Why Ethereum displays confidence despite bear market

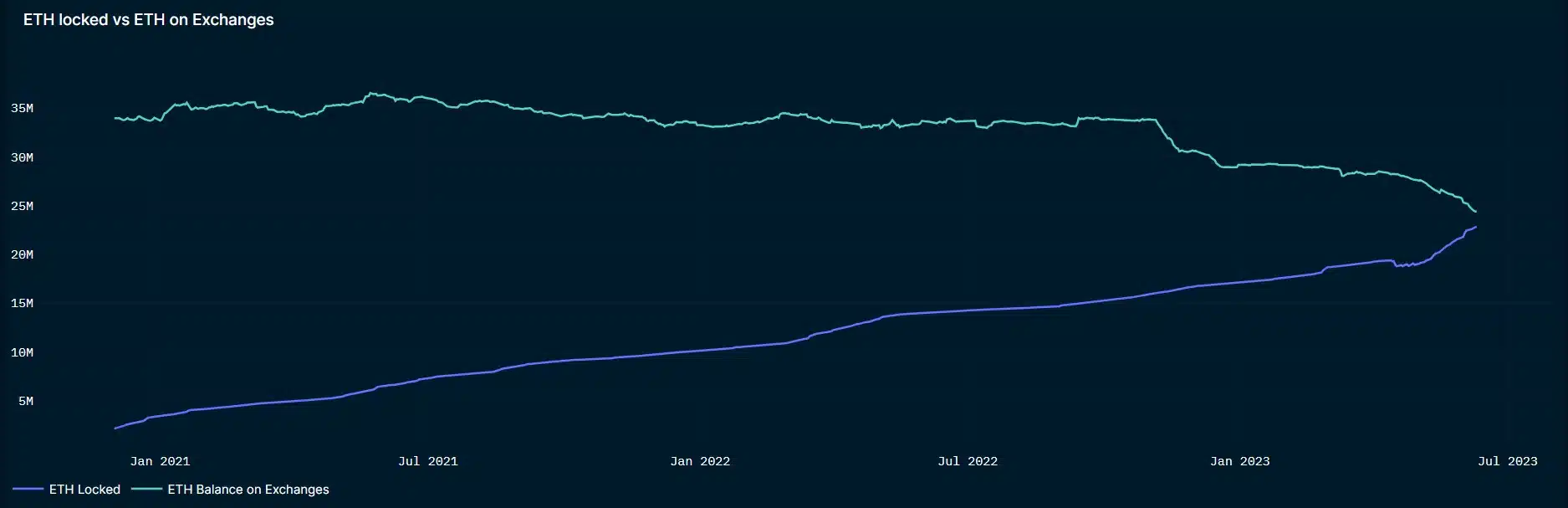

- The number of ETH locked can soon overtake the ETH balance on exchanges.

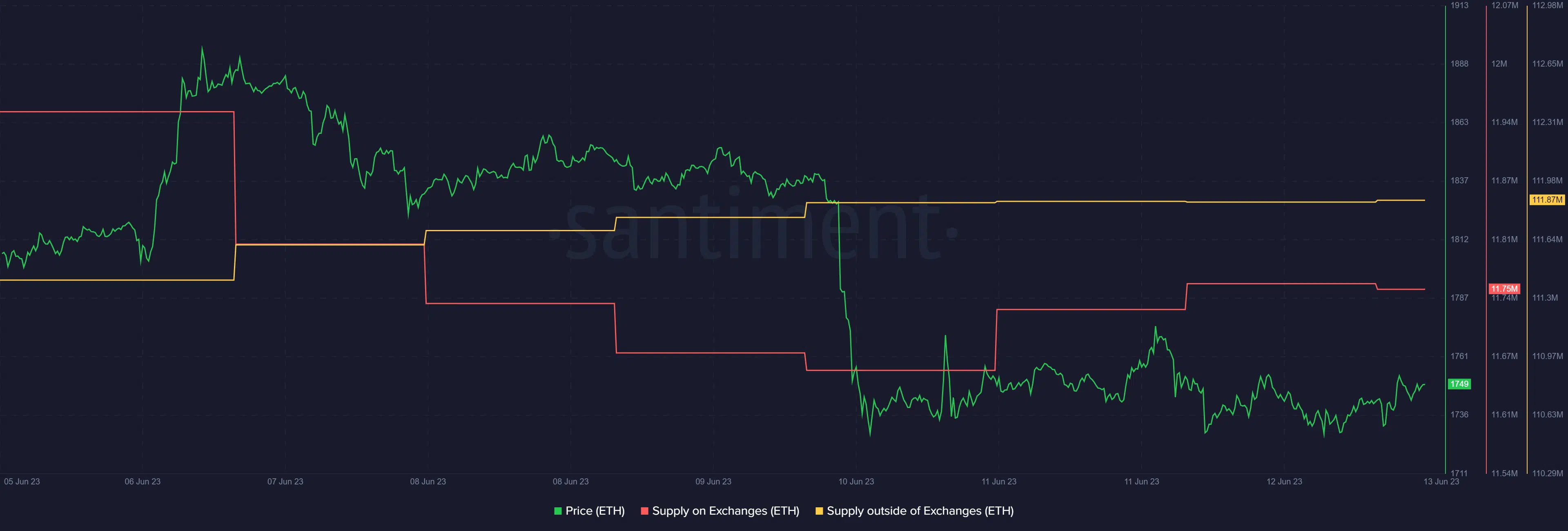

- Buying pressure increased as supply on exchanges declined.

Ethereum [ETH], like most altcoins, witnessed a price correction last week as its value declined by 3%. Due to the decline in price, investors suffered losses.

Read Ethereum’s [ETH] Price Prediction 2023-24

Despite the drop in value, the number of ETH locked has been on the rise for several months. This suggested that investors’ confidence in ETH was high. Is the king of altcoins setting up the stage for the next bull rally?

Investors are taking losses

Thanks to the price drop, investors were not making profits at press time. As per Glassnode, the percentage of Ethereum addresses in profit reached a one-month low of 58.448%.

Additionally, the number of Ethereum addresses holding more than 1,000 ETH reached a one-year low, suggesting that some investors were selling their holdings.

? #Ethereum $ETH Percent Addresses in Profit (7d MA) just reached a 1-month low of 58.448%

View metric:https://t.co/BUbkntqvVb pic.twitter.com/55U1yd6qfW

— glassnode alerts (@glassnodealerts) June 13, 2023

ETH 2.0’s growth is impressive

ETH 2.0’s value has registered a sharp increase of late. As per Glassnode, the total value of ETH 2.0’s Deposit Contract reached an ATH of 23,998,443 ETH at press time.

? #Ethereum $ETH Total Value in the ETH 2.0 Deposit Contract just reached an ATH of 23,998,443 ETH

View metric:https://t.co/SzbMPqvhlb pic.twitter.com/HhAAX6HpCf

— glassnode alerts (@glassnodealerts) June 13, 2023

In fact, there is a high possibility that the number of ETH locked will overtake the ETH balance on exchanges, which has been declining. Therefore, a closer look at the scenario suggests that ETH might rebound above $1,800 again.

Is Ethereum setting up the stage?

A reason behind the increase in the ETH locked amount could be investors’ confidence that its price will increase. At press time, ETH was down by over 3.5% compared to the last week and was trading at $1,750.37 with a market capitalization of $210 billion.

As per CryptoQuant, ETH’s exchange reserve was decreasing, suggesting that it was not under selling pressure. The same was also proven by its supply on exchanges, which declined while its supply outside of exchanges went up.

However, Ethereum’s active addresses increased.

Is your portfolio green? Check the Ethereum Profit Calculator

A peek at Ethereum’s derivatives market

Ethereum’s Open Interest has been declining. The market usually liquidates when Open Interest declines. Therefore, the confidence of investors in ETH might soon be reflected on its price chart.

Moreover, its taker buy/sell ratio was also green, indicating that buying sentiment was dominant in the futures market.