HEX: The tale of the crypto project that rewards you for locking away your money

- HEX operates a “time product” structure that allows its users to lock up their HEX tokens for rewards.

- The value of the HEX token has dropped by over 90% in less than six months.

Often described as the first blockchain Certificate of Deposit (CD), HEX staking kicked off in December 2019 as an Ethereum-based cryptocurrency project that offers a way for investors to earn interest on their “locked-up” HEX tokens.

HEX is a blockchain-based project that replicates a common product in the banking world – a time deposit. In traditional finance, CDs refer to a specific type of savings account offered mainly by banks. When customers invest in a CD at a bank, they agree to “lock” some of their money with the bank for a stated term period.

As a reward for keeping the money locked for the specified tenure, the customer is offered a fixed interest rate generally higher than regular savings accounts offer. Upon maturity, the customer can withdraw its initial investment and the earned interest.

HEX for dummies

Designed to work similarly to how CDs work in traditional finance, HEX offers interest to users who “lock” their coins (HEX tokens) by staking them on its platform.

Participants are allowed to stake their tokens for varying lengths of time, ranging from as little as 24 hours to as long as 5,555 days (about 15 years). During this period, participants are typically not allowed to access or transfer staked assets.

Like CDs in real-world banking, the longer the staking tenure, the higher the returns that accrue to the user. This incentivizes users to stake for more extended periods and reduces selling pressure on the HEX token, which might negatively impact its price if allowed to continue unabated.

When users stake their HEX tokens, they receive T-shares, and their staked HEX is burnt. These T-Shares act as a measure of users’ stake in the system and determine their share of rewards at the end of the maturity period.

According to the project’s whitepaper, the number of T-Shares that accrue to a staker on the platform is calculated by multiplying the amount of HEX tokens staked with the current T-Share price and the length of the staking period.

For example, according to data from HexStats, the pay per T-Share as of 22 July was $557. Therefore, if a user staked 500 HEX tokens on that day for a 365-day term, they would receive 278,500 T-Shares by 22 July 2024, paid out in HEX tokens. However, it is key to note that the number of T-shares you receive is flexible. It can change over time.

You cannot eat your cake and have it on HEX

As mentioned above, users are typically not expected to unstake their claims during the staking period. However, the Ethereum smart contract that powers HEX has a feature that enables users to terminate their stakes before the committed time. This is not without penalty.

According to the whitepaper, the penalty is determined based on ½ of the days they initially committed to staking, rounded up. For example, if they devoted themselves to staking for 365 days (1 year), the penalty would be calculated based on 182 days (½ of 365 days), regardless of how many days they have actually staked.

There is a minimum penalty period of 90 days that is applied to any user who decides to withdraw their tokens early, regardless of their initial committed time. So, even if someone initially committed to staking for a shorter period, for example, 179 days, the penalty would still be set to 90 days.

State of HEX staking

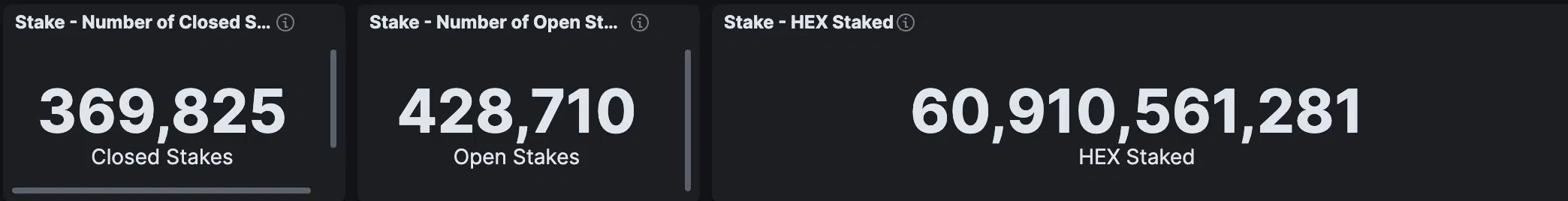

According to data from Elastic, since the project’s launch, a total of 60,910,561,281 HEX tokens have been staked. Since December 2019, 369,825 stake positions have been closed, with 428,710 open stake positions remaining by press time.

According to the Open Stakes by Expected End Time dashboard on Elastic, the number of HEX tokens whose staking periods will expire will decline progressively over the years. By 1 October 2038, 59.03 million HEX tokens (on a 5-day moving average) will reach their maturity dates.

Further, the daily count of staking positions opened on HEX has climbed significantly in the last three months. During the same period, the circulating supply of HEX tokens declined steadily.

Regarding penalties on the project, data from Elastic revealed that 4,423,713,660 HEX tokens have been billed in penalties for both early and late unstaking. Late unstaking occurs when a user leaves their stake “unattended after it has sat for its committed period.”

An assessment of monthly penalties incurred by HEX users revealed a decline since October 2021. In June, 30 million HEX tokens were paid in penalties. This represented a 93% fall in monthly penalties charged within a two-year period.

HEX returns remain hexed in the last four months

After rallying to a price high of $0.118 on 23 March, HEX’s value has since declined. Exchanging hands at $0.009807 at press time, the alt’s price has dropped by 92% in under six months, data from CoinMarketCap revealed.

On a daily chart, key momentum indicators have since trended downwards, signaling a free fall in HEX accumulation since March.