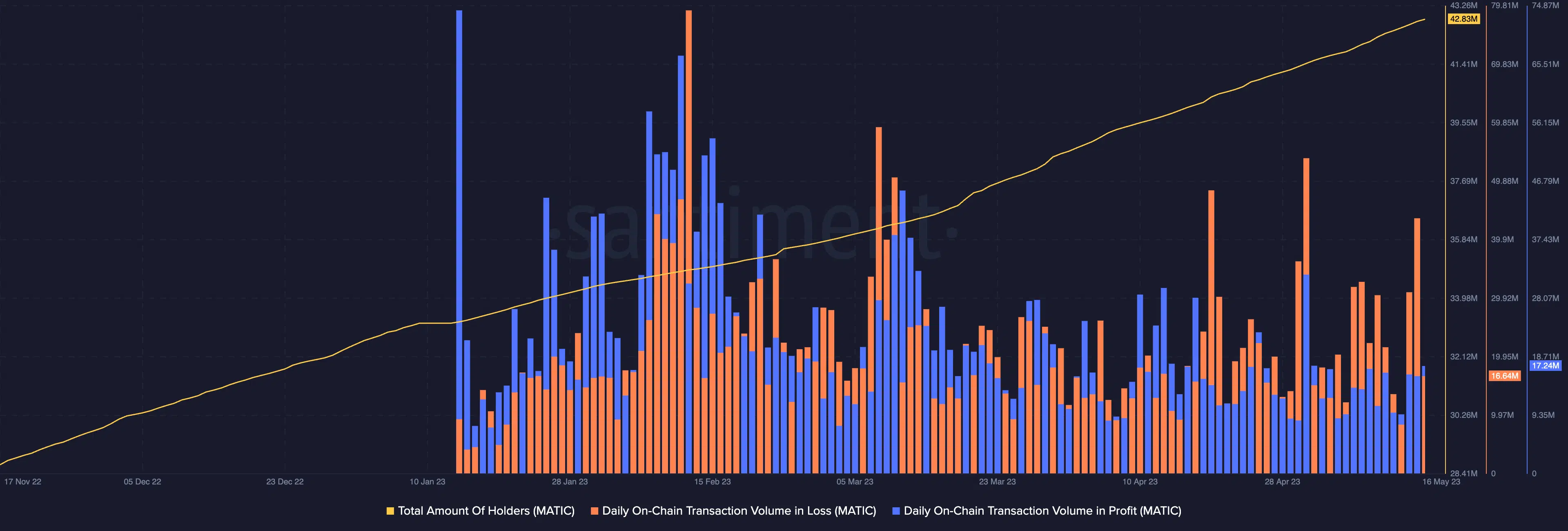

Data intelligence platform Santiment showed that the amount of MATIC holders witnessed a rise since December 2022. The metric, at the time of writing, stood at 42.8 million. Furthermore, a look at the daily on-chain transactions in loss (orange) stood at 16.6 million.

However, upon considering the daily on-chain transactions in profit (purple), it could be stated that addresses in profit outnumber the addresses in a loss. Although the difference between the two wasn’t extreme, most sellers stood in a profitable position at the time of writing.

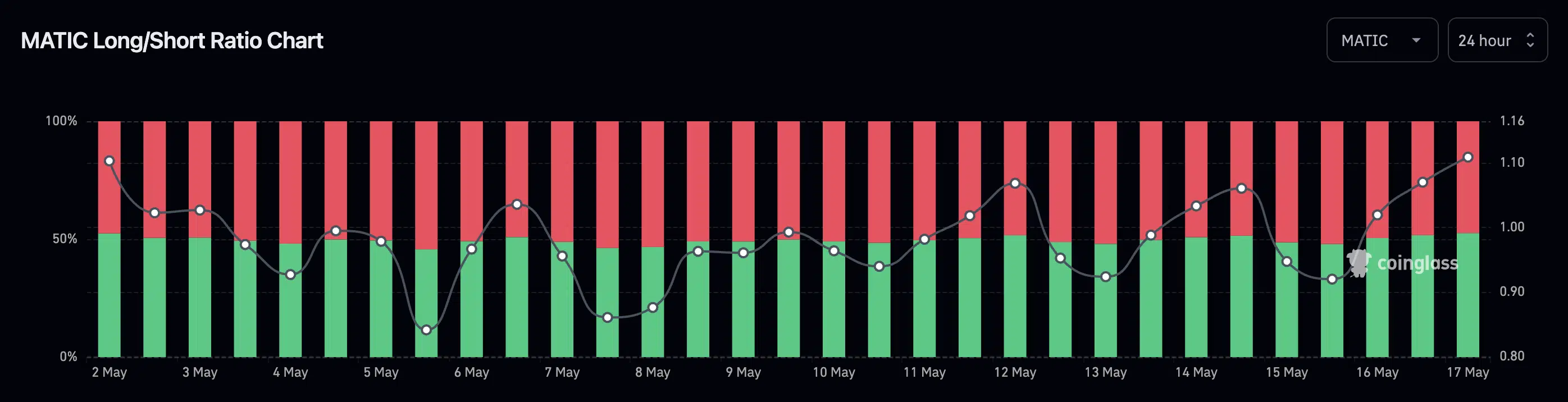

Furthermore, data from coinglass came bearing some good news. At the time of writing, MATIC’s long/short ratio stood at 1.0886. At press time, 52.19% of traders held long positions as compared to the 47.81% of traders that held short positions. This could be considered a bullish sign for the altcoin.

Have no fear when MATIC is here…

At press time, MATIC’s daily chart could be seen in recovery mode. This was because the Relative Strength Index (RSI), although below the neutral line, was seen in an ascending position. The RSI stood at 40.50.

Realistic or not, here’s MATIC market cap in BTC’s terms

Furthermore, the Chaikin Money Flow (CMF) could also be seen moving in an upward direction which could be taken as a buy signal. A look at MATIC’s Awesome Oscillator (AO) also indicated that, at press time, MATIC was operating in the green. This could be taken as a sign that the bulls were trying to gain control of the market.