Starknet ‘Quantum Leap’ goes live; Here’s what it means for the network

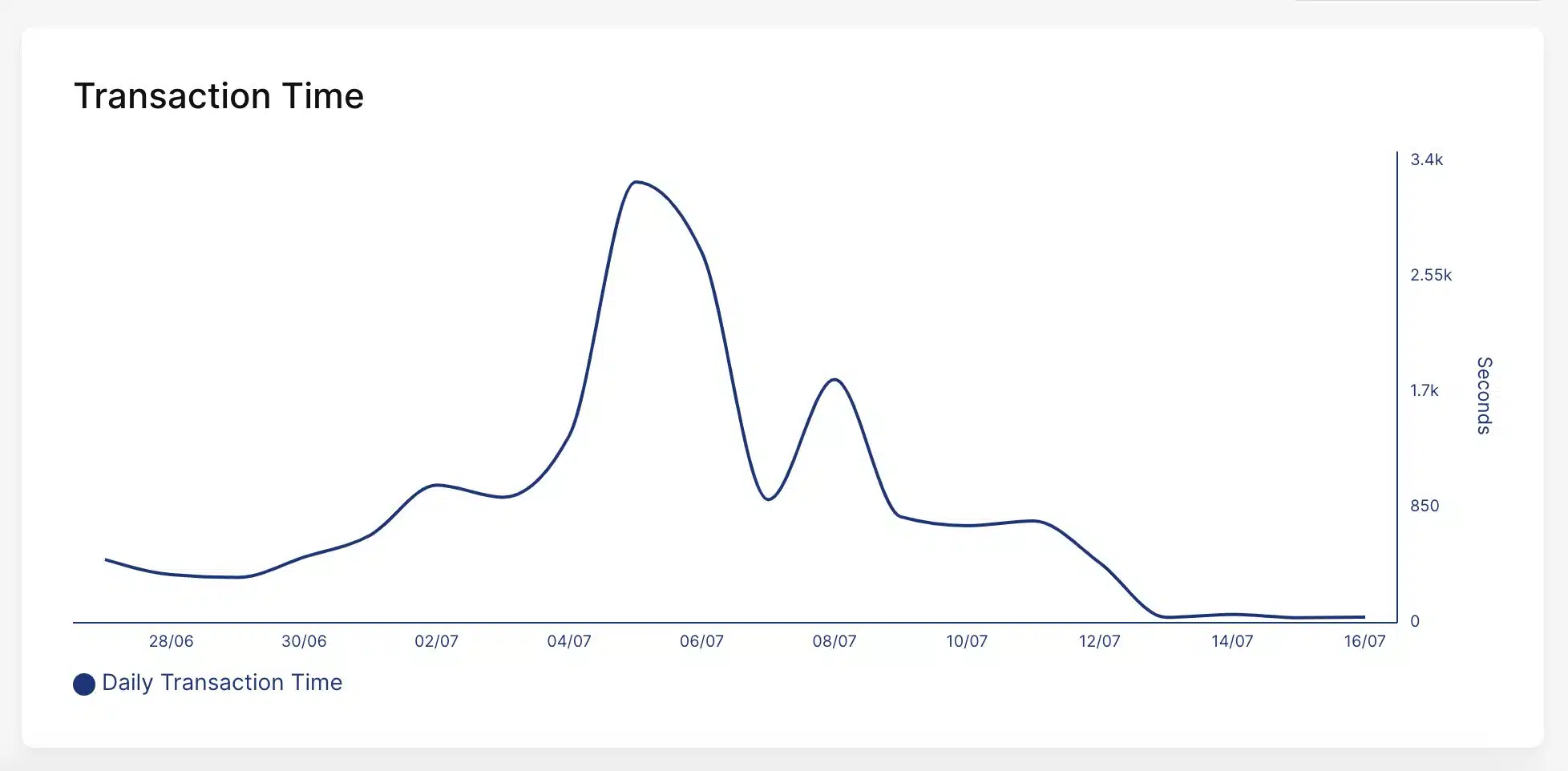

- Average network latency over the last five days dropped significantly.

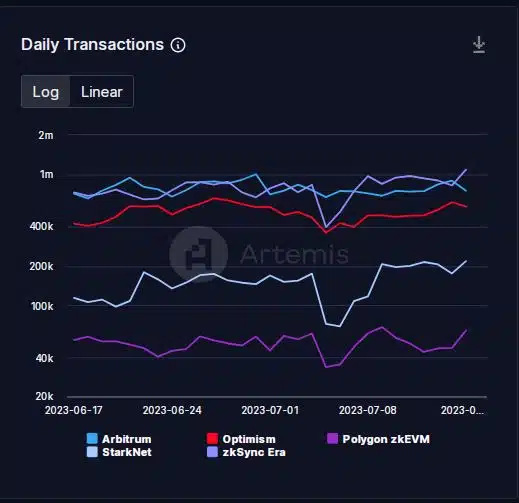

- Starknet’s daily transaction count was considerably lower than other L2s.

Starknet’s much-awaited “Quantum Leap” upgrade started to produce exciting results in terms of transaction throughput and latency.

According to a Twitter user, the time taken for a transaction to get accepted on a L2 block decreased significantly ever since the upgrade went live on the Ethereum [ETH] mainnet on 12 July. The data sourced by the user from Starknet’s block explorer Voyager, revealed that from a high of 429 seconds, the average transaction latency over the last five days was slashed to 27 seconds.

TPS stagnates after initial spike

The deployment of v0.12.0 was an important milestone in the zk-rollup’s 2023 roadmap, aim of which is to boost capacity in order to accommodate the anticipated rise in users and developers.

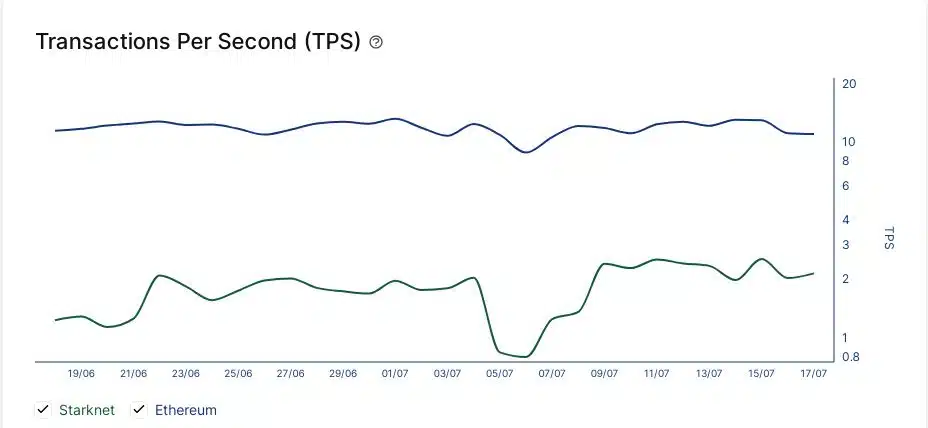

The latest upgrade intended a 10x increase in throughput. However, after an initial spike, the transactions processed per second (TPS) have remained sluggish. According to the graph below, the average TPS on Starknet over the last five days was 2.1. In comparison to base layer’s double digits figures, this was underwhelming.

Even when compared with other L2 networks, Starknet underperformed. The number of daily transactions executed on the network has remained significantly lower than optimistic rollups like Arbitrum [ARB], Optimism [OP] and the popular zk-rollup zkSync Era, as per data from Artemis.

But despite the shortcomings, proponents remained optimistic about Quantum Leap.

TVL remains on the lower side

With higher throughput, Starknet hoped to attract more sophisticated decentralized finance (DeFi) and gaming applications. This could boost its total value locked (TVL).

As of 16 July, the TVL of the L2 solution was just $19.22 million, a fraction of Arbitrum and zkSync Era, and trailing Polygon zkEVM’s total assets worth by a considerable margin as well.

Plan to make Starknet affordable

Starknet’s next big focus was to cut down its transaction fees. As part of its v0.13.0, L1 (Ethereum) data cost, which accounts for 95% of transaction costs, would be targeted using Starknet’s Volition.

As per L2 Fees, transaction costs on Starknet were one of the highest among all rollups. It required $0.21 to send one ETH on Starknet as compared to $0.05 on Arbitrum, $0.03 on Polygon zkEVM, and $0.04 on Optimism.