Buzz around Litecoin rises as halving draws near, but…

- LTC was one of the top gainers in the last 24 hours, breaching through the $100 ceiling.

- After locking in sufficient gains, whales started to stack their portfolios with LTC.

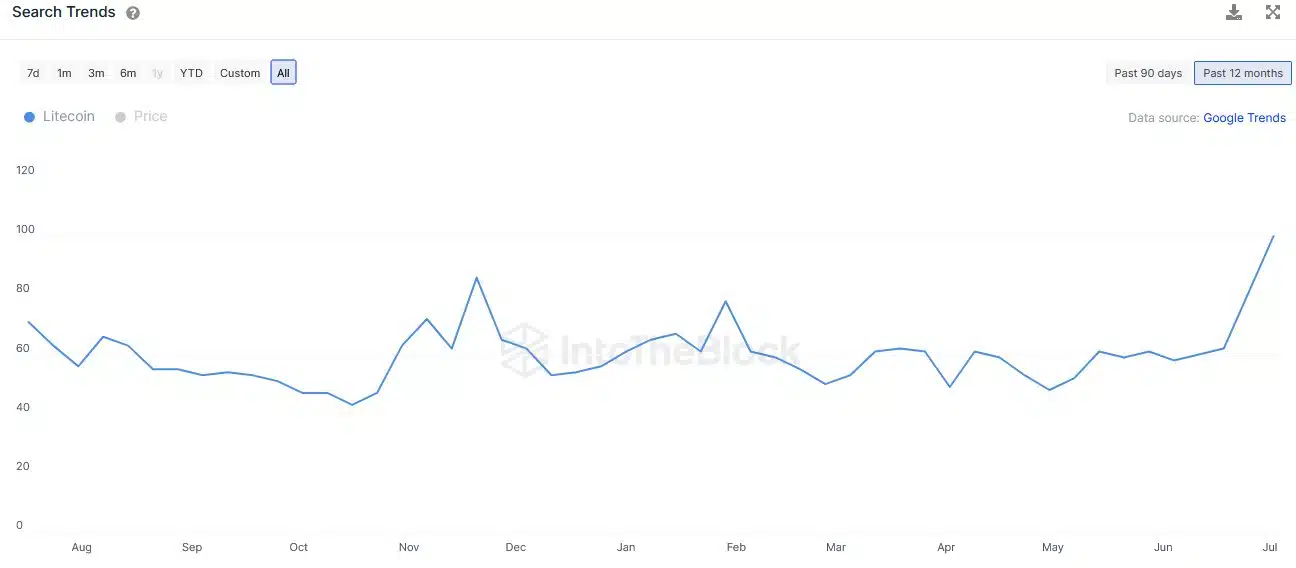

Proof-of-work (PoW) network Litecoin [LTC] has been creating a lot of buzz as its widely anticipated halving event is less than three weeks away. According to on-chain analytics firm IntoTheBlock, search trends for “Digital Silver” hit a yearly high as of 12 July, indicating strong interest both outside and inside the crypto sphere.

How much are 1,10,100 LTCs worth today?

The importance of halving

The anticipation coincides with a quadrennial occurrence that sees miners’ block rewards cut in half, hence lowering the number of tokens in circulation.

Based on the fundamentals of scarcity economics, the value of LTC will increase as tokens become scarcer. It could then be utilized as a potential inflation hedge in the future.

According to CoinMarketCap, LTC was one of the top gainers in the last 24 hours, breaching through the $100 ceiling with a 4.23% jump at the time of publication. Over the past month, the asset soaked up impressive gains of more than 28%.

Accumulation on the rise?

As seen generally in financial markets, a positive buzz encourages accumulation activities and results in investors scurrying to acquire the asset. But was it the case with the younger sibling of Bitcoin [BTC]?

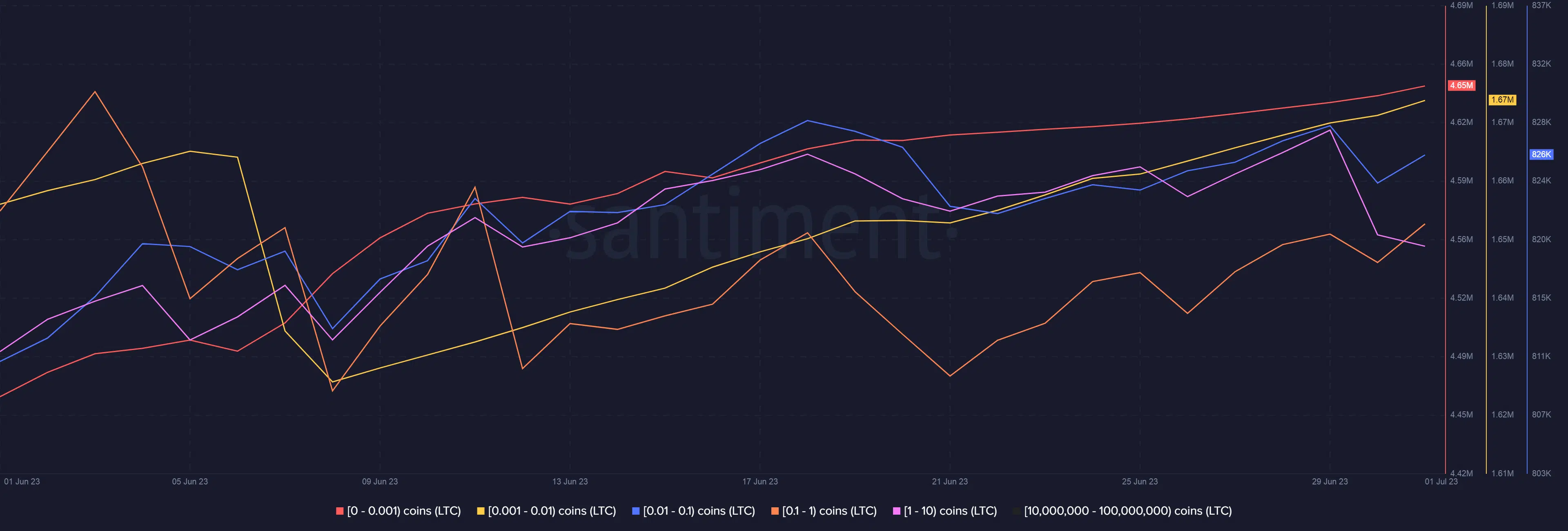

The asset’s increasing retail adoption was a testament to this narrative. Wallets containing less than 10 LTCs have steadily increased over the past month, according to Santiment.

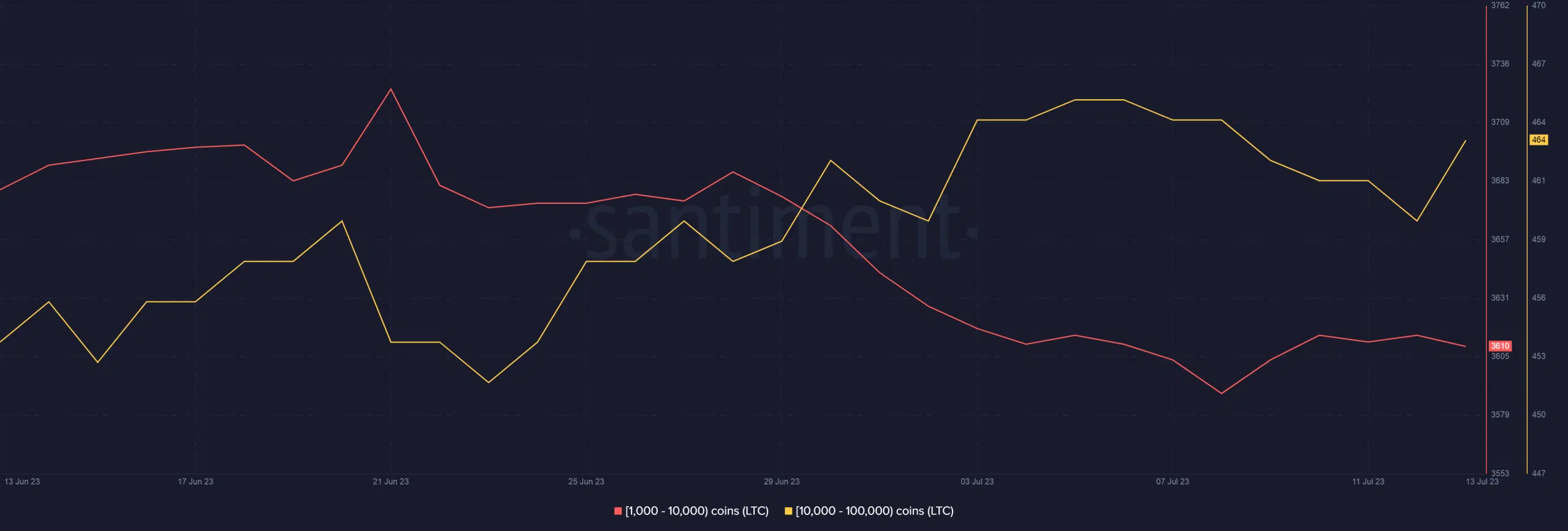

But LTC’s growth was not just fueled by retail holdings. Large investors, popularly known as whales, jumped on the bandwagon as well. After locking in sufficient gains in the first week of July, these players started to stack their portfolios with LTC.

As reflected below, the user cohort holding 1,000-100,000 coins showed early signs of accumulation, which might intensify as we move closer to the halving event.

What to expect post halving?

While speculation in crypto circles is rife, the halving event alone might not necessarily be a significant driver of price movement. This could be explained by looking at the price action following the previous two occurrences.

Is your portfolio green? Check out the Litecoin Profit Calculator

The first halving event occurred on 25 August, 2015, after which LTC’s price remained flat. The most recent halving, which took place on 5 August, 2019, resulted in a continuation of the downtrend.

Skeptics have argued that participants are already aware of the halving event and factor it into their price calculations and strategies, resulting in insignificant impact post the event.