China – 1, USA – 0 in the crypto-regulatory battle? Maybe, but…

- China unveiled a white paper in a bid to establish its capital Beijing as a global innovation hub for the digital economy.

- China re-entered the top 10 of Chainalysis’ Global Crypto Adoption Index report for 2022.

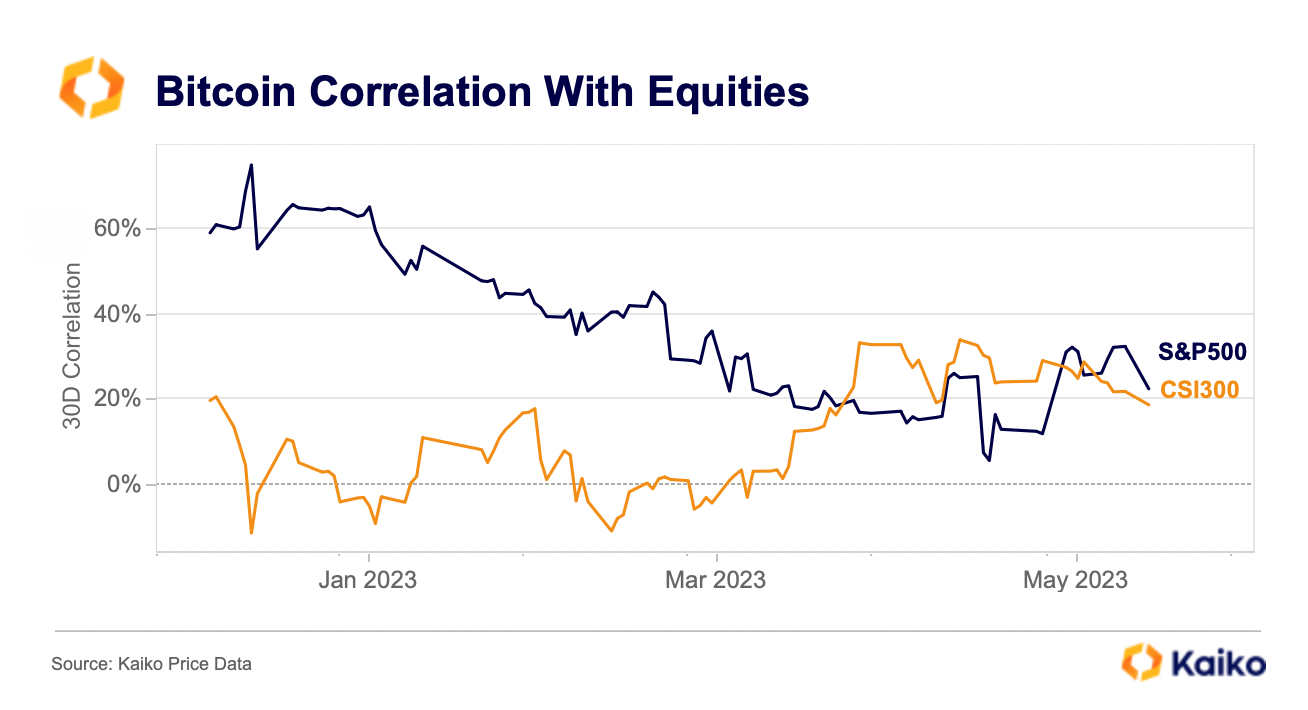

A fascinating trend was seen emerging in the cryptocurrency industry, capturing the attention of various analysts and major players. As per digital assets market data provider Kaiko, a noticeable divergence emerged between Bitcoin’s [BTC] correlation with U.S. equity markets (S&P 500) and that of Chinese equities (CSI 300).

The correlation between BTC and Chinese equities (CSI 300) strengthened considerably in 2023. This was in sharp contrast to the king coin’s falling correlation with U.S. equities. The U.S. banking crisis of March led investors to put their funds in the crypto market. This ended up playing a big part in decoupling BTC from traditional finance.

While the regulatory landscape in the U.S. has become tough for crypto market participants, a new ray of hope was coming from China.

Crypto 2.0 in China?

The aforementioned development could be attributed to recent indications of China reopening its market to the digital assets industry.

The Beijing Municipal Science and Technology Commission published a white paper at the Zhongguancun Forum on 27 May, in an effort to establish the Chinese capital as a major global innovation hub for the digital economy. Additionally, the commission plans to set aside $14 million to achieve this goal.

The latest attempt to foster its Web3 industry comes as a marked departure from its earlier crackdowns. Recall that China put a complete ban on cryptocurrency trading and mining in September 2021.

China was one of the first countries to embrace crypto assets, ushering in an age of growing awareness and trading from 2009 to 2018. At one time, China was the BTC trading and mining capital of the world. However, after the blanket ban, it ceded its position to the U.S.

But things may take a turn in favor of China given its latest move. Furthermore, crypto czars have given a thumbs up to the white paper. Furthermore, Binance CEO CZ called the timing of the release “interesting” as Hong Kong’s new crypto regulations are set to come into effect from 1 June.

Tron founder Justin Sun retweeted CZ’s tweet and called the government’s focus on Web3 as “fascinating”.

Interesting timing on this Web 3.0 white paper from the Beijing government tech committee with the June 1st anticipation in Hong Kong. pic.twitter.com/0Ts1UB0jnL

— CZ ? Binance (@cz_binance) May 27, 2023

Is your portfolio green? Check out the Bitcoin Profit Calculator

Interestingly, China re-entered the top 10 of Chainalysis’ Global Crypto Adoption Index report for 2022 after slipping to the 13th position in the 2021 report. This feat coming despite China’s ban on cryptos meant that the ban was ineffective. Additionally, it could also mean the ban was loosely enforced, the report mentioned.