UNI has this coming after latest range low

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

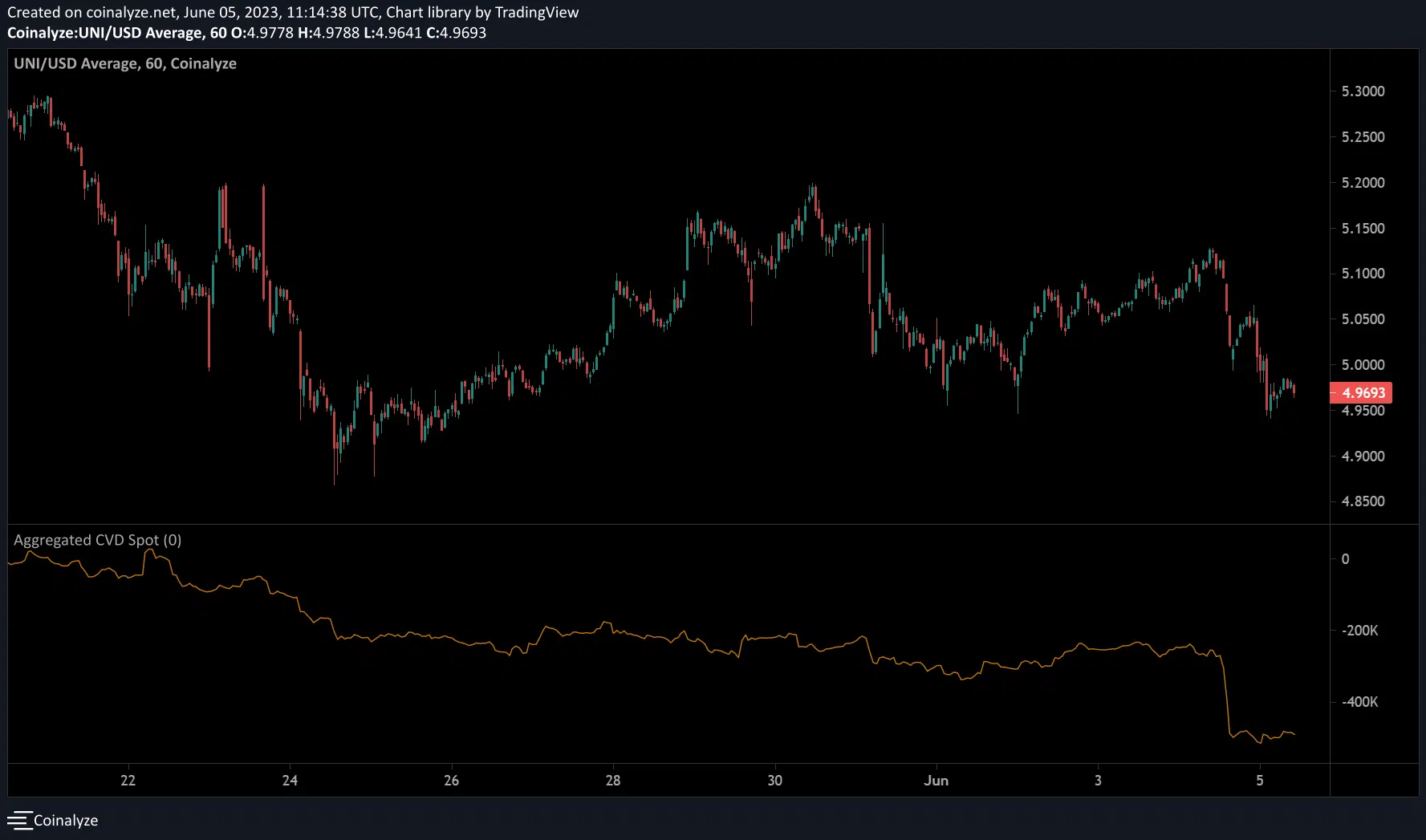

Short-sellers enjoyed more gains during Uniswap’s [UNI] price slump over the weekend. After Bitcoin’s sharp correction, the DeFi token dropped about 2.7% in the past 24 hours.

But the plunge has hit the range low and could offer bulls little hope of a price reversal if the past trend repeats.

Will the bulls defend the range low?

From 8 May, UNI has been trading sideways, with range extremes at $5.35 and $4.94. In the second half of May, the mid-range level of $5.15 acted as a sticky resistance, derailing further upward movement.

Over the weekend (3 and 4 June), UNI’s price action faced rejection at the mid-range again, setting it to retrace to the range low of $4.94. Notably, bulls have previously defended the range low. A repeat of the trend could see UNI rebound toward the mid-range level of $5.15.

If that’s the case, the range low could offer an entry for a long opportunity with a good risk ratio targeting the mid-range. A retest of the range high of $5.35 could offer more gains.

However, a session close below the range low of $4.94 and a subsequent bearish breakout will invalidate the above bullish thesis. Such an extended drop could ease at the immediate support level of $4.710.

Meanwhile, the Relative Strength Index (RSI) and On-Balance Volume (OBV) dipped, denoting increased selling pressure and low demand in the past few hours.

CVD spot declined; longs discouraged

How much are 1,10,100 UNIs worth today?

The Cumulative Volume Delta (CVD) spot witnessed a steady decline since late April. Over the weekend, the metric registered a sharp drop, indicating sellers gained more leverage in the market.

However, the metric was almost flat at press time, highlighting equal buying and selling pressure, hence the need for caution.

In addition, more long positions worth over $50k have been wrecked in the past 24 hours alone. However, less than $100 worth of short positions have been liquidated in the same period.

Hence, this captures a bearish outlook, and tracking BTC price action could be crucial before making moves.