Ethereum: L2 data fees reaches ATH, how the spoils were shared

- The hike in fees denotes a 5x increase from the value when the year began.

- Among all L2 projects, Arbitrum remains the one with the most market share.

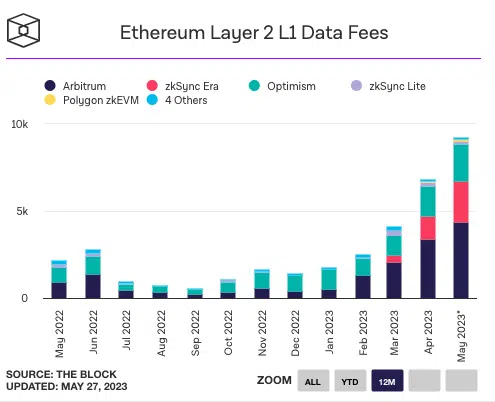

Layer two (L2) solutions under the Ethereum [ETH] blockchain have sustainably gained traction as a means of addressing the network’s scalability and high transaction fees. As a result, the L2 data fees on Ethereum reached an All-Time High (ATH), according to data from The Block.

Read Ethereum’s [ETH] Price Prediction 2023-2024

L2 data fees refer to the costs associated with transferring data and executing transactions on L2 networks built on top of Ethereum L1 Mainnet. As more users and applications utilize L2 solutions, the demand for processing transactions off-chain surges, reflecting increased usage and demand for these scaling solutions.

More for optimistic; ZK hoping to catch up

From the data displayed above, both optimistic rollups and Zero-Knowdedge (ZK) rollups contributed to the milestone. However, it was notable to mention that Arbtirum [ARB] and Optimism [OP], which fall under the optimistic rollup, did more than their ZK counterparts.

For the month of May, Arbitum contributed a whopping 47.3%. Optimism, on the other hand, grabbed 23.04% of the spoils. While ZK rollups only played second-fiddle, zkSync helped to beat off the Optimism competition by taking 25.38% of the total $16.2 million registered.

The rise in these data fees indicates the growing adoption and utilization of these networks. Also, it could be connected to the spike in transaction fees on the Ethereum Mainnet.

Meanwhile, there was a noteworthy observation from the publishing fees record. And it was that of the Polygon [MATIC] zkEVM. Despite the hype around its launch in Beta, the project seems to have lost the goodwill initially accustomed to it, taking only 1.03% of the fees.

Ethereum: TVL competition drying up

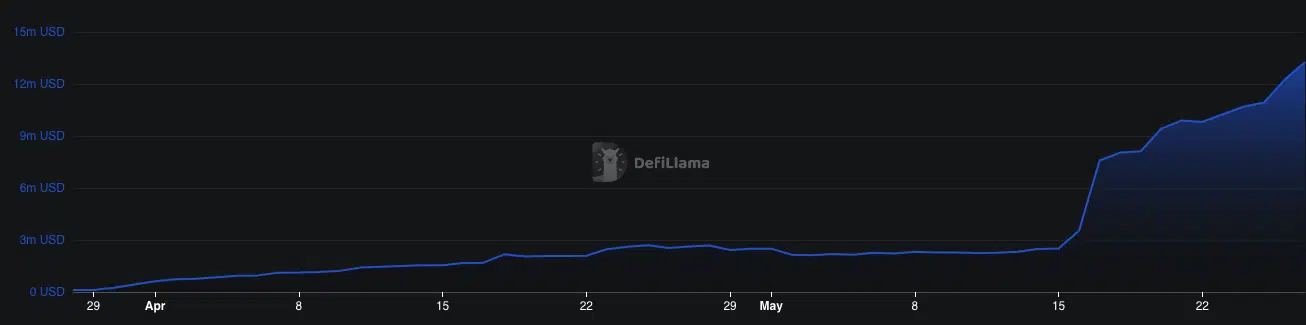

This decline has also extended to its Total Value Locked (TVL) performance. Although DefiLlama showed that the metric increased, it was far below its major competitors at $13.27 million.

The TVL is widely used as a liquidity pool for smart contract lending and staking in a blockchain node. When the metric increases, it means that a protocol’s health is superb. But when it decreases, it opens up threats to the protocol and serves as an indicator of starved liquidity.

Realistic or not, here’s ARB’s market cap in MATIC terms

zkSync Era was also ahead of Polygon zkEVM with its TLV at $127.63 million. In the optimistic landscape, it was an entirely different case. For Optimism, it seems to have maintained some sort of stability at $889.36 million. Like it was with the data fees, Arbiturm also took the top spot with a TVL of $2.34 billion.

As it stands, optimistic rollups seem to have the hearts of investors. And as such, the ZK cohort would need to do more to impress and improve in market share.