Has Solana moved on from its fiasco with Sam Bankman-Fried?

- Solana’s TVL has fallen by 97% since November 2021.

- Network fees and revenue have fallen steeply in the last year.

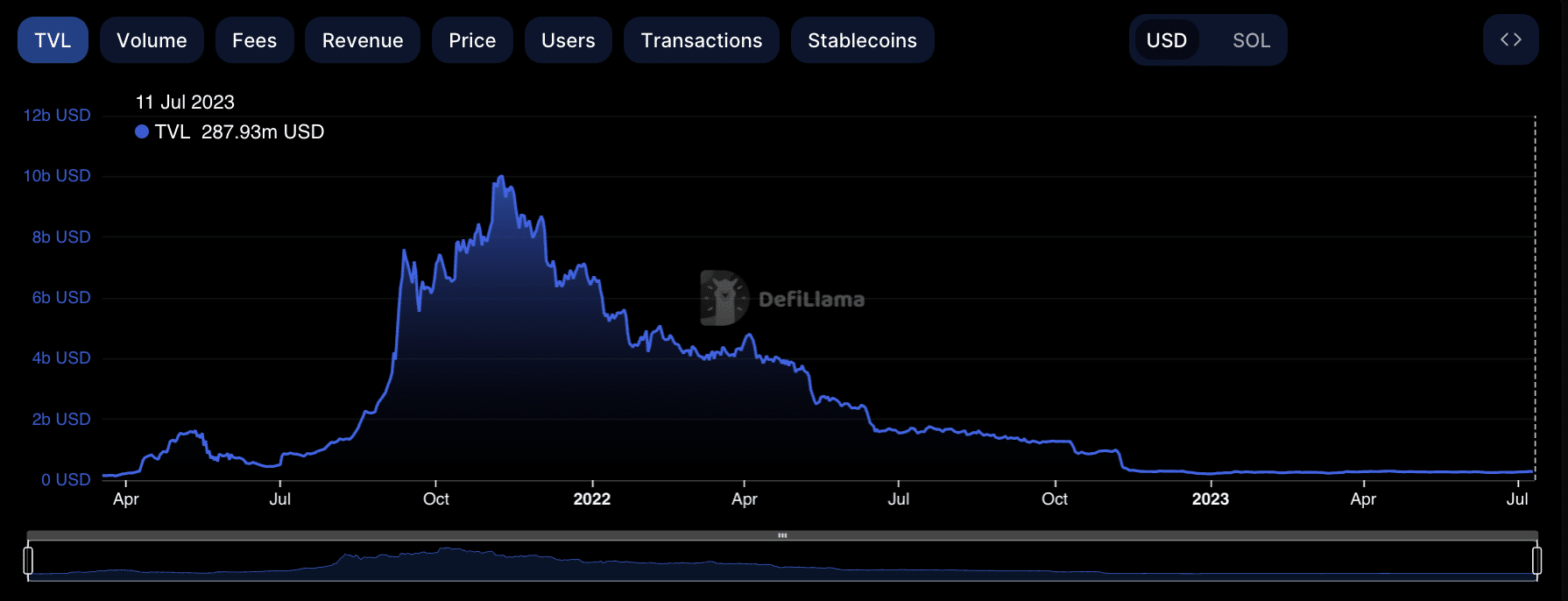

The DeFi TVL of Layer 1 (L1) blockchain Solana [SOL] has returned to its April 2021 lows, data from DefiLlama revealed. After peaking at $10 billion on 9 November 2021, it has since declined by 97%. At press time, Solana’s TVL was $286.86 million.

Read Solana’s [SOL] Price Prediction 2023-24

Solana’s many downtimes and its ties to disgraced Bankman-Fried

Since its launch, the Solana network has been plagued with a series of chain halts due to network overload caused by activities such as botting and spam. In the last year alone, the network suffered some form of major outage a total of ten times, the latest being on 28 February, when the chain experienced “a large forking event.”

While Solana touts itself as a cheaper layer 1 than Ethereum [ETH], the frequent downtimes in the last year eroded confidence in it, causing some of its protocols to experience a decline in network activity, hence the steady fall in TVL.

Also, Solana’s ties to disgraced founder Sam Bankman-Fried contributed to the significant fall in its TVL when cryptocurrency exchange FTX surprisingly went under in November 2022.

It is believed that Bankman-Fried could have been Solana’s single most prominent backer. Critics have also argued that the rise in the value of the SOL coin and associated assets between 2020 and 2021 was influenced, to some extent, by Bankman-Fried’s interventions and promotion in the market.

According to data from DefiLlama, within 24 hours of FTX’s collapse, Solana’s TVL plummeted by 32.4%. Since then, it has fallen by 32%.

State of the chain

This year, Solana’s network activity has trended downwards since the middle of May, data from Artemis showed. According to the data provider, the count of unique wallet addresses sending on-chain transactions daily on the network has dropped by 53% since 18 May.

Likewise, information from the same data provider revealed a corresponding decline in transactions count since the end of June. With 15.79 million transactions completed on the blockchain on 9 July, the total number of transactions registered daily on Solana declined by 37% since 28 June.

Realistic or not, here’s SOL’s market cap in BTC’s terms

Regarding network fees and revenue, data from Token Terminal confirmed a 66% respective fall in the last year. As a result of a decline in Solana usage in the last year, fees received from transactions completed by users on the chain have dropped.

Data from Token Terminal also revealed that Solana fees annualized totaled $11.9 million. And the revenue from the same amounted to $5.95 million.