All you need to know about Synthetix’s latest move

- Synthetix makes a move to expand its perps portfolio with seven additional digital assets.

- SNX sees a resurgence of sell pressure after previously delivering a bullish performance.

The Synthetix network just announced that it extended its perps support for at least seven extra assets. This move may deliver more utility at a time when its native token SNX has been delivering a bullish performance.

Read Synthetix’s [SNX] price prediction 2023-24

Will Synthetix’s newly added perps fuel more bullish confidence? First, let’s take a deeper dive into what the latest announcement from the network is all about. For those that are not aware, perps can be described as on-chain futures options. They are ideal for anyone looking to trade crypto derivatives instead of spot assets.

Fantastic news! Synthetix Perps now supports $PEPE, $SUI, $BLUR, $XRP, $DOT, $FLOKI, and $INJ. 7 new markets & 300K in $OP trading rewards are available this week.

Synthetix Perps now has 40 total perps. ? ? ? ?

Learn more ?https://t.co/k3d9XEsv3X pic.twitter.com/sBQpQ1xAz1

— Synthetix ⚔️ (@synthetix_io) May 23, 2023

Some of the underlying assets for which Synthetix just launched perps have been in high demand, recently and Pepe is an ideal example. This means Synthetix is looking to tap into the excitement around these assets. Strong demand for the newly supported perps may fuel more utility for the SNX token, but is it enough to support SNX’s upside?

SNX bulls encounter resistance at the 50-day MA

Synthetix’s native cryptocurrency SNX delivered a 33% upside since 12 May. This bullish performance outperformed some of the top cryptocurrencies including Bitcoin and Ethereum.

Although the latest Synthetix news revealed the likelihood of more demand, SNX’s price action demonstrated some selling pressure in the last 24 hours. This was after a brief surge above the 50-day moving average.

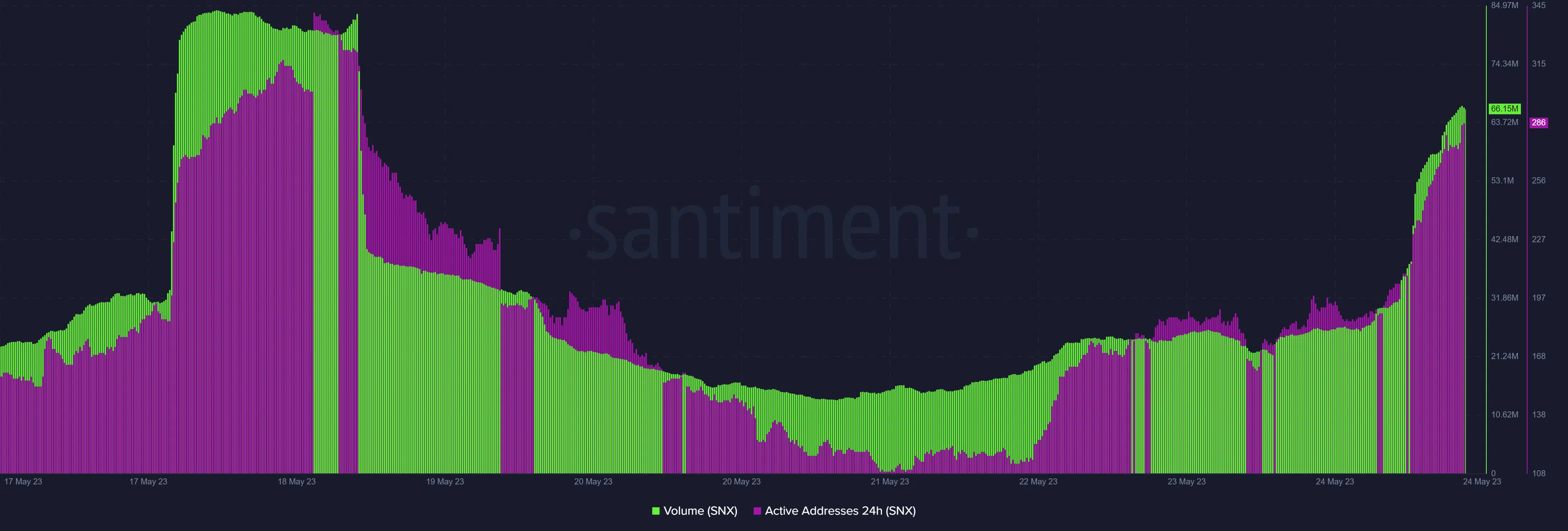

Note that the pullback occurred after its MFI dipped into overbought territory and right above the RSI’s mid-level. SNX volume registered a substantial volume spike in the last 24 hours. This was also consistent with a spike in daily active addresses to the highest point so far this week.

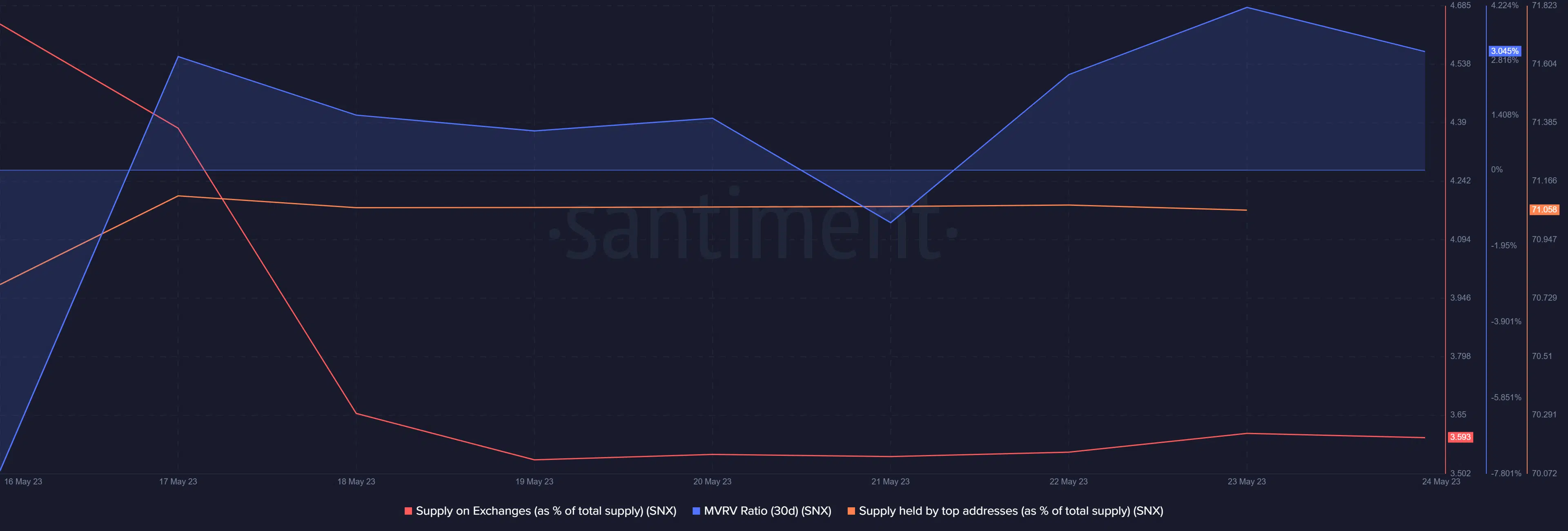

So why did the price fall despite the volume and active addresses surge? The bearish outcome in the last 24 hours occurred a day after the supply held by top addresses registered some outflows.

Meanwhile, there was an increase in the supply held on exchanges within the last three days. This indicated a build-up of sell pressure.

A possible explanation for the resurgence of sell pressure was that whales have been securing short-term profits. The surge in volume reflected an influx of liquidity from retail traders, hence offering exit liquidity for whales.

Is your portfolio green? Check out the Synthetix Profit Calculator

It is still too early to tell whether SNX will extend this pullback or whether this is just a bit of a cool-down before the rally continues. Nevertheless, the recently added perps may fuel long-term demand for the SNX token.