Uniswap’s chart turns red: What lies ahead?

- UNI’s supply on exchanges increased while supply outside of exchanges decreased.

- Metrics suggested that the token was under selling pressure.

On 3 June, Uniswap [UNI] witnessed a massive spike in its adoption as it reached a new milestone. As per Uniswap’s latest tweet, Uniswap wallet downloads crossed the 200,000 mark in six weeks since its launch.

200k wallet downloads in just 6 weeks ?

Thanks for your support and feedback as we work to make this the best wallet in crypto ?

If you're not one of those 200k…download here:https://t.co/AbDJspGvlx

— Uniswap Labs ? (@Uniswap) June 3, 2023

At first glance, this massive milestone suggested increased adoption of the blockchain across the globe. However, the reality was different.

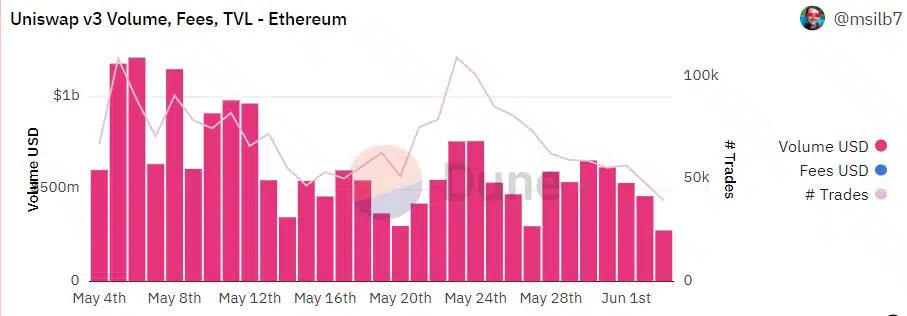

As per Token Terminal’s data, fees generated on the Uniswap blockchain had plummeted sharply over the last 30 days. A decline in the metrics typically indicates less usage of the network. This was proven by UNI’s daily active users, which also witnessed a fall.

Uniswap v3’s performance was worrying

Not only did the network’s fees and active users decline, but Dune’s data revealed that UNI’s v3 stats were following the same trend. Uniswap v3’s volume in USD dropped over the last few months, and its gas usage per swap also collapsed, suggesting less usage of the network.

UNI’s performance on the price front was a cause of additional concern, as its weekly and daily charts were painted red. According to CoinMarketCap, UNI’s price had declined by 2% in the last 24 hours.

At the time of writing, it was trading at $4.97 with a market capitalization of over $2.8 billion, making it the 22nd largest crypto by market cap. A reason for concern was UNI’s supply.

Santiment’s chart revealed that the token’s supply on exchanges increased while its supply outside of exchanges declined. This is a typical bullish sign, suggesting a further price downtrend.

However, investors’ confidence in UNI remained unaffected, as evident from its supply held by top addresses, which increased last week.

Realistic or not, here’s UNI market cap in BTC’s terms

The negative price trend can continue for longer

As per CryptoQuant, Uniswap’s exchange reserve was increasing. This indicated that the token was under selling pressure, showcasing a continued price dip. The total number of coins transferred has decreased by -90.86% compared to 4 June, a negative signal.

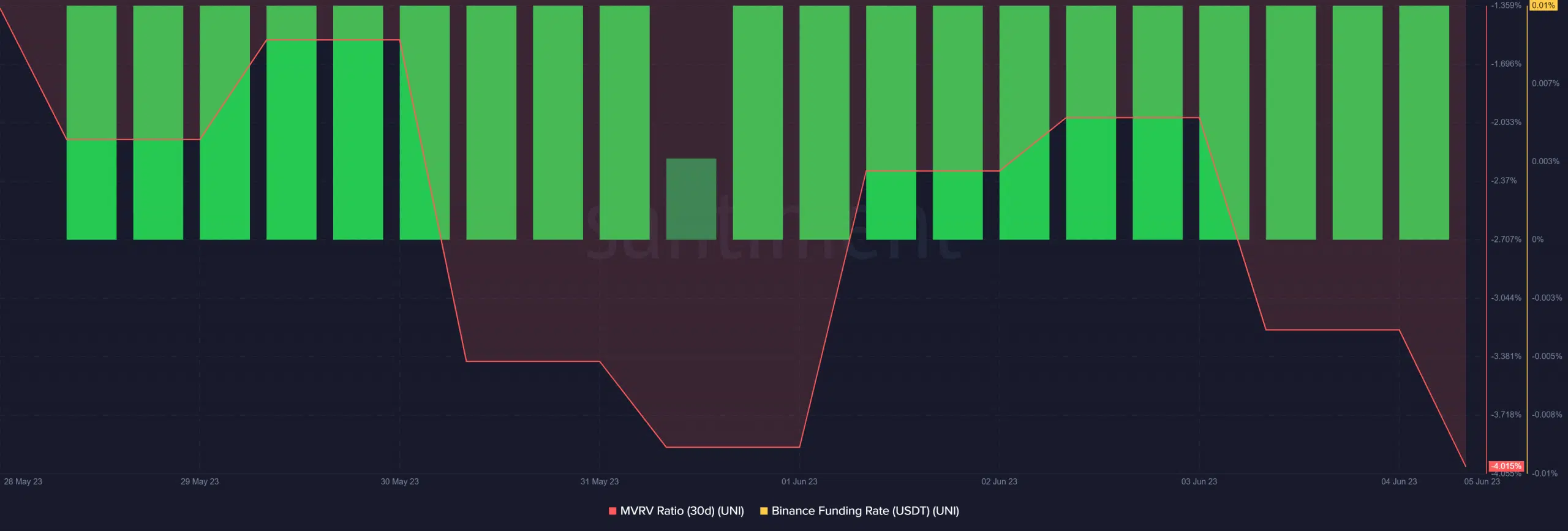

UNI’s MVRV Ratio sank substantially as well. Coinglass’ data further supported a bearish notion, as UNI’s Open Interest increased. Increasing Open Interest represents new or additional money coming into the market.

However, on a good note, UNI’s demand in the derivatives market remained high, as evident from its green Binance funding rate.