How Bitcoin helped revive crypto in June

- Binance’s market share declined by 1.4% to 41.6%, the most among centralized exchanges.

- Derivatives market share fell for the first time in four months.

Fueled by institutional interest in digital assets, the broader crypto market made a robust recovery in June. The bullish rally, which started after TradFi giant BlackRock’s application for a spot Bitcoin [BTC] Exchange-Traded Fund (ETF), resulted in yearly highs of major assets.

Read Bitcoin’s [BTC] Price Prediction 2023-24

King coin BTC breached past the stubborn $31,000-barrier for the first time since May 2022 and has jumped nearly 20% since the announcement of the spot ETF. At the same time, the total crypto market cap has increased by 14% to $1.17 trillion at the time of writing, per CoinMarketCap.

On expected lines, the bull run boosted the trading activity across major centralized exchanges (CEXes), snapping a two-month losing streak.

Buzz back on exchanges

The price action of the preceding months disappointed both the bullish and bearish forces of the market. This resulted in exchange trading volume dropping to multi-year lows.

However, the legal action taken against behemoths Binance and Coinbase by U.S. regulators and the flurry of spot ETF applications injected much-needed volatility into the markets.

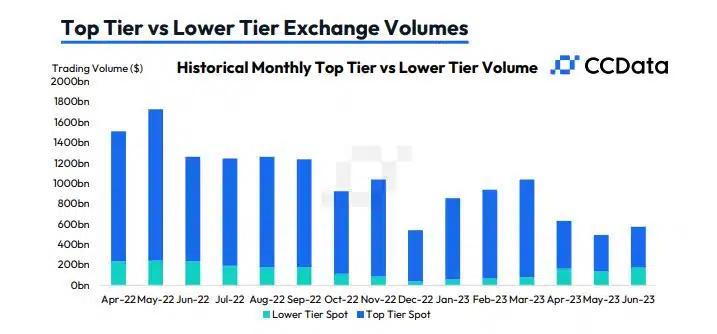

According to a report by digital assets data provider CCData, spot trading volume on CEXs rose 16.4% to $575 billion in June, recording the first increase in three months. While the “Top-Tier” volumes increased by 12.5%, the “Lower-Tier” exchanges saw a jump of 26.4% from the previous month in May.

To the uninitiated, CCData’s Exchange Benchmark categorizes the digital asset exchange industry as “Top-Tier” or “Lower-Tier” based on the level of risk involved.

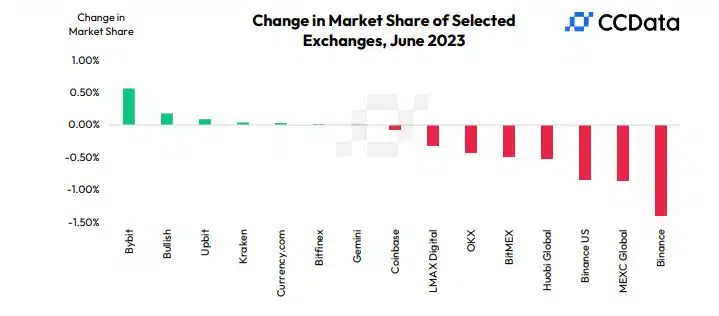

The comparatively lower growth rate for Top-tier exchanges was possibly due to the legal challenges, as highlighted earlier. Binance, its American arm Binance.US and Coinbase all witnessed a decline in their market share in June. Binance, the world’s largest exchange by spot volume, was the biggest loser among CEXs. Its market share declined by 1.4% to 41.6%.

The curious case of Coinbase

On the other hand, Coinbase’s share declined the least, just 0.08% to 5.36% in June. The report stated that increased activity by U.S.-based institutional investors lifted the volumes on America’s largest crypto trading platform.

This was further exemplified by the growing share of BTC trading volume on the platform. As of 4 July, Coinbase accounted for more than 60% of BTC volumes among exchanges operating in the U.S. market, up from 45% in April. It was expected to improve its share for the third month in a row in July, as per the report.

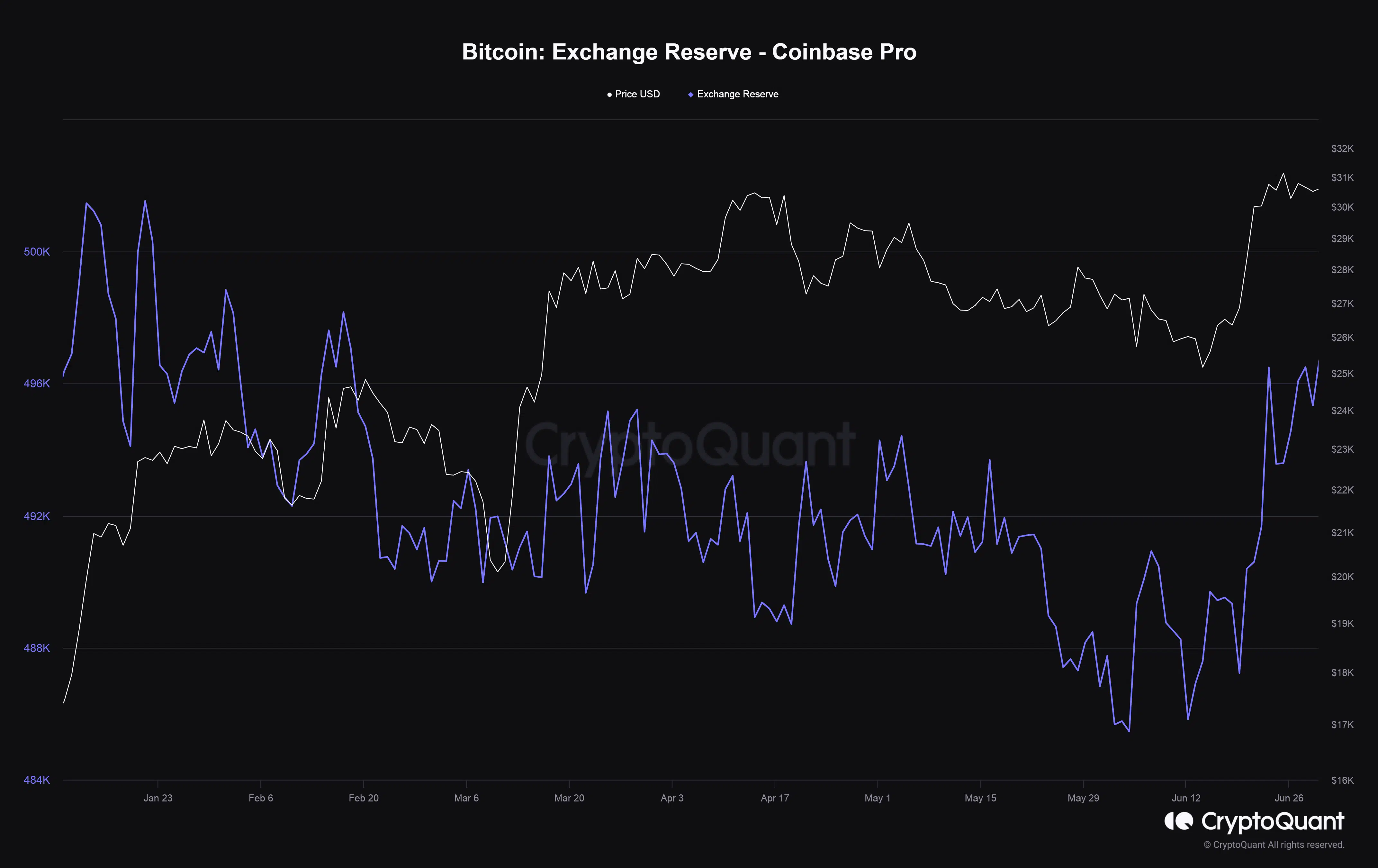

Moreover, BTC supply on Coinbase shot up following the jump in the asset’s price, as per CryptoQuant. As Coinbase is primarily used in the American market, it could be inferred that overall spot trading activity was driven by the U.S. institutional investors.

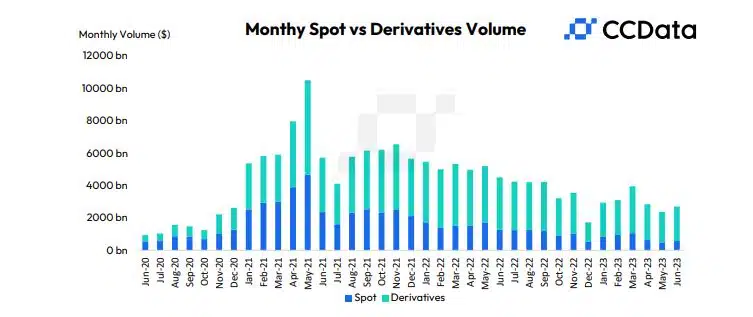

Derivatives market lose share

The dominance of spot trading activity affected the share of derivatives market. Although the derivative volumes increased 13.6% to $2.13 trillion in June, the overall dominance fell to 78.7%. This was a noticeable decline from the all-time highs of 80% in May.

Interestingly, this was the first drop in derivatives market share in four months, indicative of a spot accumulation of crypto assets.

It should be noted that spot ETFs, unlike futures ETFs, will be backed by real Bitcoin, and the price of one share on the exchange will react to the spot price of BTC, akin to holding a BTC.

Exchange supply, including Bitcoin, at multi-year lows

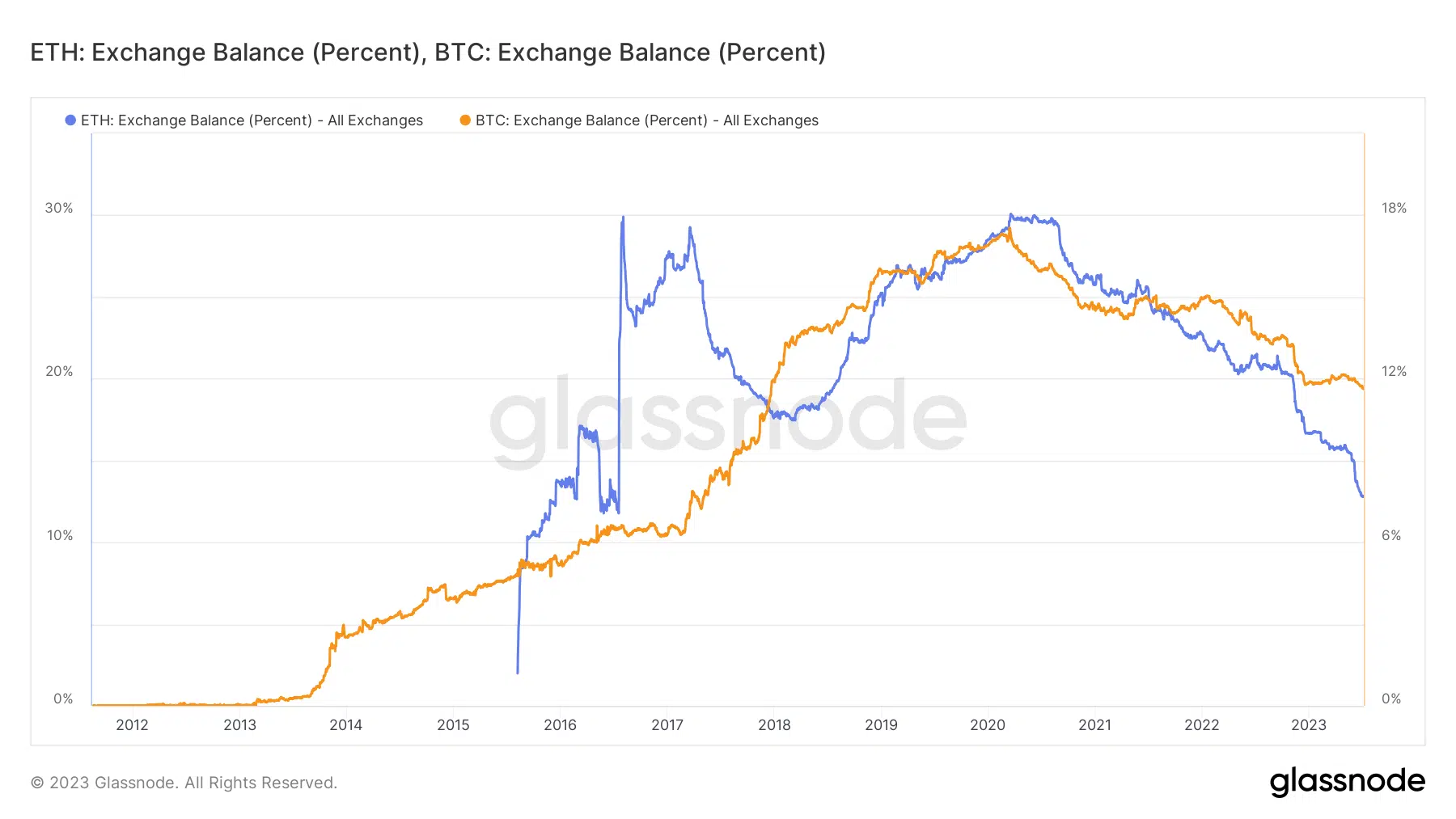

While crypto volumes were clearly invigorated in June, the supply of top digital assets on CEXs continued to dwindle. According to Glassnode, BTC’s percent supply on exchanges plunged to a five-year low of 11.6% as of 6 July.

Is your portfolio green? Check out the Bitcoin Profit Calculator

The second-largest digital asset by market cap Ethereum [ETH] exhibited a similar behavior, albeit its decline has been steeper. At the time of writing, only about 12.8% of ETH’s total circulating supply was available for trading and buying, the lowest in nearly six years.

However, things could change pretty soon, as per Binance CEO Changpeng Zhao (CZ). In a recent ‘Ask Me Anything’ session on Twitter, the crypto tzar predicted a bull run for Bitcoin over the next year-and-a-half. Moreover, he predicted that crypto exchanges should brace themselves for increased trading volumes.