Crypto market falls to negative sentiment, tremors felt throughout

- Outflows increased to $62 million from $39 million the week before, representing an increase of 58%.

- The short Bitcoin fund, which bets on the decline of Bitcoin, recorded $6.3 million in net outflows.

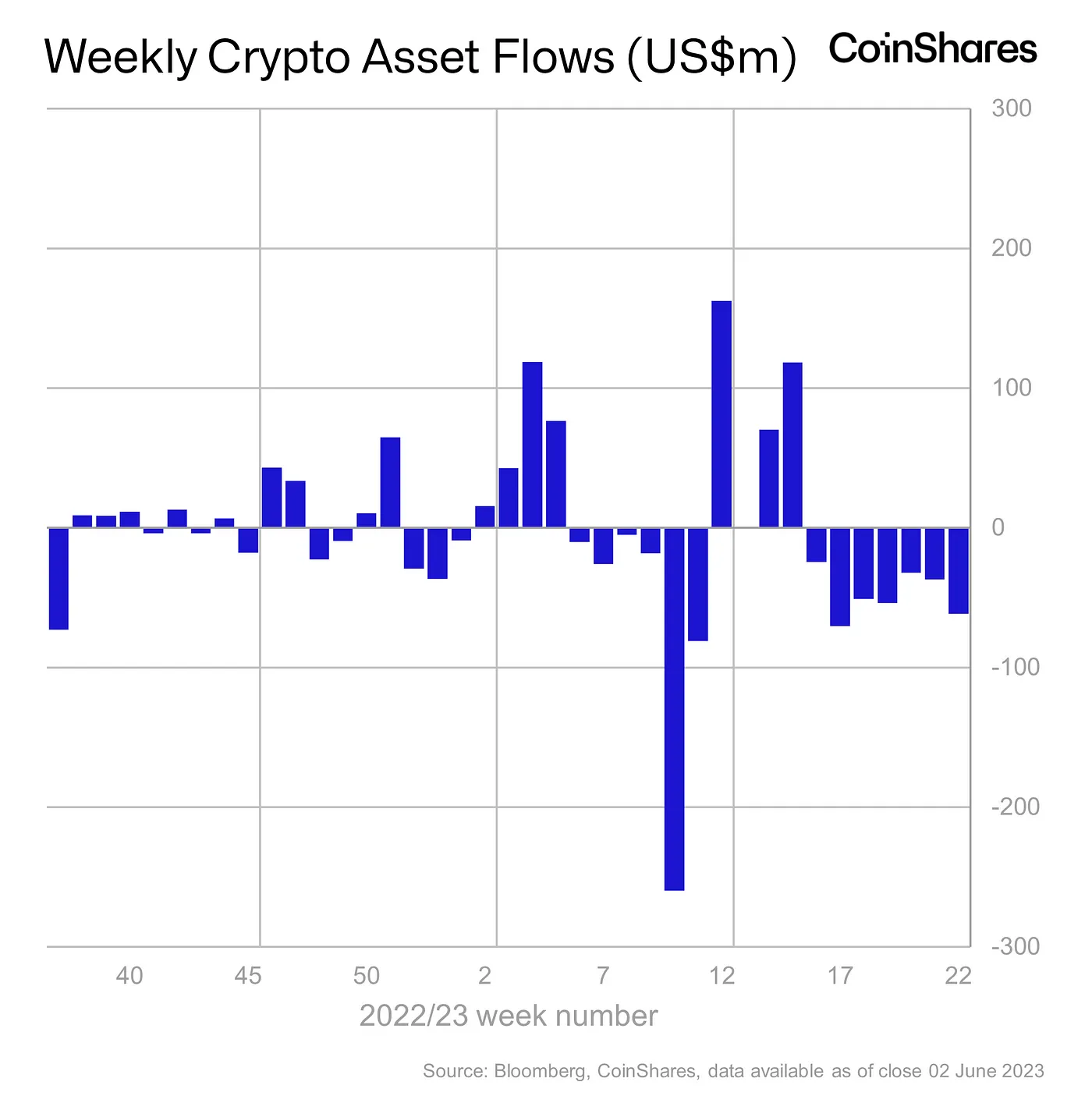

According to the latest report by crypto asset manager CoinShares, digital asset investment products recorded a seventh straight week of net outflows, underlining the bearish sentiment prevalent in the market. Outflows increased to $62 million from $39 million the week before, representing an increase of 58%.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

However, according to the research, the withdrawals were primarily driven by investors closing short positions and taking profits, rather than a fundamental shift in opinion towards cryptocurrencies, particularly Bitcoin [BTC].

Profiting from declines

The seventh consecutive week of outflows, totaling $329 million, represented 1% of total assets under management (AuM). According to Coinshares, this trend was very similar to the spate of outflows observed at the start of 2022.

Most outflows last week were from Tron [TRX], totaling $51 million and representing about 70% of the total AuM. On the other hand, the largest and the second-largest asset by market cap, BTC and Ethereum [ETH], logged minor outflows of $2.7 million each.

However, what’s interesting to note is that the short Bitcoin fund, which bets on the decline of Bitcoin, recorded $6.3 million in net outflows, indicating that investors may be short covering.

As per CoinMarketCap, BTC has plunged over 11% over the past month, creating fertile ground for short position traders to exit the market with gains.

Coinshares added that the outflows came amidst a lull in trading activity with volume across the broader crypto market remaining 60% below the year’s average. Additional data from CoinMarketCap lent credence to this observation. Daily volume was stuck in the $20 billion- $30 billion range throughout May as the market entered a period of low volatility.

Is your portfolio green? Check the Bitcoin Profit Calculator

Analyzing futures crypto markets

The nominal value of BTC’s Open Interest (OI) fell marginally over the last week to $11.91 billion, as per Coinglass. As the price of the asset has retreated over 7% in the same time, it goes to prove that money was moving out of the market.

Surprisingly, the downturn didn’t prevent bullish leveraged traders from opening positions betting on price increase. The number of longs increased sharply vis-à-vis shorts at the time of writing.