Polygon zkEVm falls behind StarkNet and zkSync Era, what next?

- Polygon zkEVM activity paled compared to StarkNet and zkSync Era.

- Polygon usage and MATIC market cap remained de-coupled.

Polygon [MATIC] has been performing well in the cryptocurrency space, with daily active users on its network staying consistent throughout market cycles. However, its underperformance in the zkSync space could impact the protocol’s future growth.

Is your portfolio green? Check out the Polygon Profit Calculator

Falling behind

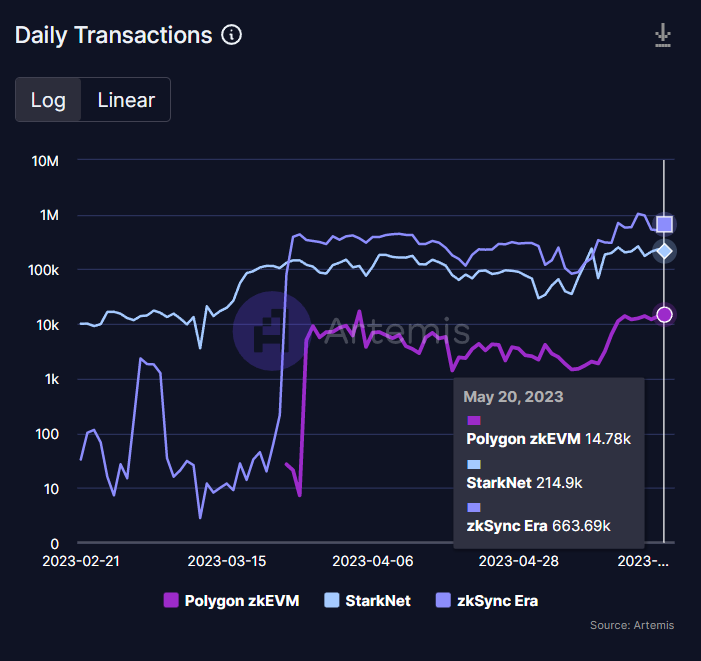

Based on Artemis’ data, the transaction volume on Polygon’s zkEVM reached 14,780, indicating lower activity compared to other protocols like StarkNet and zkSync Era. At press time, StarkNet recorded 214,900 daily transactions, while zkSync Era boasted of 663,690 daily transactions.

The surge in activity on StarkNet and zkSync Era could be attributed to AirDrop hunters waiting for token drops on both these protocols. However, as seen earlier with Arbitrum, if these protocols retain users, they could see significant growth and give Polygon a run for its money.

The decline in activity on the Polygon protocol could impact MATIC as well. At press time, however, Polygon’s usage and MATIC’s price were not directly co-related.

A strange relationship

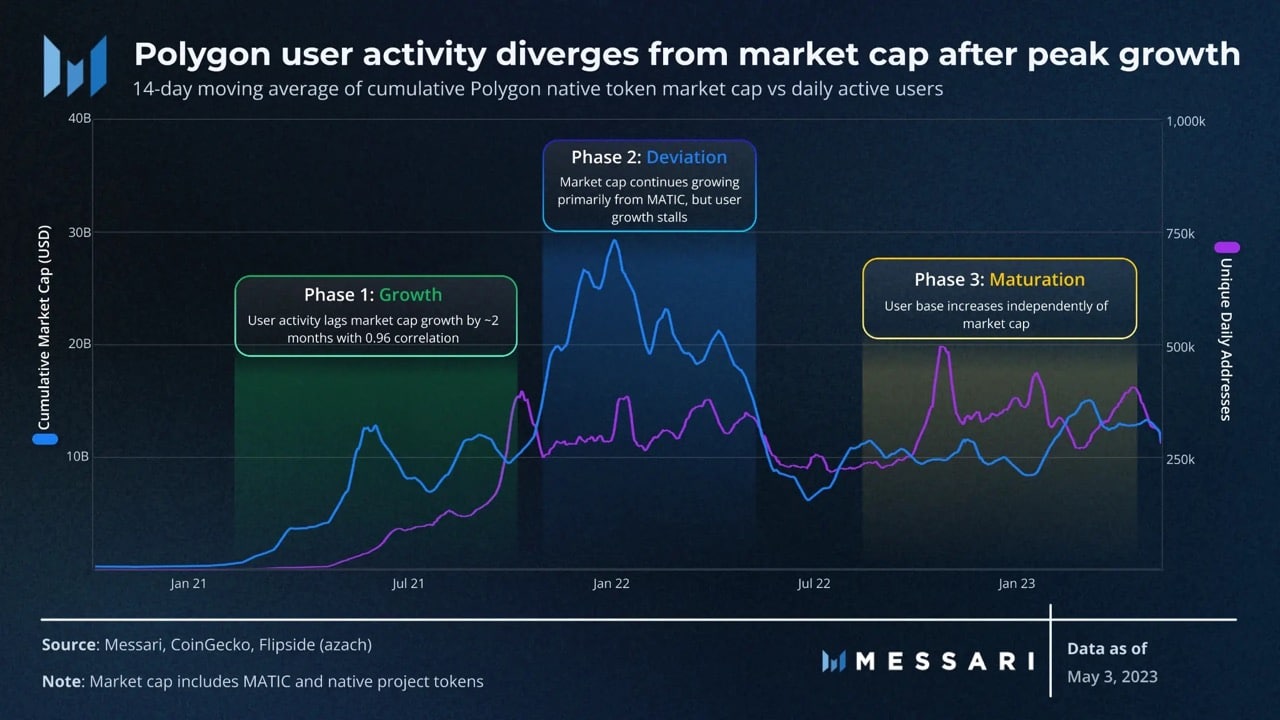

According to Messari’s data, the relationship between Polygon’s cumulative market capitalization and user base does not appear to move in tandem at a holistic level. Instead, their movements can be categorized into three distinct phases.

.@0xPolygon's cumulative market cap and user base do not appear to move in tandem, at least not at a holistic level.

Rather, there are three distinct phases in their movements:

+Phase 1: Growth

+Phase 2: Deviation

+Phase 3: Maturation pic.twitter.com/sYnugoD5Pu— Messari (@MessariCrypto) May 22, 2023

In the first phase, characterized as “Growth,” user activity lags behind market cap growth by approximately two months, with a correlation coefficient of 0.96. This suggests that as the market cap of Polygon grows, user activity follows suit, albeit with a slight delay.

The second phase, termed “Deviation,” reveals that market cap growth primarily stems from the performance of MATIC, Polygon’s native token. However, during this phase, user growth experiences a stall, indicating a divergence between market cap expansion and user base development.

Read Polygon’s [MATIC] Price Prediction 2023-2024

Finally, in the third phase, known as “Maturation,” the user base of Polygon shows independent growth regardless of market cap fluctuations. This suggests that the adoption and expansion of Polygon’s platform continues to attract users even when market cap dynamics may not directly influence user activity.

What is MATIC up to now?

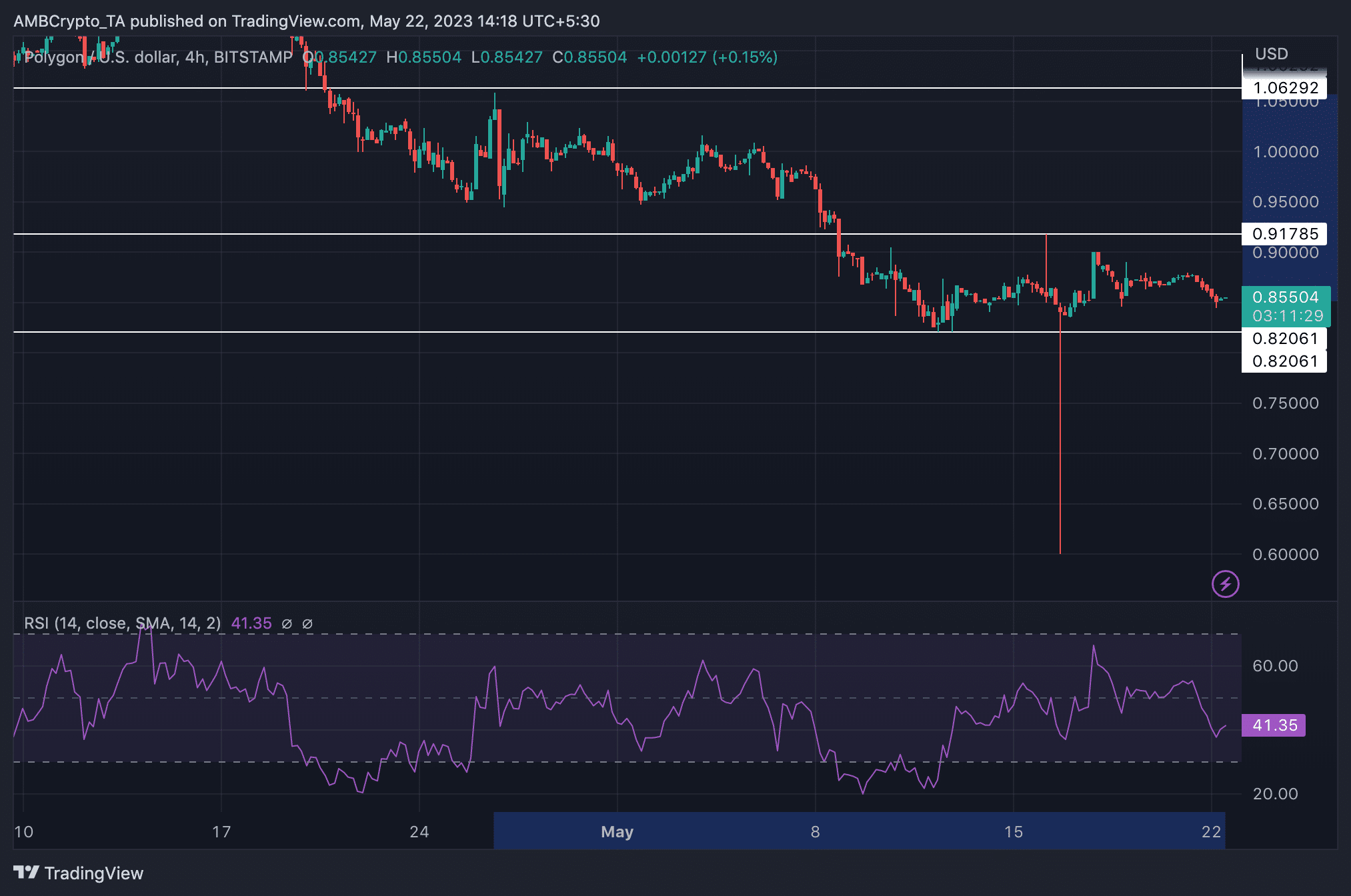

After testing the resistance level of $1.056 on 26 April, MATIC’s price fell by 19.43%. At press time, MATIC was trading at $0.851. Its RSI had declined significantly in the past few days, suggesting that momentum was with MATIC sellers at the moment.