BNB dips under key support – Can bulls rebound

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Bearish momentum eased off.

- Bullish rebound could be spurred by 50.12% long advantage.

Binance Coin’s [BNB] downward spiral reached new lows over the past 24 hours with a break of the $265 support level. This extended the losses of the fourth-largest cryptocurrency by marketcap to 9.8% over the past two days.

Realistic or not, here’s BNB’s market cap in BTC terms

The U.S. Securities and Exchange Commission (SEC) lawsuit against Binance and its CEO, Changpeng Zhao, played a significant role in BNB’s downturn with investors reducing their exposure to BNB.

With Bitcoin [BTC] ranging around the $26k price zone, is BNB headed for more dips or is a rebound on the cards?

Bearish momentum in full swing

BNB’s month-long range between the $303 support level and $318 resistance level ended on 5 June. The break below the $303 support level was largely triggered by the SEC’s lawsuit against Binance.

This reflected on the four-hour timeframe by a large bearish candle that broke the next support level at $283.

While sellers took maximum advantage of the downtrend, bulls could potentially mount a rebound in the short term. A look at the Moving Average Convergence Divergence (MACD) showed a bullish crossover on the four-hour timeframe along with green bars above the zero level.

The Chaikin Money Flow (CMF) also moved from negative territory and stood at the zero mark, as of press time. This suggested that capital inflows were slowly returning.

The close below $265 saw BNB stabilize at the minor support level of $254. A quick retest of the $265 resistance level didn’t yield any results for bulls. However, buyers continued to mount a charge to reclaim the $265 level as of the time of writing.

On the other hand, a continuation of the bearish dominance could see price reach the December 2022 low of $225, with short sellers targeting an entry on a second retest of the $265 resistance level.

Read Binance Coin’s [BNB] Price Prediction 2023-24

Will a slight advantage for longs translate to a bullish rebound?

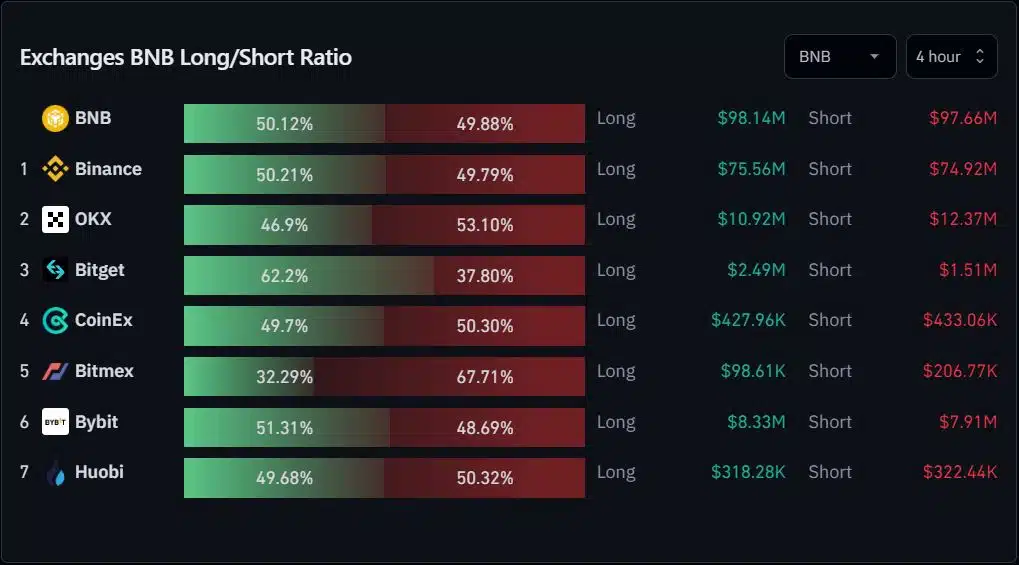

As on-chart indicators flashed encouraging signs for buyers, the futures market reacted positively. Data from Coinglass showed that longs had a slight 50.12% advantage on the four-hour long/short ratio. This hinted at market speculators leaning towards a short-term bullish rebound.

With the funding rate remaining positive, BNB could see a rally in the short term. However, traders should pay close attention to potential rulings on the SEC lawsuit, as this could impact prices significantly.