How USDT’s dominance ties into Cosmos’ rise

- USDT’s dominance rose to 64.74%, indicating a resurgence in its influence in the stablecoin market.

- USDT’s collaboration with Cosmos could boost both ecosystems.

The fall of Silicon Valley Bank impacted USD Coin [USDC] negatively and propelled Tether’s [USDT] market cap and dominance to unprecedented levels. However, recent concerns and uncertainty surrounding its de-pegging impeded the progress of USDT. Nevertheless, new data indicated that USDT’s dominance has increased once again.

Is your portfolio green? Check out the ATOM Profit Calculator

Notably, on 21 June, USDT announced a collaboration with the Kava Network. This partnership will deploy USDT on the Kava Chain, which acts as a gateway to the Cosmos ecosystem.

This strategic move not only benefits USDT but also has positive implications for the Cosmos [ATOM] ecosystem.

USDT leads stablecoin race

At press time, USDT’s dominance had reached 64.74% according to data provided by DeFi analyst Victor. This demonstrated a resurgence of USDT’s influence in the stablecoin market.

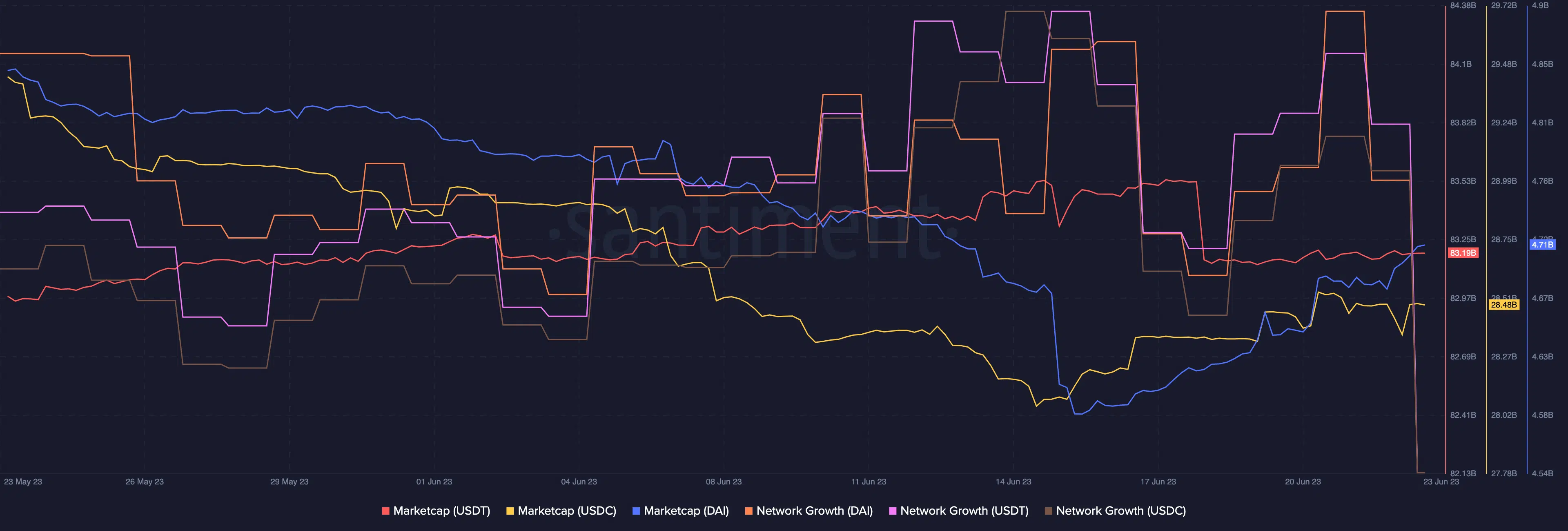

In terms of market cap, USDT continued to decline, raising concerns about its future performance. Despite having a relatively higher market cap than other stablecoins, the declining trend suggested potential challenges for USDT ahead.

On the other hand, USDC’s market cap witnessed some growth over the past week, indicating its resilience amidst the changing landscape.

However, the most impressive growth was showcased by DAI. Over the last few weeks, DAI’s market cap experienced significant expansion. This surge can be attributed, at least in part, to the downfall of Binance USD [BUSD] following lawsuits against the Binance exchange.

The resulting impact on BUSD created an opportunity for other stablecoins like DAI to gain market share.

When examining the network growth of these stablecoins, a decline was observed across all stablecoins. Thus, new addresses were losing interest in stablecoins at press time.

Regardless, USDC remained the dominant stablecoin at press time, capturing 49.9% of all volume according to Dune Analytics’ data. USDC trailed close behind, 37.7% of the overall market share.

State of ATOM

The deployment of USDT on Cosmos could help increase interest in the protocol and improve network activity. This collaboration has the potential to attract new users and enhance the overall ecosystem of both USDT and Cosmos.

Realistic or not, here’s ATOM’s market cap in BTC’s terms

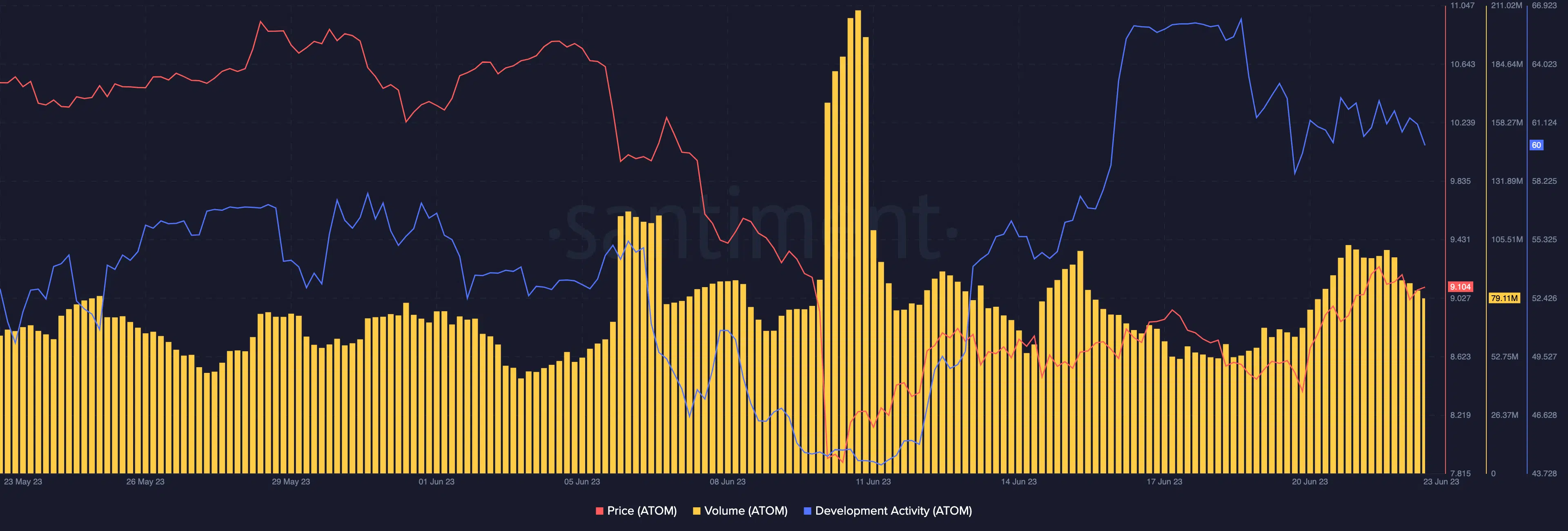

At press time, ATOM, the native token of Cosmos, was trading at $9.104, after experiencing price growth over the last week. Additionally, the volume of ATOM surged during this period, indicating increased market activity and investor interest in the token.

Development activity on the Cosmos network observed a spike as well, suggesting that there may be new upgrades and updates on the horizon. These developments could attract users to the Cosmos protocol and contribute to its growth.