Staked ETH finds new purpose with Eigenlayer’s whitepaper

- The EigenLayer team was preparing for a phased mainnet launch.

- ETH staked on the network saw a 16% growth since the Shapella Upgrade.

Security has been a fundamental challenge of Web3 since its inception. Ethereum’s [ETH] transition to a proof-of-stake mechanism was a significant advancement as it enhanced decentralization and security while reducing the energy consumption associated with mining activities.

The network is secured by economic incentives and validators have to lock up 32 ETH. This is done to ensure that validators don’t go rogue and indulge in malicious activities like the 51% attack.

While this strategy contributes to the security of the base layer, the benefits are not passed on to other applications developed on top of Ethereum. These include sidechains, bridges, and oracles and leaving them to develop their own security might not be as efficient.

Additionally, the sharp rise in the number of bridge hacks in 2022 exposed the vulnerabilities.

A game changer for Web3 security?

EigenLayer is protocol built on Ethereum that allows ETH stakers to participate in validating new software modules developed on top of the Ethereum ecosystem, according to its white paper.

The protocol introduces what it calls “restaking” i.e, staked ETH will be repurposed to extend security to other applications. And the security gets shared across the ecosystem.

EigenLayer will function as a middle layer giving users the right to choose which module they wish to secure using their staked ETH. Validators will earn extra yield in return as the staked ETH is used for securing additional applications.

Moreover, apart from staking ETH natively, validators will have an option of staking the liquid derivatives of their staked assets such as Lido Staked ETH [stETH].

Since the publication of its white paper, the project received great attention, with many experts praising its novel idea. The protocol was successfully launched on testnet in April and the team was preparing for a phased mainnet launch.

Is your portfolio green? Check out the Ethereum Profit Calculator

The stakes are high

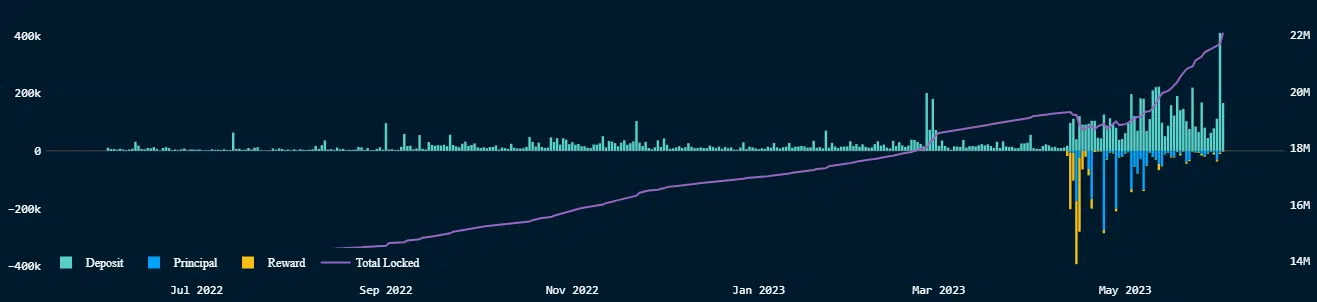

As per the Nansen dashboard, the amount of ETH staked on the Beacon chain has surged to 22.36 million at the time of writing. The move showed a significant 16% growth from what it was during the Shapella Upgrade on 12 April.

Even during the last 24 hours, there was a net deposit of 182k ETH. This suggested that users had more confidence in the staking mechanism.

At the time of writing, ETH exchanged hands at $1,905.35, a marginal increase in the 24-hour period, as per CoinMarketCap.