Ethereum likely to descend to this key level soon

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Ethereum saw large volatility but was bearishly biased on the 4-hour chart.

- This downtrend was against the trend on the daily timeframe and presented a support zone to watch for a positive reaction from.

Ethereum has trended upward on the charts since March, but this was on the higher timeframe charts. They presented a bigger picture of the price action, which continued to favor the bulls. But this was of no help over the past few days when bearish momentum ruled.

Read Ethereum’s [ETH] Price Prediction 2023-24

Ethereum gas prices have declined to a monthly low but the active address count took a hit over the past week. According to Santiment data, market sentiment was also largely unaffected. Will this be enough to halt the downtrend of the past ten days?

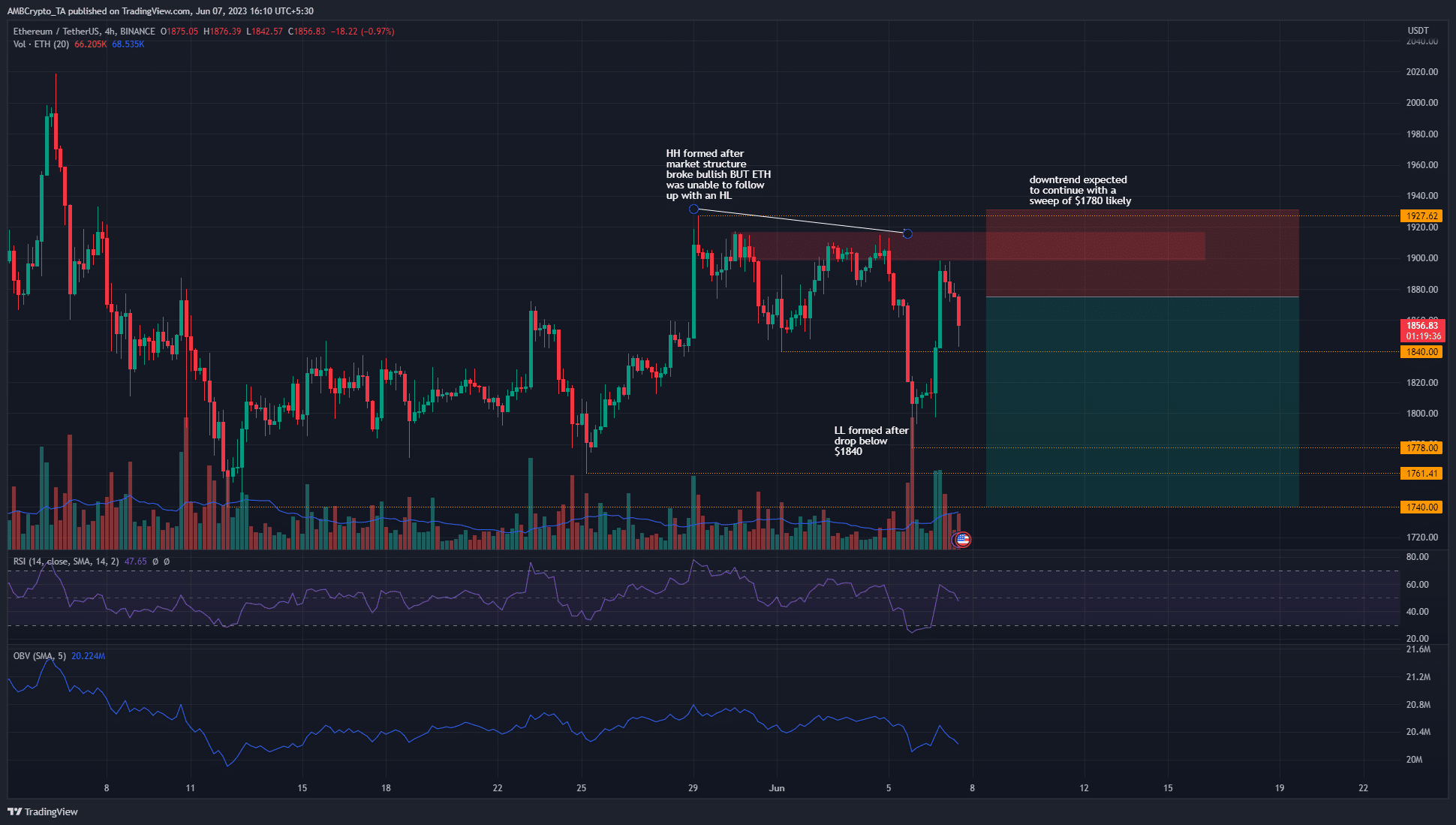

Ethereum maintains a bearish structure, but where should short sellers enter?

Before examining a short entry, we must explore the reason behind it. Ethereum was in an uptrend on the daily timeframe and hence buyers still have a good chance of defending the $1700-$1800 support zone. Despite the losses it saw since mid-April, key levels such as the $1686 support have not yet been breached.

Moreover, the support zone from $1700-$1800 has served as a key area of demand for ETH investors. This was evidenced by two strong reactions from this zone in May, but both of them were unable to initiate a downtrend.

A higher high (HH) was formed on 29 May after a drop to the $1761 mark on 25 May. ETH bulls were unable to follow this move with the formation of a higher low to carry on the uptrend.

Instead, prices fell to $1840 and lower still to $1778, marking it as a lower low (LL). This came after the inability of the buyers to force their way past the $1915 resistance zone.

Hence, short sellers can look for entries in the $1850-$1900 area. A move above $1927 will invalidate the bearish idea, and can help in setting stop-loss orders. To the south, the $1760-$1780 area has been significant since early April, and can be used to take-profits.

The RSI was at neutral 50 and could signal a failure to flip the momentum to bullish in the coming hours. The OBV has trended slowly higher for a good portion of May, but the past week saw steady losses.

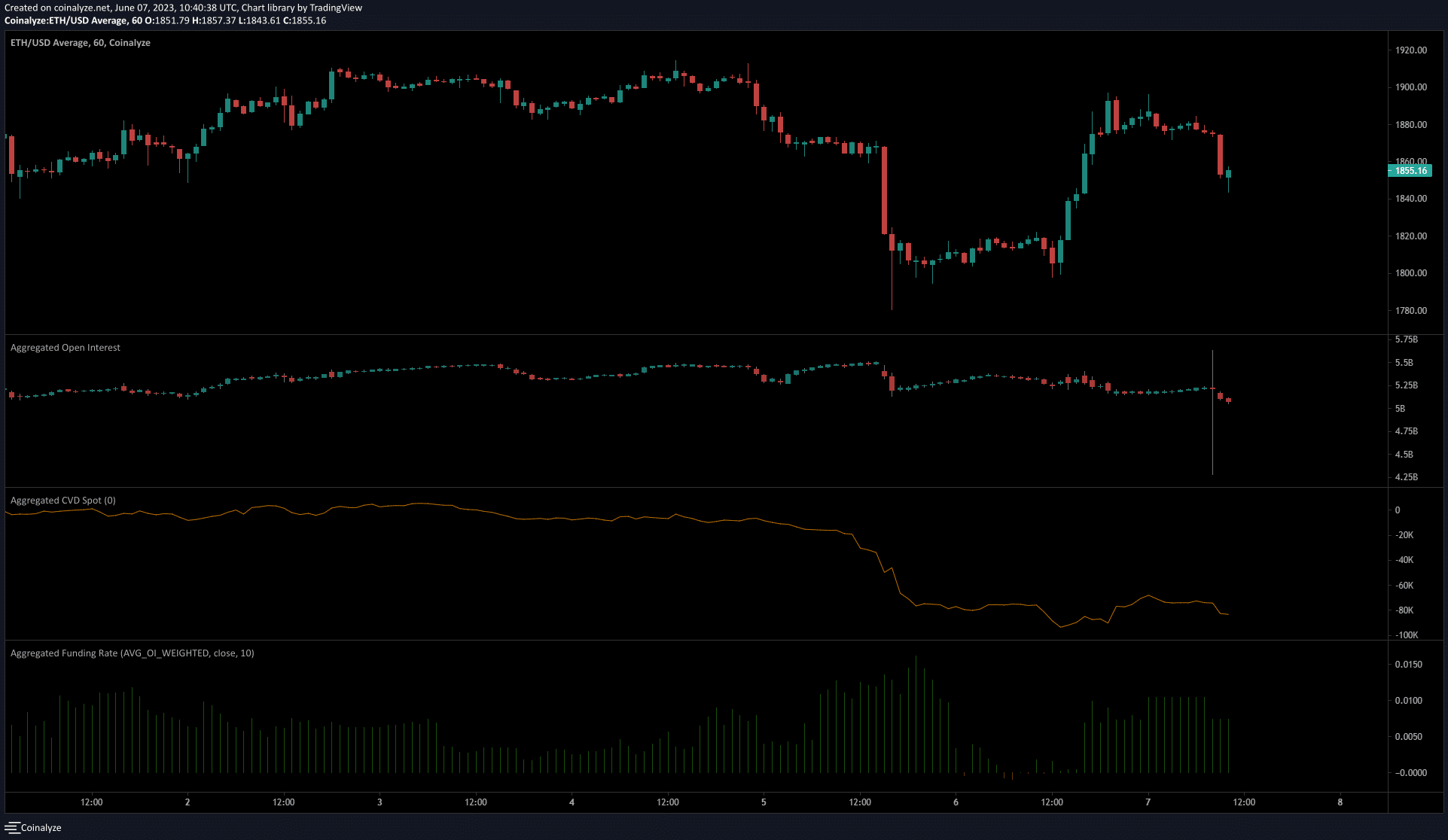

The Open Interest remained flat despite large volatility

Source: Coinalyze

The bounce from $1778 to $1898 saw the Open Interest behind Ethereum climb by close to $180 million. Yet this was not a lot for the market, and signaled a majority of the speculators could be sidelined.

Is your portfolio green? Check the Ethereum Profit Calculator

The downtrend of the spot CVD underlined the bearish pressure in the market. It also helped explain the lack of bullish speculators. The funding rate remained positive but overall, the environment showed long positions were discouraged.

![Three days ago, Uniswap [UNI] attempted a breakout from a parallel channel, surging to hit a local high of $7.6. However, the altcoin faced strong rejection.](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-83-400x240.jpg)