Why Bitcoin will not retest $20,000 anytime soon

- The possible increase in the U.S. CPI and bank withdrawals could ensure Bitcoin’s price rise.

- BTC’s short-term projection remained bearish at press time.

BitMEX co-founder Arthur Hayes published a Substack newsletter, explaining why Bitcoin [BTC] will not lean toward $20,000 ahead of the next bull run. In an article titled “Patience Is Beautiful,” Hayes pointed to several factors as reasons for his projection.

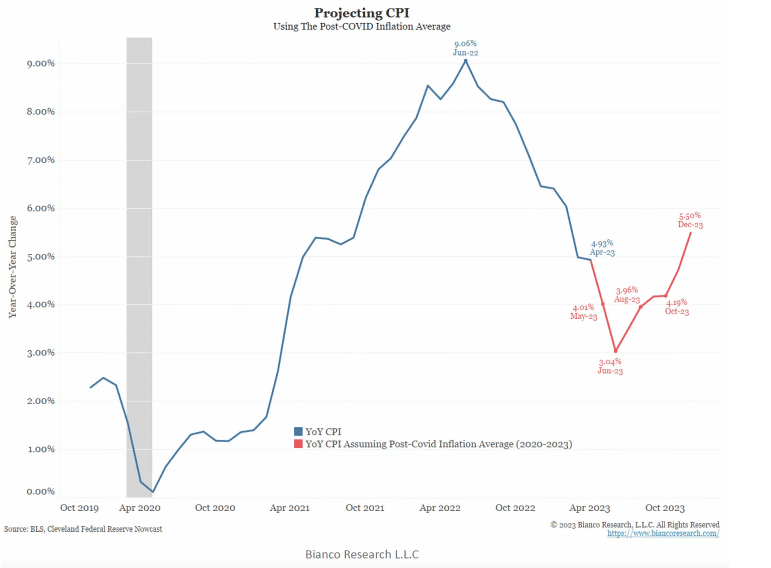

Some points he raised included the Consumer Price Index (CPI) and the crises in the U.S. banking sector. For context, the Consumer Price Index is a key economic metric that measures the overall change in consumer prices based on the cost of goods and services.

A high CPI is Bitcoin’s gain

Regarding the CPI, the current Chief Information Officer (CIO) of the exchange noted that inflation would reach a local low in the country before re-accelerating later in the year. He wrote,

“Due to the statistical phenomenon known as the base effect, the high month-on-month (MoM) inflation readings of 2022 will drop out to be replaced with lower MoM inflation readings of summer 2023.”

Hayes also agreed with Bianco Research’s CPI projection of above 5% by December 2023. Notably, a higher CPI indicates higher inflation.

Prior to his latest release, the former exchange CEO had said that the debt profile of the U.S. Treasury would drive more demand for Bitcoin.

Outflow from the banks

Concerning the banking system crises, Hayes opined that investors would most return to the action of 2020 and 2021.

During that period, a large percentage of investors moved their funds from the traditional sector to the money market and other markets that offered better yields.

Interestingly, it seemed that investors were already taking action, based on the Federal Deposit Insurance Corporation (FDIC) Q1 report.

The agency noted that total deposits decreased for the fourth consecutive quarter, as it mentioned,

“Total deposits declined $472.1 billion (2.5 percent) between fourth quarter 2022 and first quarter 2023. The quarterly decline is the largest reduction reported in the QBP since data collection began in 1984. This was the fourth consecutive quarter that the industry reported lower levels of total deposits.”

Bears in the price action

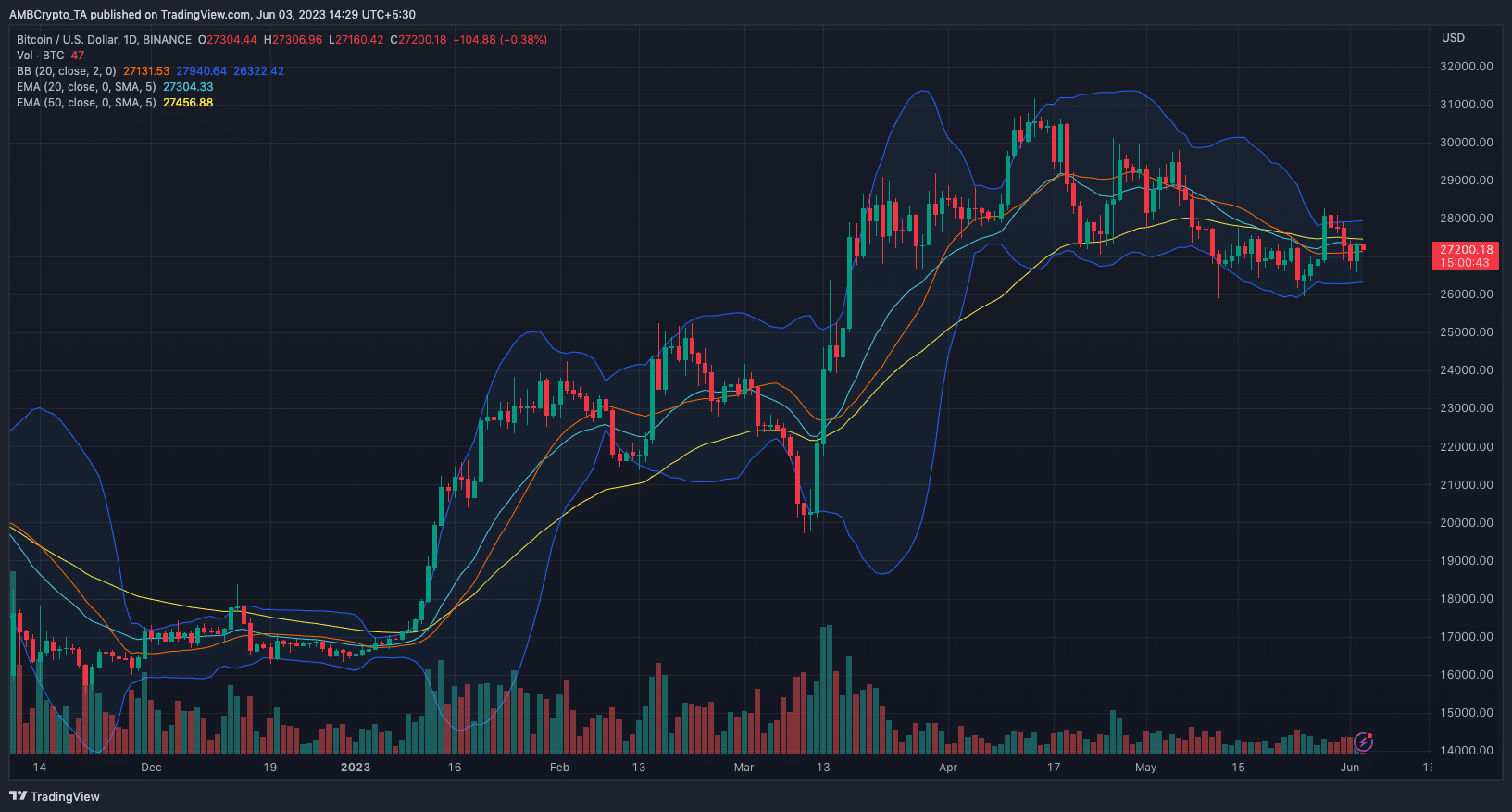

Meanwhile, BTC has experienced a slight respite, as its price increased by 1.84% in the last seven days. But in terms of volatility, the Bollinger Bands (BB) showed that the king coin has contracted.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

In addition, the technical outlook revealed that BTC had exited the overbought region since the price no longer touched the upper band.

However, the uptick may not last due to the state of the Exponential Moving Average (EMA). At the time of writing, the 20 EMA (cyan) had crossed the 50 (EMA) yellow. Therefore, the press time trend might have turned bearish.

![Shiba Inu [SHIB] price prediction - Mapping short-term targets as selling pressure climbs](https://ambcrypto.com/wp-content/uploads/2025/03/SHIB-1-2-400x240.webp)