Odds of XRP retesting these levels are…

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- XRP rallied over 10% between Tuesday (16 May) and Friday (19 May).

- CVD flattened over the weekend; it rose slightly at press time.

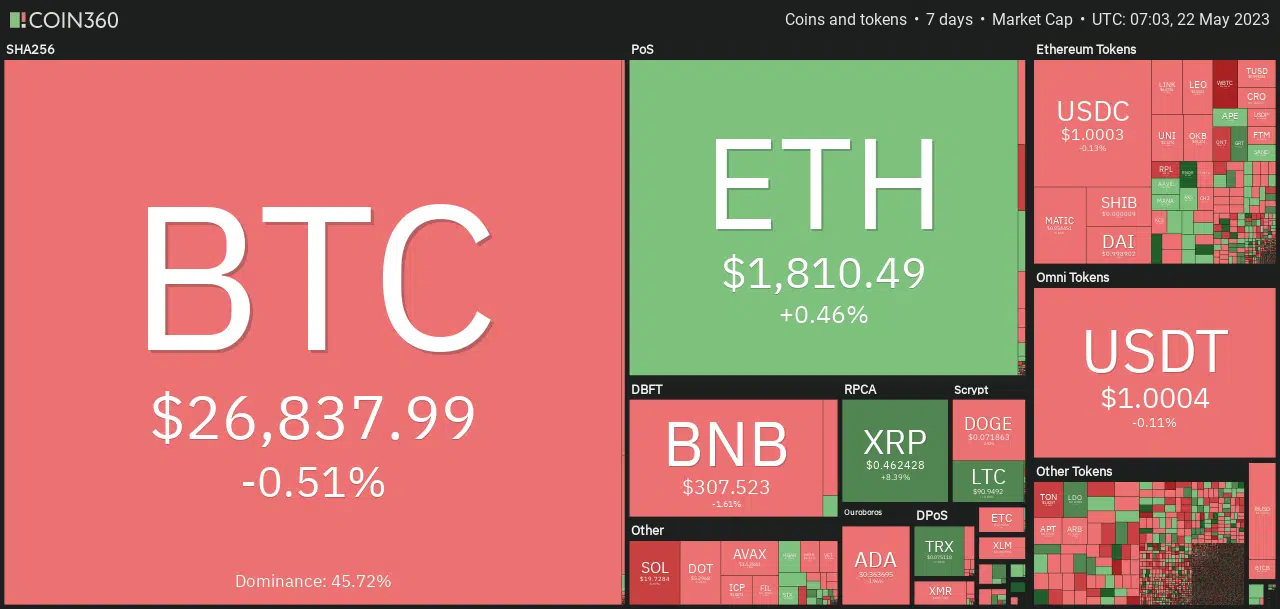

Ripple [XRP] bulls remained steadfast and cashed gains despite the overall bearish sentiment last week. Amongst the top 20 crypto assets, XRP was an outlier, posting over 8% gains on the weekly front, according to CoinMarketCap. The weekly performance was only closely followed by Litecoin [LTC] at 7%.

Is your portfolio green? Check out the XRP Profit Calculator

However, Bitcoin [BTC] was stuck in the $26k price zone as of press time and could constrain strong upside movement, even for XRP.

Despite the ongoing legal proceedings, the Ripple team unveiled plans to be a go-to-platform for CBDC development for countries, governments, and financial institutions. Could this fuel further bullish momentum, or will BTC’s fluctuations curtail it?

What’s next for XRP?

The strong rally from 16 May saw XRP rally over 10% by 19 May, as per the price range tool on TradingView. Initially, the price faced rejection at the former mid-range level of $0.4604, but bulls later smashed it on 18 May.

After that, the price has been swinging on either side of the mid-range. The strong rally on 18 May left an FVG (fair value gap) zone of $0.451 – $0.459 (white). So far, the price has reacted positively to the FVG and could be a demand zone.

But bulls may be slowed near the recent highs at $0.4757 if BTC fluctuations below $27k persist. If BTC reclaims $27k decisively, a retest of the former range high of $0.487 could be feasible.

Conversely, a session close below the FVG zone and $0.4412 could tip sellers to sink XRP to former range lows of $0.433.

Meanwhile, the RSI’s value was 56, indicating increased buying pressure. Similarly, the OBV has risen since May 12, showing improved volumes in the same period.

CVD eased over the weekend, but …

How much are 1, 10,100 XRPs worth today?

On the one-hour chart, the CVD (cumulative volume delta) spot has been positive and rising since May 12. It shows buyers dominance and bullish sentiment. However, the indicator eased over the weekend, only to rise slightly at press time.

The global funding rates for XRP have remained exceptionally positive since May 16 – a bullish short-term outlook. Although these favor bulls, investors would want to track BTC price action for well-optimized trade set-ups.