Bitcoin: Short-term holders see profit

- Roughly 2.6 million Bitcoin have been pushed into profit.

- BTC’s price was on three days of consecutive decline but maintained the $30,000 price range.

In a thrilling turn of events, Bitcoin [BTC] shattered a significant price barrier and surged past the $30,000 mark. This paved the way for numerous investors to rejoice in their financial gains. But what does the profitability of these fortunate holders imply for the future path of Bitcoin’s trend?

Is your portfolio green? Check out the Bitcoin Profit Calculator

Bitcoin short-term holders cruise into profit

New data from Glassnode revealed that the recent surge in Bitcoin’s price has brought about a wave of triumph for short-term holders. The leap from approximately $25,000 to beyond $30,000 has pushed many of these holders into a profitable position.

To be precise, over 66.4% of short-term holder coins, amounting to a staggering 1.8 million, have now found themselves in profit. This surge has elevated the profitable short-term holder supply percentage to 96.9%, equivalent to roughly 2.6 million BTC.

Furthermore, historical patterns indicated that such periods of profitability often led to price increases. This means that we could see the price of BTC rise more if more STH is pushed into profit.

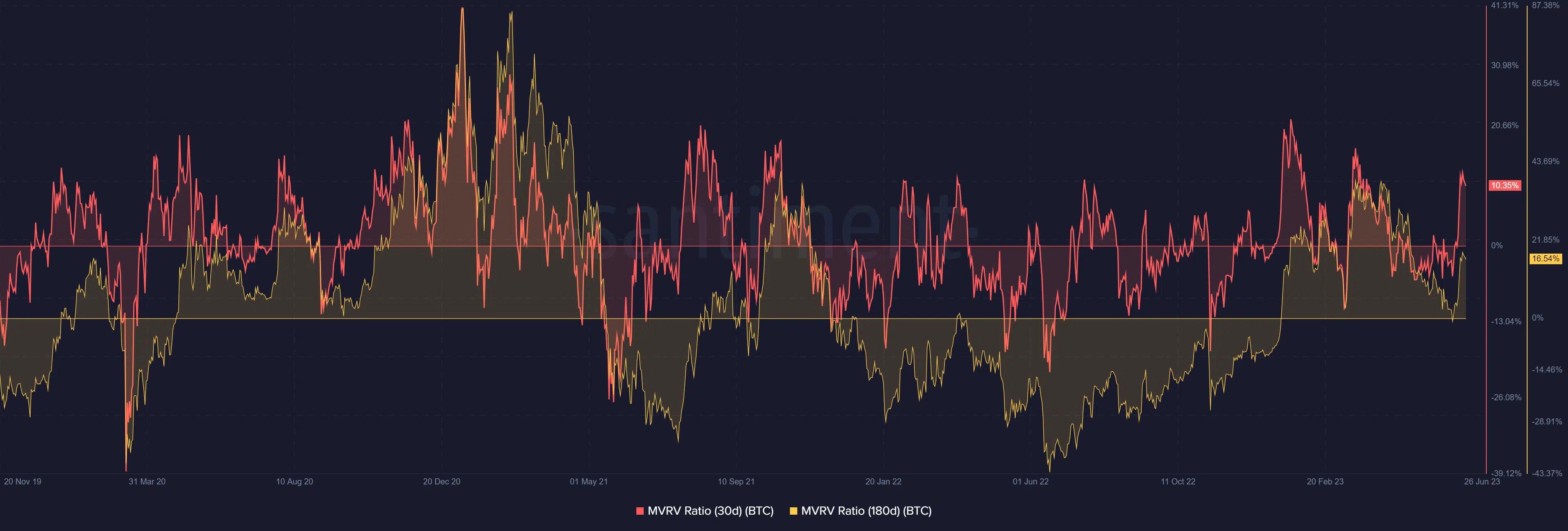

Comparing 30-day and 180-day Bitcoin MVRV

An examination of the Bitcoin 30-day Market Value to Realized Value Ratio (MVRV) on Santiment showed the profitability of STH. As of this writing, the 30-day MVRV stood above 0, signaling a favorable state of profitability for BTC held by STH.

The metric surpassed 10% at press time, though there were indications of a slight decline.

The comparison between the 30-day MVRV and the 180-day MVRV revealed that it was not only STH who were reaping profits.

Examining the 180-day MVRV showed that holders within this timeframe were holding their BTC at a profit margin of over 16%. This suggested that both short-term and long-term BTC holders from the past six months have been able to seek profits from their holdings.

A closer look at the 90-day MVRV analysis confirmed the overall profitability trend, showcasing positive returns for BTC holders within this timeframe.

How much are 1,10,100 BTCs worth today?

Which way is BTC moving?

As of this writing, Bitcoin was trading at approximately $30,300, exhibiting a slight decline on a daily timeframe. Notably, the chart revealed that BTC had experienced a three-day consecutive decline, albeit with minimal differences in value.

Despite these short-term fluctuations, the king coin’s overall trend remained bullish, as indicated by its Moving Average Convergence Divergence (MACD). The MACD was observed to be trending above zero as of this writing.