Digital asset investment products see revival in June. Details inside…

- After falling in May, the assets under management surged 9% in June.

- Boosted by BlackRock’s spot ETF application, GBTC saw a 79% jump in volume.

The month of June witnessed a robust recovery in the demand for digital assets. This was thanks to the optimism that grew following a flurry of applications for a Spot Bitcoin [BTC] Exchange-Traded Fund (ETF).

The resurgence was triggered after BlackRock, the world’s largest asset management company, applied for an ETF that will directly track Bitcoin. Since then, other TradFi giants like WisdomTree and Invesco have jumped on the bandwagon. In the process, the king coin briefly touched the $31,000 level, the highest in over a year.

Institutional interest rejuvenates digital assets

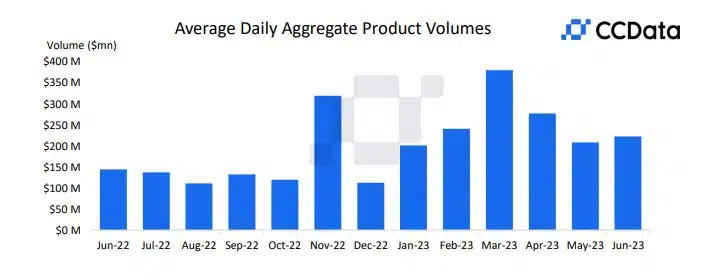

According to a report by digital assets data provider CCData, the bullish narrative resulted in a sharp growth of digital asset investment products. The average daily aggregate volumes of digital asset investment products snapped its two-month declining streak to rebound with a 6.77% jump to $223 million in June.

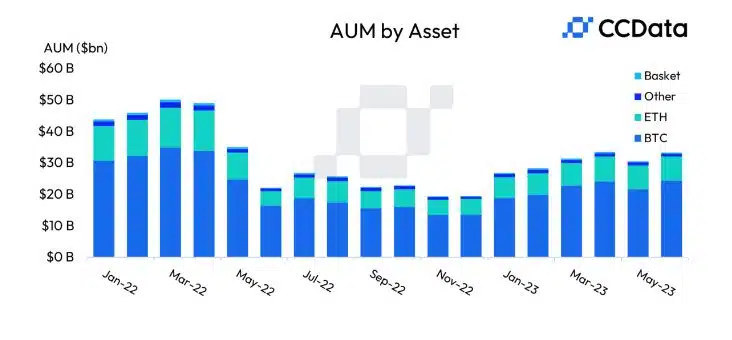

Moreover, a notable recovery was also observed in the total assets under management (AUM). After falling in May, the AUM surged 9% in June to hit $33 billion, representing a year-to-date (YTD) growth of nearly 70%.

Growth was led, as expected, by Bitcoin-based investment products, which increased their market share to 73%. This was a three percentage point increase from May. However, despite a 2.68% growth in AUM, Ethereum [ETH]-based products saw a decline in market share, from 24.5% in May to 23.1% in June.

Trust products capitalize

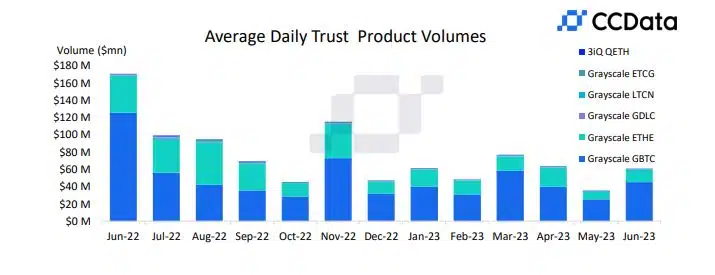

The report also highlighted a surge in the trading activity of trust products. Grayscale Bitcoin Trust (GBTC), the world’s largest Bitcoin fund, recorded $45 million in trading volume in June, a jump of 79% from the previous month. The trust, which is very similar to a crypto ETF, got a boost from BlackRock’s application.

GBTC remained the most traded trust product, capturing 74% of the market share in June, up from 70.9% in May.

On similar lines, the second-largest traded crypto trust product, Grayscale Ethereum product (ETHE), registered a 57.3% uptick in volume. However, its market share declined from 25.7% in May to 23.6%.

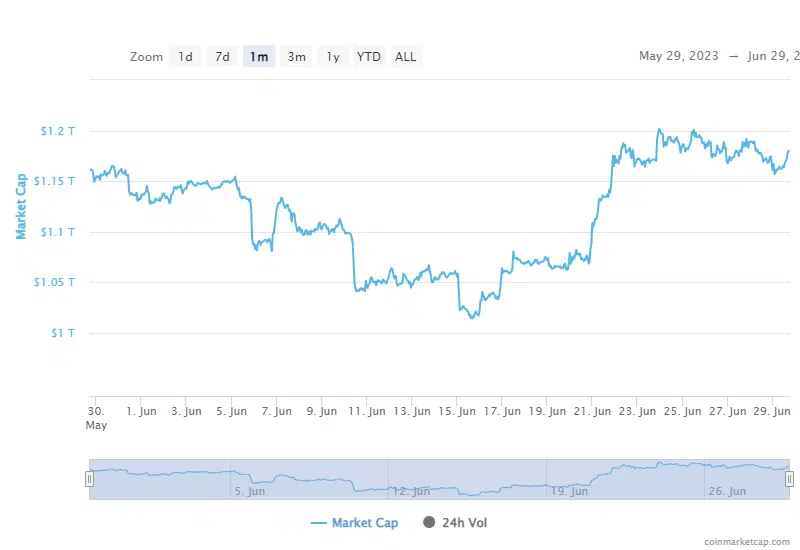

Meanwhile, the aggregated market cap of all crypto assets shot up by 15% over the last two weeks. Thus, it managed to recover all the losses made since the legal actions taken on crypto behemoths by U.S. regulators. At the time of writing, the market cap was $1.18 trillion.