Bitcoin losing its audience? Google data shows…

- Bitcoin witnessed a large decline in terms of search volume on Google.

- Miners sold their holdings en masse as hashrate fell significantly.

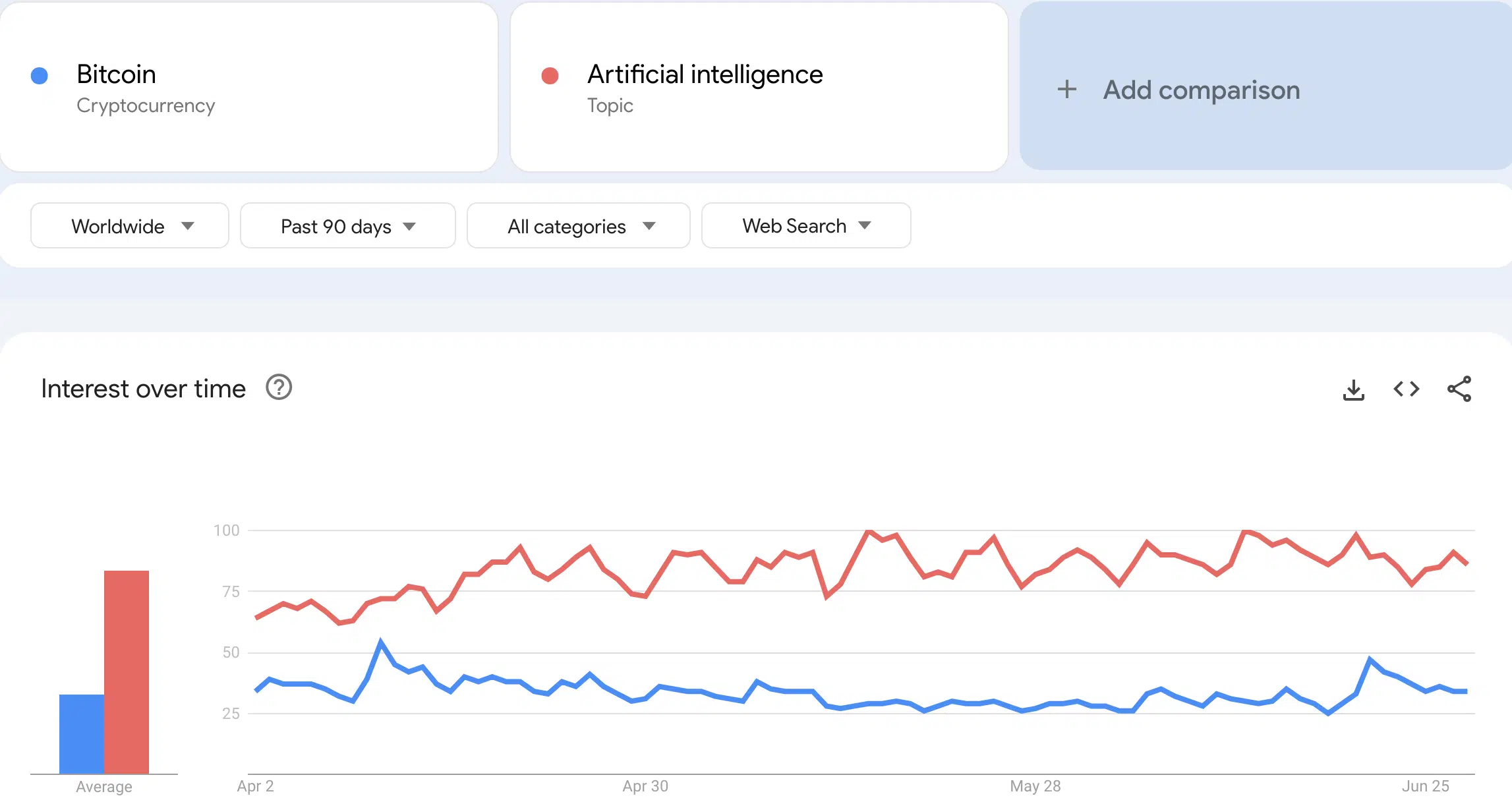

Recent data indicated a significant decline in Bitcoin’s [BTC] popularity, particularly evident from the dwindling number of BTC-related Google searches over the past few years. In comparison to Google searches for artificial intelligence (AI), the volume of BTC searches is notably low.

Read Bitcon’s Price Prediction 2023-2024

Is the BTC hype declining?

Even though searches for BTC have risen incrementally since the beginning of the year, the search interest hasn’t quite lived up to its 2021-2022 hype.

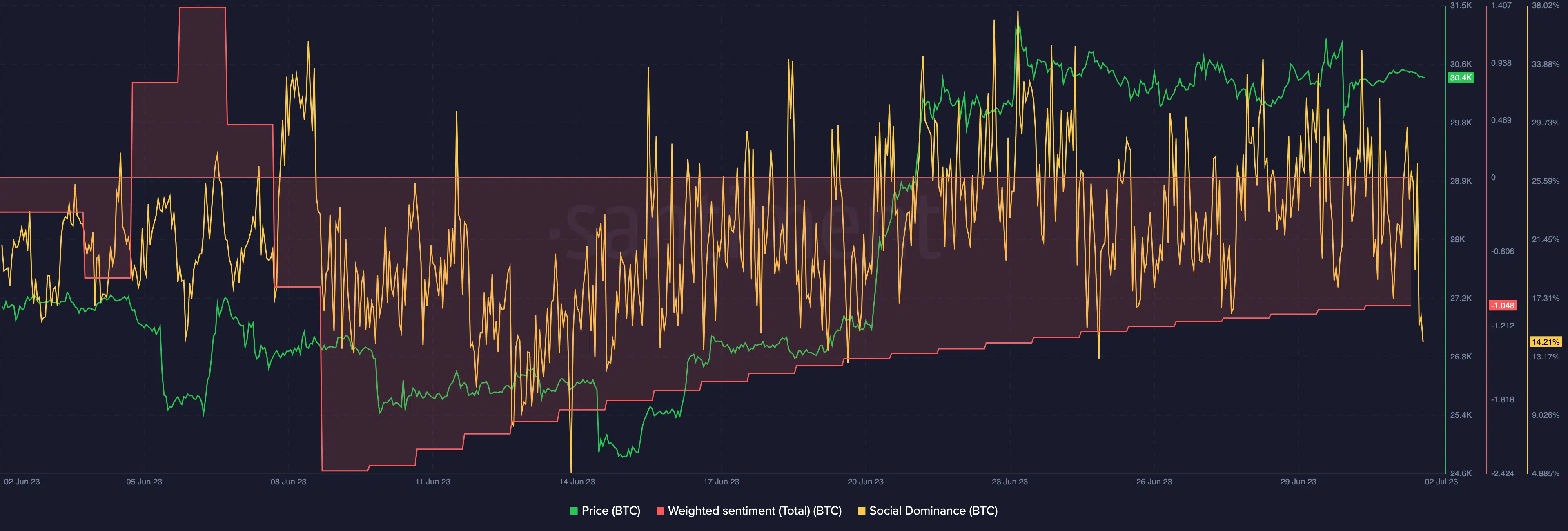

In terms of social dominance, Bitcoin’s presence on the social front fell from 30.74% to 16.8% in the last few weeks. Additionally, since last month the sentiment around Bitcoin has continued to decline. This indicated that the number of negative comments made about Bitcoin outweighed the number of positive ones at press time.

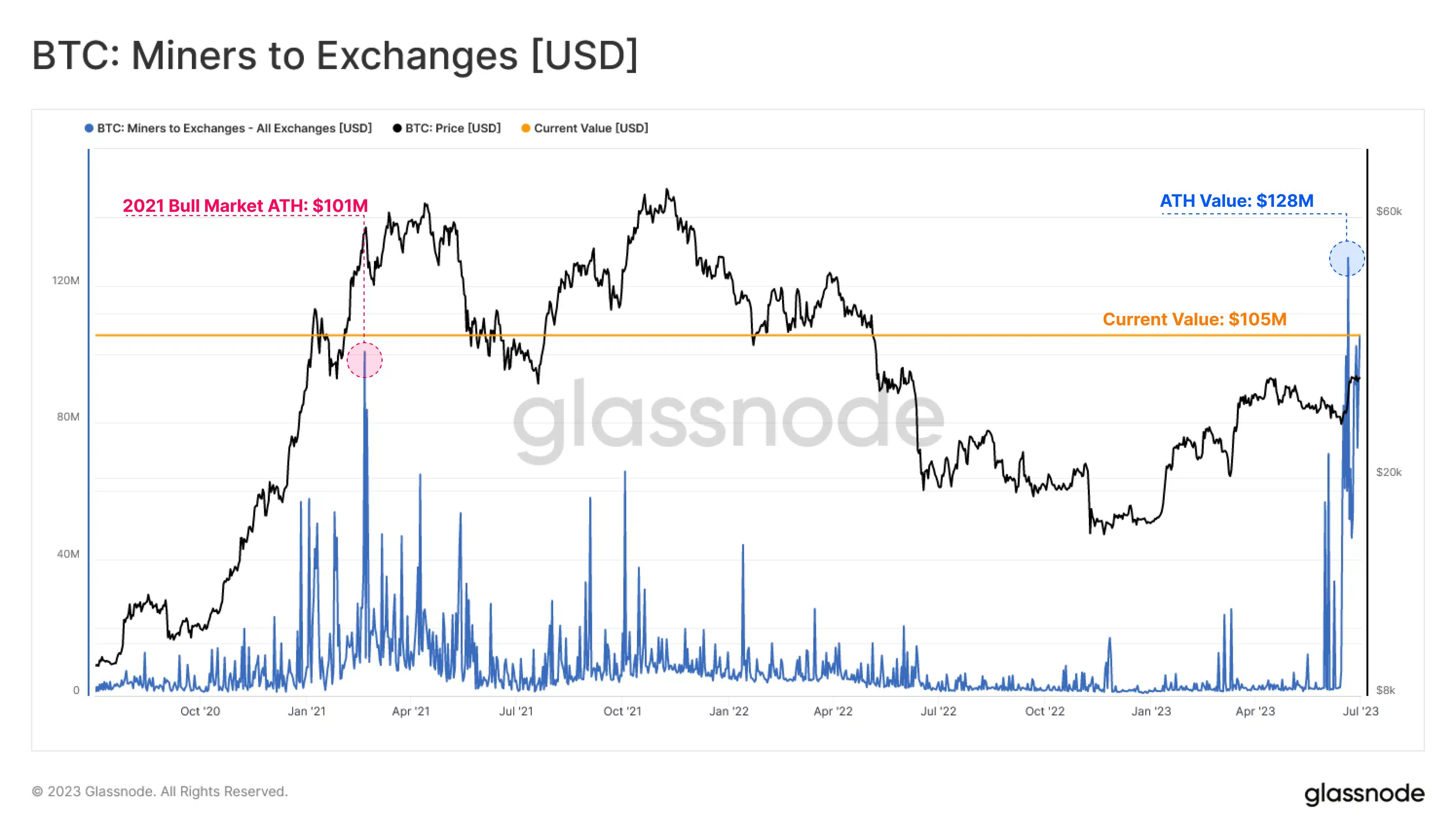

Apart from the social front, miners weren’t optimistic about holding their Bitcoin as well. According to glassnode’s data, after surpassing the psychologically significant $30K level in the spot price, Bitcoin Miners have persistently been sending substantial amounts of BTC to exchanges. At press time, miners transferred a total of $105 million to exchanges, marking the second largest recorded USD-denominated transfer.

Miners say their goodbyes to holdings

The continuous selling of BTC by miners puts downward pressure on the price of Bitcoin. The influx of BTC into exchanges increases the supply available for sale, potentially outweighing the demand and causing price depreciation.

Additionally, the significant transfers of BTC by miners to exchanges can contribute to increased volatility in the cryptocurrency market. Large sell orders can lead to sudden price fluctuations and create uncertainty among traders and investors. The lack of faith showcased by miners can also further increase the negative sentiment surrounding BTC on the social front.

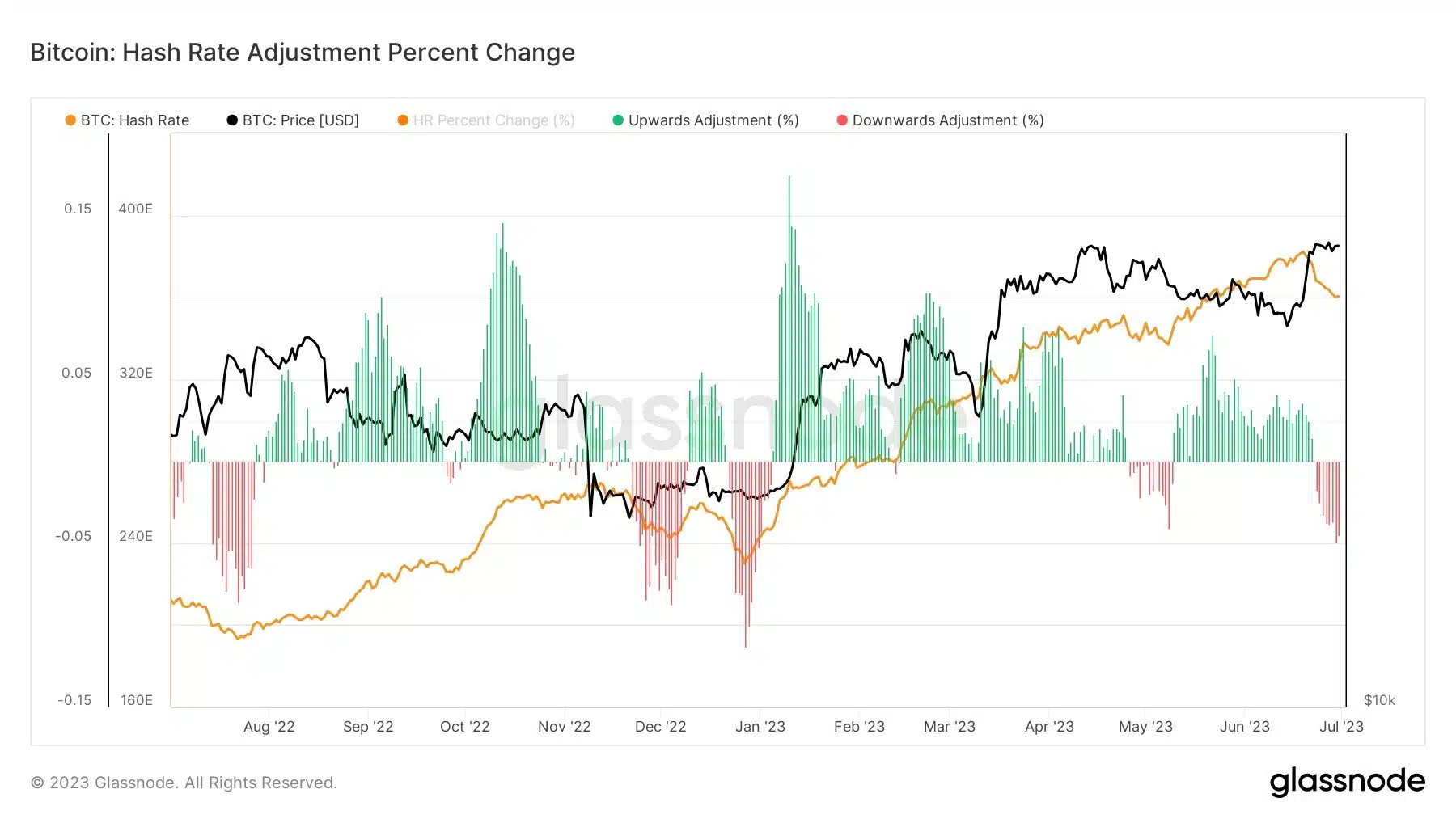

Additionally, the hashrate for miners was observed to be declining significantly as well. A lower hash rate signifies a decreased need for computational power in validating and adding transactions to the Bitcoin blockchain. This reduction in computing requirements results in lower energy and resource costs for miners, potentially enhancing their revenue generation.

Is your portfolio green? Check out the Bitcoin Profit Calculator

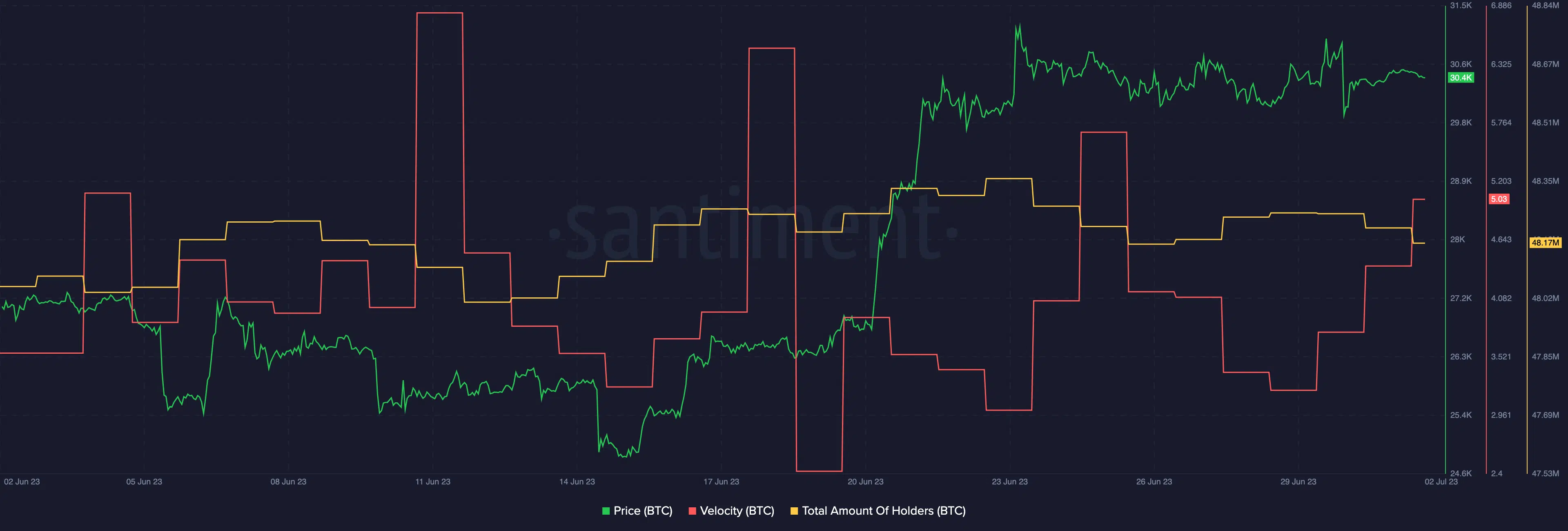

At press time, Bitcoin was trading at $30,400. Its price appreciated significantly over the last few weeks, along with its velocity, indicating a rise in transaction activity for the king coin. However, during this period, the number of holders of BTC slightly declined.

![Kusama [KSM] explodes 119% in one day - How DOT helped](https://ambcrypto.com/wp-content/uploads/2024/11/Michael-KSM-400x240.webp)