NFT market starts collapsing like a house of cards in 2023, thanks to…

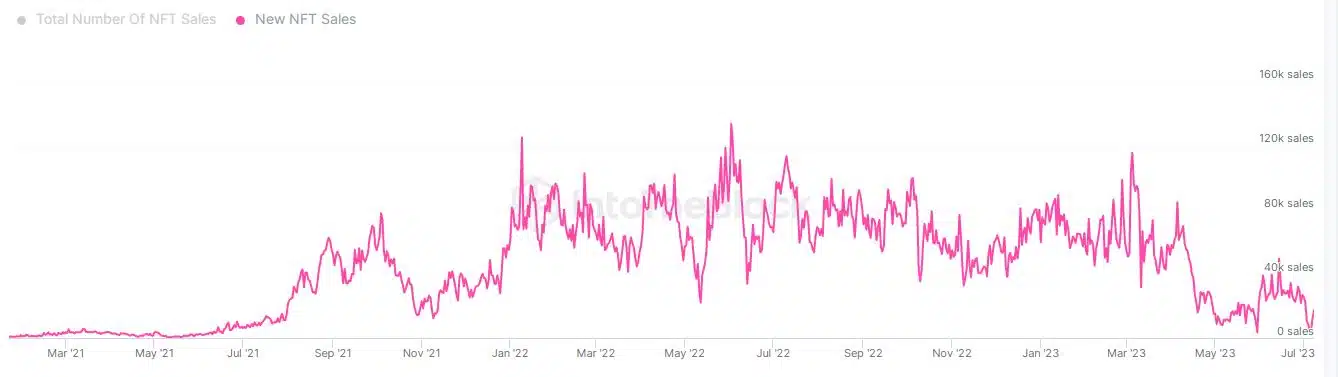

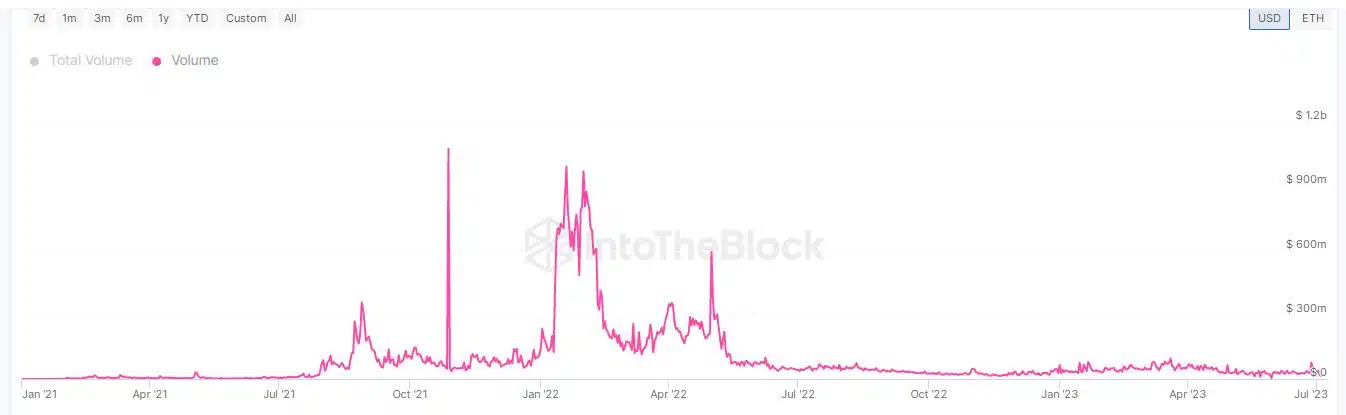

- The sales count and volume fell to their lowest levels since June 2021.

- Blue-chip collections witnessed a sharp drop in floor prices.

Non-fungible tokens (NFT) entered mainstream consciousness in a big way in 2021. Sales of popular collections skyrocketed and the frenzy caught on with who’s who of the glamour and entertainment world. The excitement continued in 2022 and despite a weaker second half, the NFT sales count recorded a 67.57% increase from 2021, according to a report by DappRadar.

It was expected that with the negativities of bear market put behind, the NFT landscape would usher in a new era of exponential growth and adoption in 2o23. Well, not to be!

NFT winter is here!

According to a report by on-chain analytics firm IntoTheBlock on the state of NFT industry, the weekly sales count was on track to record its worst performance since June 2021. The average daily count over the past week was a dismal 11.65k, a massive decline from the peaks of the 2021-22 bull market.

NFT volumes were severely impacted as sales plunged. After reaching the yearly peaks in March, the downfall started and accelerated right through the second quarter. Over the past week, the average daily trading volume was just around $16 million.

On a year-to-date (YTD) basis, the total NFT volume rose only by 11%. On the other hand, the total cryptocurrency market cap managed to clock a growth of 48% in the same time period, according to CoinMarketCap. This was a clear indication that the NFT vertical was detached from the gains in the digital assets market.

Marquee collections flop

The demand for blue-chip collections like Bored Ape Yacht Club (BAYC) and CryptoPunks fell drastically over the past week. As per the report, both the Yuga Labs-owned entities hit their two-year lows in average prices during the last week.

The largest collection by market cap, CryptoPunks, also saw its floor price hitting rock bottom. The floor price fell to 41 Ethereum [ETH] in the past week, lowest since August 2021, as per data from NFT Price Floor.

Floor price is the lowest value for any NFT in a given collection. A drop in a project’s floor price may suggest that an NFT project is losing traction. A similar pattern was observed with the BAYC collection, with floor prices for the last week mirroring August 2021 figures.

Blue-chip collections are those that have established a high and stable market worth over a relatively short period of time and are regarded as bellwether for investor sentiment regarding the market. As a result, the poor performance of BAYC and CryptoPunks may have signaled a red flag for the NFT ecosystem.

Azuki’s rise and fall

A significant contributor to the market slump was the dramatic fall of Azuki NFTs. Launched in 2022, the anime-themed collection became a massive hit owing to its quality designs and utility. However, it has been in the eye of the storm ever since the launch of its collection Elementals.

The launch was met with a fierce backlash from Azuki’s community members with many accusing the collection of being nearly identical to the original collection released last year.

As the negative word of mouth spread, buyers started to dump Azuki collections leading to a crash in its floor price. Since the launch of Elementals, the prices have fallen by 63%.

Blur’s role in the fiasco

Many users, especially those holding top collections like BAYC and CryptoPunks, blamed the market decline on the policies of the NFT marketplace Blur [BLUR].

Blur has incentivized trading on its platform through its token AirDrops for top users. As a result, traders began to increase their activity on Blur by passing collections back and forth, even if it meant incurring losses. This, as per many experts, led to a crash in their floor prices.

However, the co-founder has categorically dismissed the prevailing narratives against Blur as “bad takes“.

The NFT sector now sits at a crossroads. Internal conflicts have intensified, and if unchecked, these could lead to an implosion. It is up for NFT enthusiasts and the stakeholders to amicably sort the differences and invest time and resources to build the blockchain-based vertical.

![Magic Eden crypto [ME] surges post-listing, but concerns rise](https://ambcrypto.com/wp-content/uploads/2024/12/Magic_Eden-1-400x240.webp)