Litecoin’s upcoming halving and its effect on miners

- Litecoin experienced a surge in active addresses, which hit 13 million.

- As the halving nears, miners faced challenges with declining fees.

Litecoin [LTC] has been buzzing with activity and increased engagement in the past few weeks, stirring user excitement. A recently observed metric revealed a significant surge in activity.

However, this excitement appears to be restrained as miners on the network are witnessing a decline in an important metric.

Litecoin addresses surge

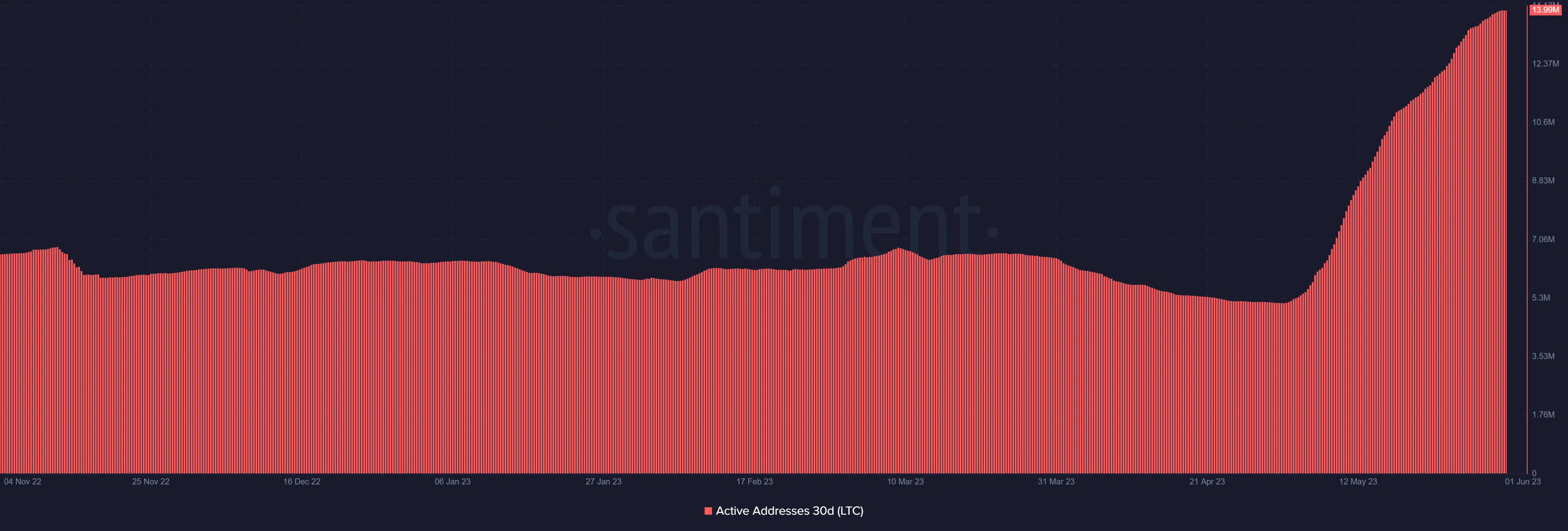

A Santiment chart revealed an interesting development for Litecoin. After a prolonged period of steady activity, there was a sudden surge in active addresses. Specifically, around 4 May, the number of active addresses skyrocketed from 5 million to 6 million.

As of this writing, the active addresses stood at approximately 13.3 million. It also experienced a peak of nearly 14 million before declining.

Although the exact cause of this surge remains uncertain, one plausible explanation could be the upcoming halving event. Scheduled to take place in two months, the halving will reduce the mining reward for Litecoin from 12.5 to 6.25 LTC.

This anticipation of a significant change in the mining landscape might have sparked increased interest and activity among Litecoin users.

Litecoin miners see decreased fees

While Litecoin holders are buzzing with excitement and increased activity, miners on the network did not experience the same impact. The miner fee chart from Glassnode indicated a potential reverse effect.

Upon examining the chart, it became evident that LTC miners witnessed two spikes in fees on 10 and 15 May, surpassing 20 LTCs.

However, there has been a subsequent decline in fees following those spikes. As of this writing, the fee hovered around 11 LTC, one of the lowest points observed on the chart. With the halving event on the horizon, this metric will likely experience a further decline.

Positive price trend persists

Litecoin’s price trend has displayed positive and negative movements, as observed on the daily timeframe chart. From 1 to 3 June, LTC witnessed consecutive uptrends, resulting in a gain of over 5%.

However, it recently shifted back into a downtrend, marking the second consecutive day of decline at the time of writing.

Is your portfolio green? Check out the Litecoin Profit Calculator

Litecoin was trading at around $92.8 at press time, experiencing a decline of approximately 1.4%. Despite this dip, it was still showcasing a positive price run.

Its price remained above the short Moving Average (yellow line), initially acting as a resistance level for Litecoin.

![Kusama [KSM] explodes 119% in one day - How DOT helped](https://ambcrypto.com/wp-content/uploads/2024/11/Michael-KSM-400x240.webp)