Institutional crypto products witness second month of growth, driven by…

- On a YTD basis, the AUM recorded an impressive growth of 71%.

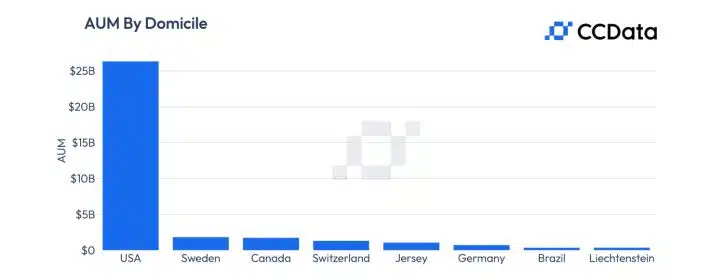

- The U.S. retained its dominant position with 78% market share in digital asset investment products.

The month of July extended broader market confidence in digital assets, diminishing late-June’s blip.

The U.S. Securities and Exchange Commission (SEC) formally admitted Blackrock’s and other TradFi institutions’ spot Bitcoin [BTC] exchange traded fund (ETF) applications for regulatory scrutiny after previously judging them as “inadequate.”

The acceptance was the first step towards what market participants thought would be a first-of-its-kind approval. It was aimed at boosting the adoption of cryptocurrencies for investment purposes.

Another month of growth

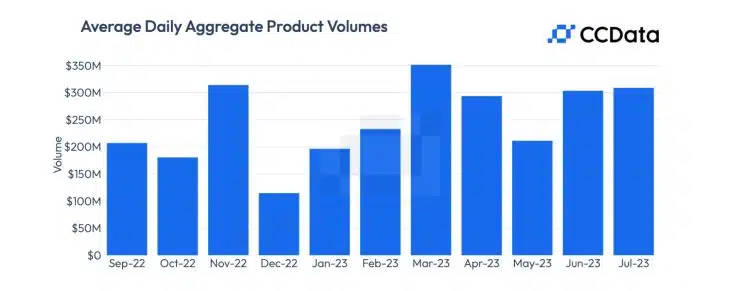

The positive sentiment translated into a marginal increase in trading volume of digital asset investment products. According to a report by digital assets data provider CCData, the average daily aggregate volume reached $309 million in July, representing an increase of 1.81% from the previous month.

This is the second consecutive month of growth in institutional crypto products.

Throughout July, Bitcoin wobbled in a tight trading range of $29.5k-$31.8k. The extended period of low volatility impacted the market value of investments. The total assets under management (AUM) were valued at $33.7 billion in July, representing a marginal increase of 1.14% from June.

However, on a year-to-date (YTD) basis, the AUM recorded an impressive growth of 71%.

The AUM is a function of flow of investor money in and out of a fund and the price performance of the underlying asset.

These assets catalyzed AUM’s increase

Growth was led, as expected, by Bitcoin-based investment products, spurred by unprecedented optimism around Bitcoin ETFs. The AUM increased marginally by 0.5% to $24 billion, leading to a slight increase in the slice of the market pie.

Bitcoin investment products held a market share of 71% as per the report, up from 70.7% in June.

While BTC products led the AUM growth by virtue of their market share, some other assets contributed healthily on account of positive developments in their respective ecosystems.

Stellar Lumens [XLM]-based products witnessed a massive growth of 62% in July, driven by a 70% jump in the value of the native token in July.

Apart from this, the partial victory secured in the two-and-a-half-year-long legal battle with the SEC resulted in a 33.2% growth in XRP-based products. The bullish sentiment spread to Solana’s [SOL] investments’ value as well which recorded a 55.7% jump in AUM.

U.S. remains a power center

The United States retained its dominant position in the digital asset space, with the country being home to the largest and most influential asset manager in the world – Grayscale Investments.

The company, which manages the world’s largest Bitcoin fund, Grayscale Bitcoin Trust (GBTC), powered the U.S. to a 78% market share with an AUM of more than $26 billion.

The report highlighted the flurry of ETF proposals and their subsequent acceptance by the SEC that helped mitigate the unrest in the U.S. market, followed by regulatory clampdowns on big entities in previous months.

In July, Sweden, Switzerland, and Germany registered a total AUM of $3,9 billion, comprising 11.5% of the total market.

GBTC sees dip in market share

Despite the scale and market dominance, trust products witnessed a marked decline. After jumping 9.65% in June, GBTC’s AUM dropped 2.88% to $18.6 billion in July. This caused a slight decrease in its market share, from 74.9% to 74.1%.

In contrast, the second-largest traded crypto trust product, Grayscale Ethereum (ETHE), registered a 1.44 % uptick in AUM to $5.65 billion. This increased its slice of the trust market to 22.5%.

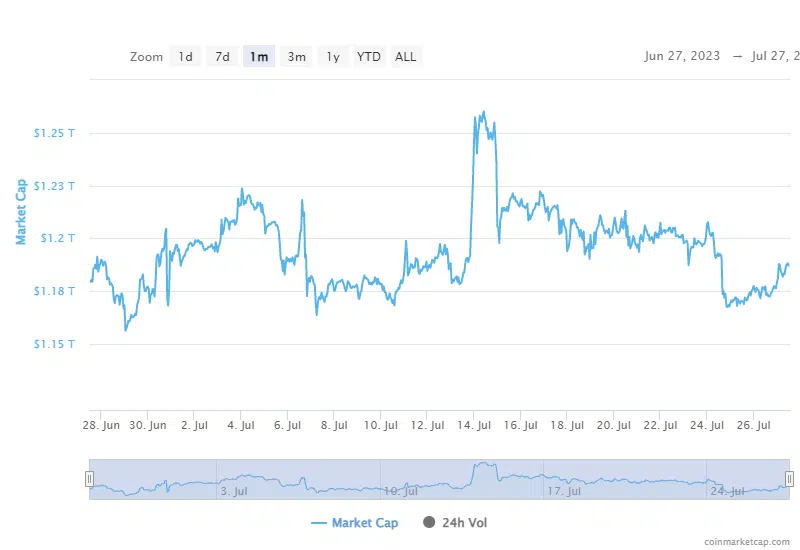

Meanwhile, the aggregated market cap of all crypto assets shot up to $1.19 trillion, according to CoinMarketCap. In the aftermath of the XRP verdict, the market cap touched a three-month high of $1.26 trillion. But the euphoria has significantly subsided since then.