As Shiba Inu hits a familiar hurdle, is a reversal likely?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- SHIB hit a familiar roadblock on the D1 chart.

- Monthly holders outperformed quarterly holders.

The December 2022 low has been a key roadblock for Shiba Inu [SHIB] bulls. Recent upside has faltered at the area twice, underscoring its sticky resistance against bulls’ efforts. At the time of writing, SHIB’s price action attempted to cross the obstacle but could reverse if sell pressure intensified.

Is your portfolio green? Check out the SHIB Profit Calculator

Will bulls exit their positions?

The December 2022 low also aligns with a bearish order block (OB) of $0.00000785 – $0.00000824 (red). In addition, the previous range formation of $0.00000850 – $0.00000903 on the D1 chart is another bearish OB on the weekly chart.

So, the stretch between $0.00000785 – $0.00000903 could be a bearish stronghold. As such, a liquidity hunt in this area couldn’t be overruled before sellers extended gains towards the immediate support of $0.00000711.

However, it was worth noting that bulls could seek stealth entry at the price imbalance and FVG (fair value gap) zone of $0.00000732 – $0.00000757 (white).

So, conservative bulls could wait for a retest of $0.00000711 for new buying opportunities. But aggressive ones could seek immediate re-entry at the FVG if BTC maintains above $30k. The overhead bearish OB will be the primary target.

Meanwhile, the RSI and OBV registered upticks, underscoring the recent buying frenzy.

Monthly holders outperformed quarterly holders

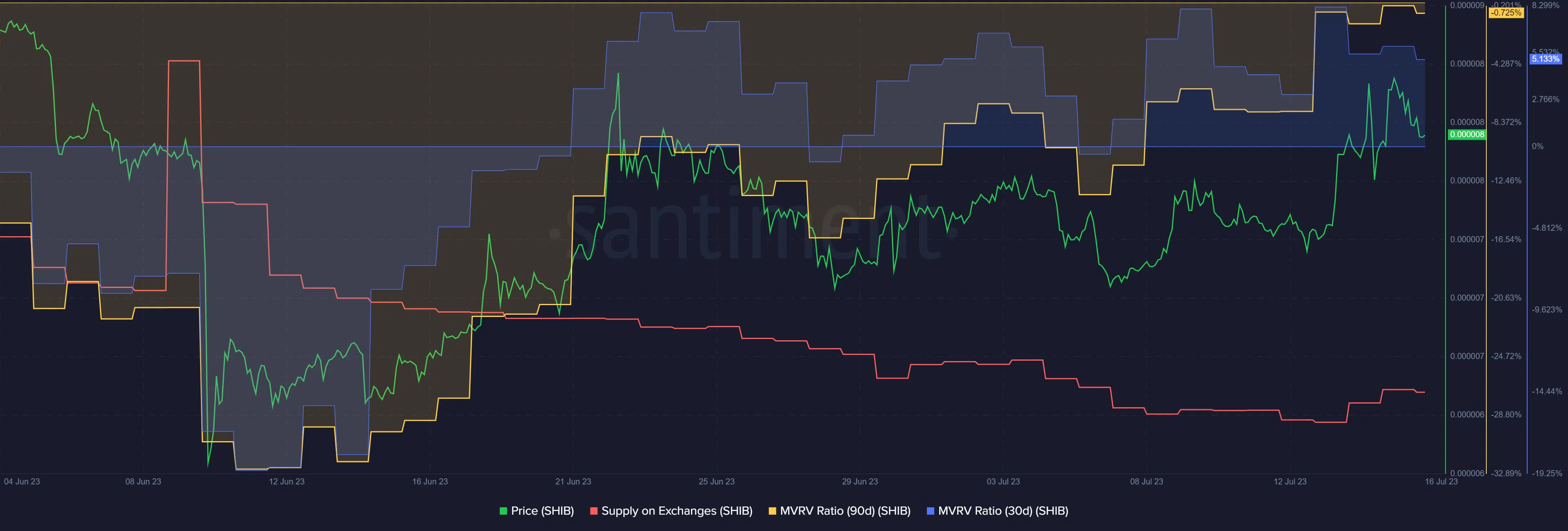

According to Santiment, the 90-day MVRV (Market Value to Realized Value) and 30-day MVRV showed stark contrast.

How much are 1,10,100 SHIBs worth today?

In particular, the 30-day MVRV was at +5%, while the 90-day MVRV was at -0.74% at the time of writing. It shows monthly holders were at 5% profit, while quarterly holders were yet to reverse all recent losses. Put differently; monthly holders outperformed quarterly holders.

There was also a spike in supply on exchanges, which could expose SHIB to potential reversal if short-term sellers lock profits at the current resistance level.