Spot volumes on CEXs plunge to 2019 levels, but there is a silver lining

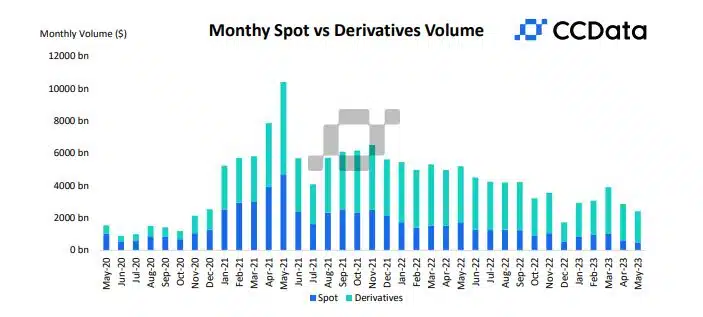

- While spot trading was in trouble, the derivatives market grew its share of the crypto trading space.

- DEXs market share rose for the fourth straight month in May to reach its all-time high of 12.8%.

Major crypto assets in the market were confined to narrow trading ranges throughout May as volatility fell to levels last seen during the beginning of the year. Bitcoin [BTC], considered as the bellwether for crypto space, was stuck in the $26,000-$27,000 region for a greater part of last month.

As the price action disappointed both the bullish and bearish forces, trading activity declined considerably across major platforms.

According to a report by digital assets data provider CCData, spot trading volume on centralized exchanges plunged to its lowest monthly level since March 2019. Speculative demand also ebbed as derivatives trading volume fell more than 15%, the lowest since December 2o22.

Spot trading volume plunges

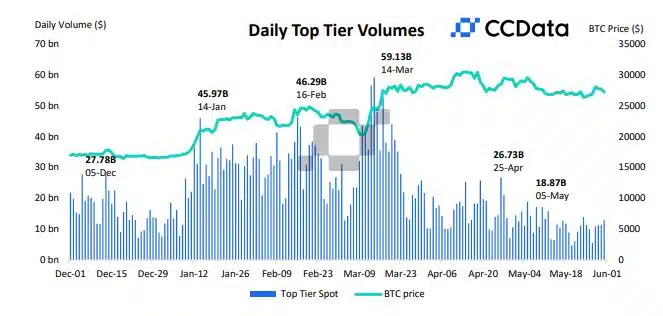

The downturn was expectedly driven by the underperformance of top centralized exchanges (CEXs). As indicated, top-tier exchanges registered a daily volume of $18.9 billion on 5 May. This marked a nearly 30% drop from the figure clocked 10 days ago on 25 April.

The volume went on to drop further, resulting in a 21.8% drop in cumulative spot trading volume to $495 billion.

Among these Top-tier exchanges, the biggest culprit was the world’s largest crypto trading platform Binance [BNB], whose market share fell for the third consecutive month in May.

The report mentioned that a combination of multiple factors led to Binance falling from its all-time high in February. These included suspension of zero-fee trading, regulatory scrutiny from U.S. regulators and the overall dull mood as highlighted earlier.

While spot trading was clearly in trouble, the derivatives market grew its share of the crypto trading space. It touched an all-time high of 80% in May.

DEXs increase market share

The volume on decentralized exchanges (DEXs) also contracted due to the volatility present in the market. However, the defining feature was their growing dominance in overall spot trading volume.

As per the report, DEXs market share rose for the fourth straight month in May. It reached an all-time high of 12.8%.

The on-chain trading activity was primarily driven by the surge in meme coin trading, which was facilitated only by DEXs. Anticipation of potential listings on CEXs, which generally pump prices of new coins, led speculators to turn to decentralized trading platforms.

A testament to DEX’s increasing relevance was the performance of Uniswap [UNI], the numero uno DEX, which outperformed major CEXs like Coinbase and OKX for the fourth consecutive month.