Assessing the state of Litecoin [LTC] as it continues to outperform its peers

- LTC was one of the best-performing crypto assets over the last week.

- The Open Interest in LTC futures surged to its highest value since November 2021.

Bucking the broader market trend, Litecoin [LTC] racked up gains of over 15% in the last seven days, data from CoinMarketCap revealed. Bolstered by the rally, LTC stormed into the list of top 10 gainers in the crypto market in the last week.

LTC has been on a tear ever since users bogged down by rising transaction fees on the Bitcoin [BTC] network, chose to shift towards less expensive alternatives. The other driving force behind Litecoin’s increasing network traffic was the introduction of LTC-20 token standard. This is a fork from the BRC-20 standard on which Bitcoin Ordinals NFTs are based.

Is your portfolio green? Check out the Litecoin Profit Calculator

Network activity spikes but whales stay away

The overall market sentiment for LTC turned bullish, as per blockchain analytics firm IntoTheBlock. The price rally boosted the earnings of investors as about 58% of the holders realized profit at the current market price.

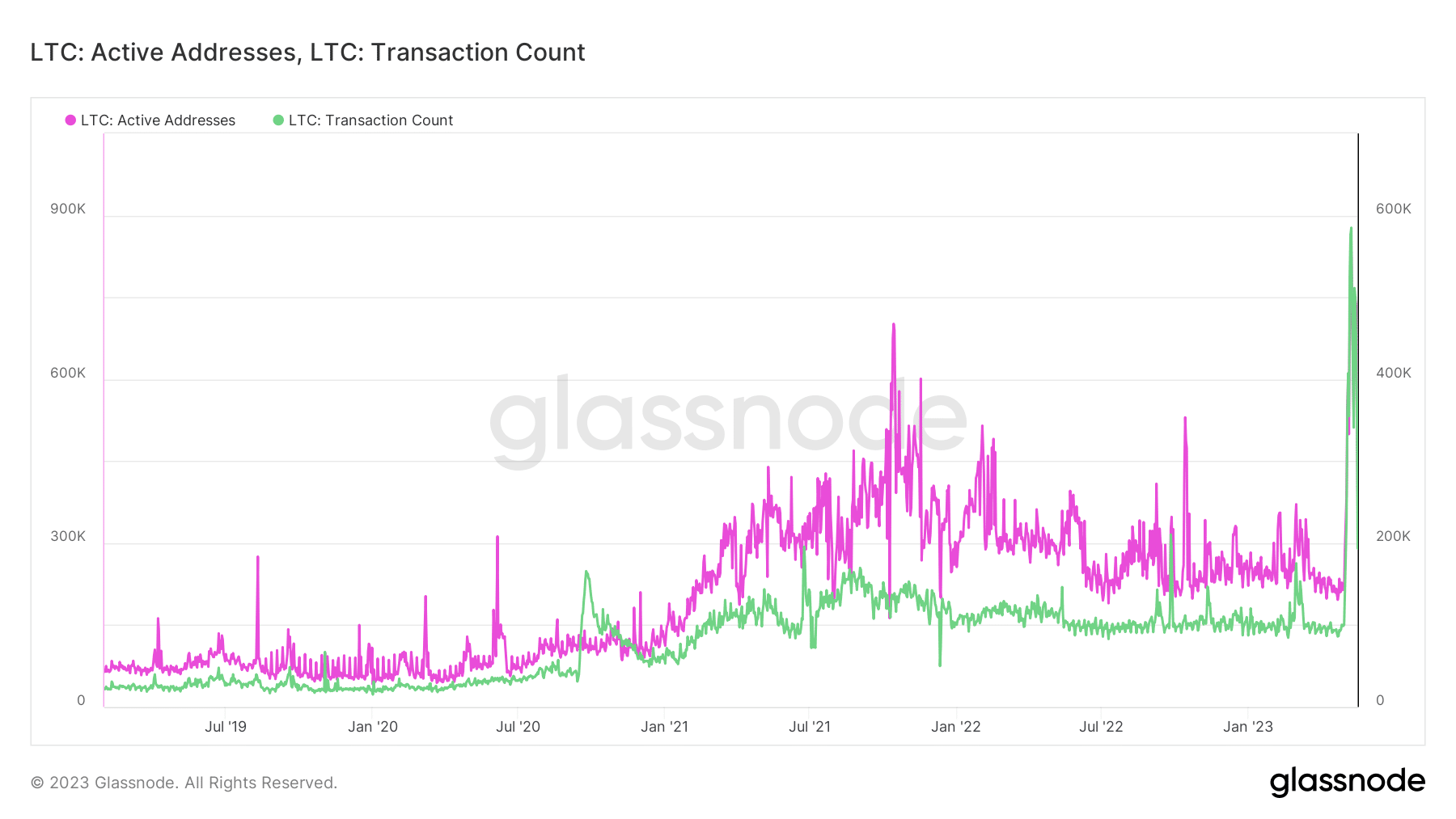

As mentioned earlier, network adoption increased significantly as more addresses made a transition from Bitcoin to Litecoin, also popularly known as “silver to Bitcoin’s gold”. As per Glassnode, the active addresses and transaction count reached an all-time high on 10 May, coinciding with Bitcoin’s transaction jam.

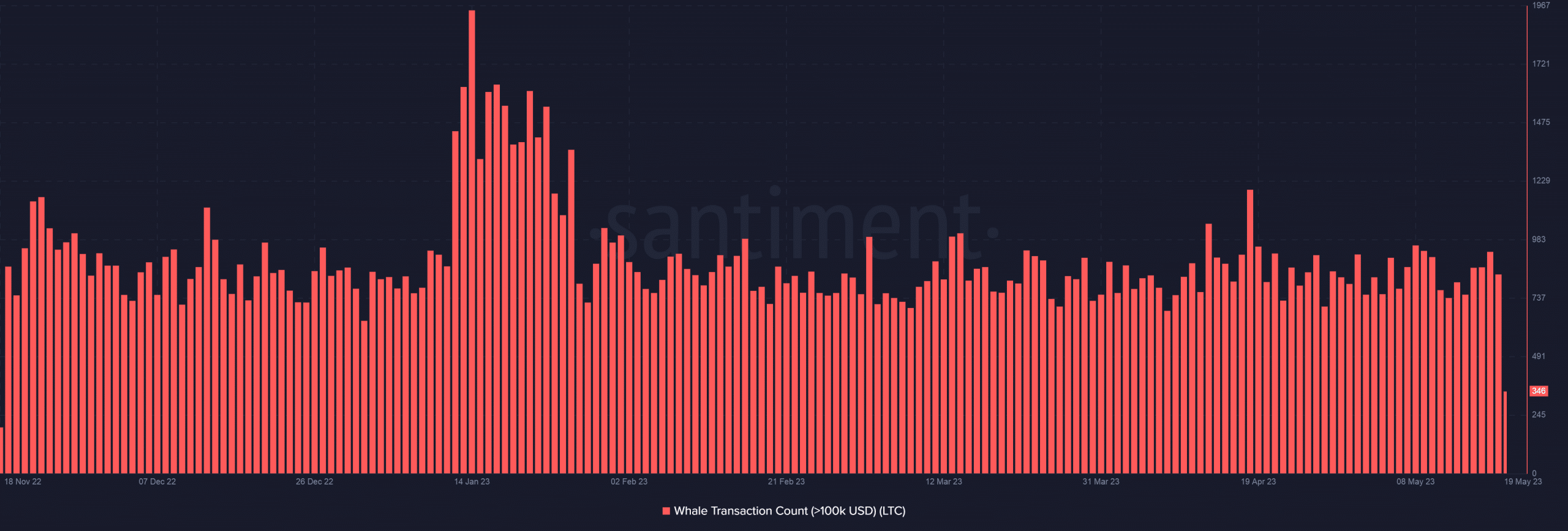

However, large addresses were yet to join the party as the number of transactions transferring tokens worth more than $100,000 didn’t show a noticeable spike. This was because the spurt in addresses was primarily driven by retail investors who created miniature sets of wallets holding between 0-0.001 LTC.

LTC chalks out an independent path

IntoTheBlock dashboard showed that LTC’s correlation with BTC fell to 0.34. A correlation close to 0 implies that the asset in question moves on a different wavelength when compared to BTC. This was an encouraging signal as LTC could become resistant to or less affected by changes in the price of BTC.

LTC’s upward momentum has led to a spike in the speculative interest in the coin. As per Coinglass, the Open Interest (OI) in LTC futures surged to $478.22 million on 18 May – the highest since November 2021. A rise in open interest indicates an influx of new money into the market.

How much are 1,10,100 LTCs worth today?

Most of the new positions were gunning for price gains as the funding rates were positive across most exchanges. Funding rates represent the cost of holding bullish long or bearish short positions with positive values implying the dominance of bullish leverage traders.