Will BNB cross the $245 hurdle soon?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The H-4 market structure was bearish at the time of writing.

- The futures market recorded a massive drop in Open Interest.

In July, the crypto market was driven mainly by Ripple Labs‘ legal win and Bitcoin’s [BTC] price action. Ripple Labs’ legal win tipped Binance Coin [BNB] to foray above $250. But recent BTC price action and next week’s Fed decision could derail bulls from clearing the $245 hurdle.

Is your portfolio green? Check out the BNB Profit Calculator

In the meantime, BTC was yet to record a strong corrective rebound from its range-low. It struggled to make daily candlestick sessions close above $30k in the last few days. The trend could reinforce BNB’s bearish bias on the H4 market structure into the weekend.

Will the $245 resistance persist?

The lower lows and lower highs chalked after the price dropped from $260 flipped the H4 market structure bias to bearish. Bulls could only show bullish intent if they clear the recent lower high of $247.

However, the $245 resistance has blocked further upside since Monday (17 July). If BTC loses hold of the range-low, BNB will likely retest the range-low of $240 or $238. Put differently, the $245 roadblock could persist if BTC fails to reverse recent losses.

Conversely, a close above $245 and subsequent clearance of a lower high of $247 could tip BNB to aim at the $250 threshold again.

The RSI (Relative Strength Index) fluctuated near the neutral point in the last few hours. It shows prices could take either direction as buy and sell pressure was almost equal. In addition, the CMF (Chaikin Money Flow) registered a downtick, indicating eased capital inflows.

Open Interest rate declined

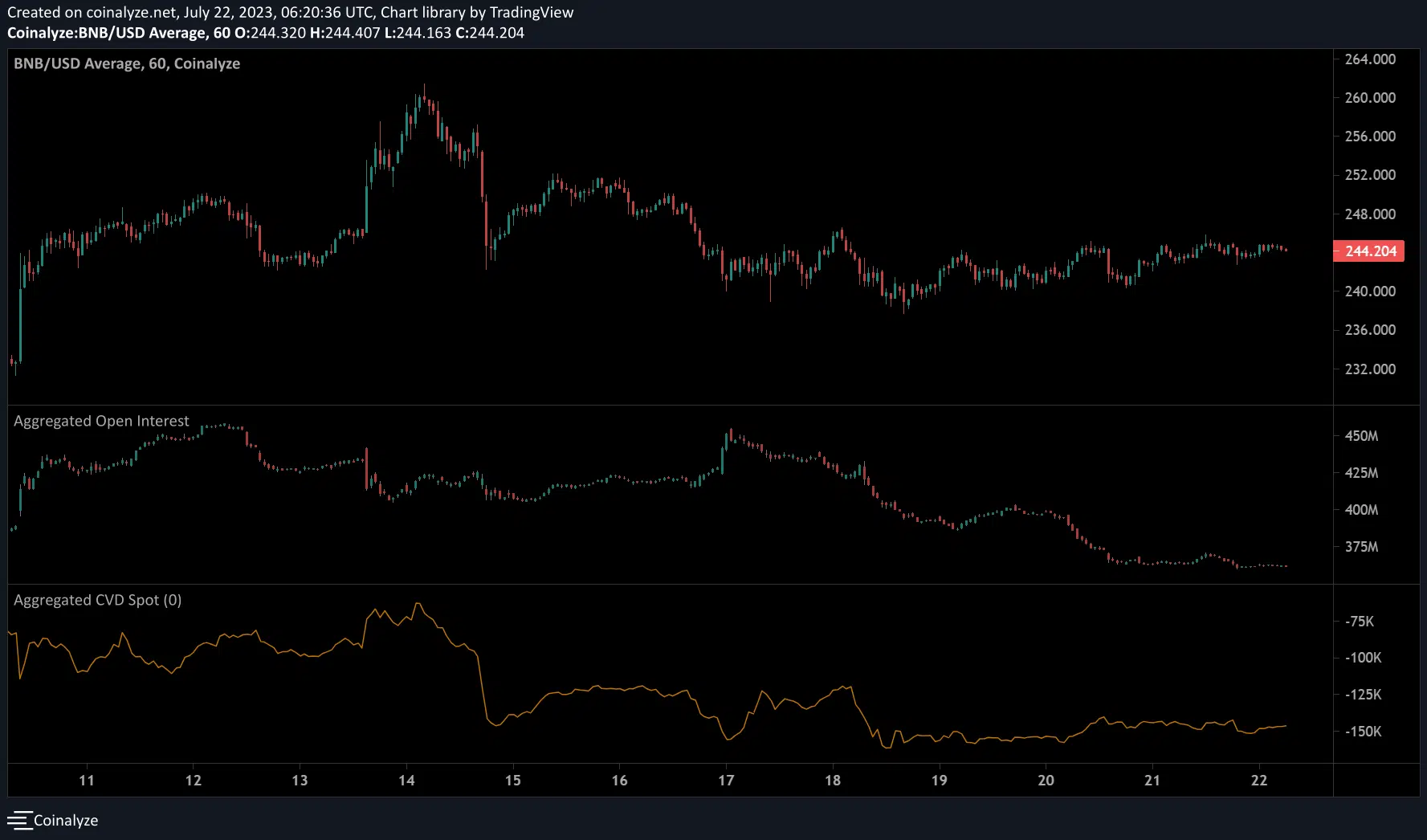

On Coinalyze’s 1-hour chart, the Open Interest (OI) rates dropped from >$450 million on 17 July to about $360 million at the time of writing.

The massive OI, alongside a decline in CVD (Cumulative Volume Delta), denotes a decline in demand in the futures market as BNB consolidated tightly between $240 – $245 since 17 July.

But both OI and CVD steadied at press time, suggesting a likely price pivot that could mean a breakout or a rejection at $245.

How much are 1,10,100 BNB worth today?

However, BNB registered more liquidations of short positions in the last 24 hours. According to Coinalyze, $39k worth of short positions were liquidated against $10k for long positions – a mild bullish sentiment.

The above metrics flashed mixed signals and calls for caution and tracking of BTC price movement before making moves.