Stablecoin GHO lingers below $1 since launch – why?

- Although designed to trade at $1, GHO exchanged hands below this peg.

- This is mostly due to a drop in the coin’s demand.

After being in development for the last year, Aave’s GHO stablecoin finally launched on the Ethereum Mainnet on 15 July. Although designed to maintain its parity with the U.S. dollar, the stablecoin has traded below the $1 peg since launch, on-chain data reveals.

Realistic or not, here’s AAVE’s market cap in ETH’s terms

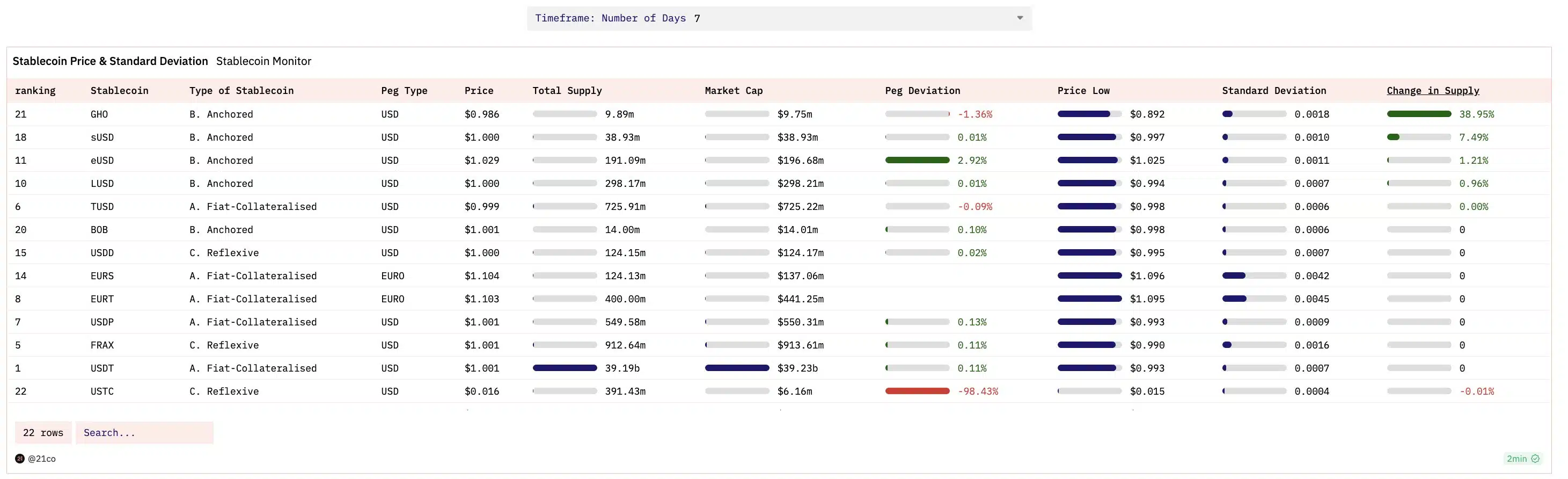

This has been the case despite the uptick in the coin’s supply since it launched. According to a Dune Analytics dashboard, GHO experienced a 38.9% increase in supply in the last week, making it the fastest-growing stablecoin in the decentralized finance (DeFi) market.

Why the new kid on the block trades below $1

At press time, GHO lingered at $0.9856. In a series of tweets, on-chain analyst Tom Wan highlighted the reasons behind the coin’s inability to trade at its designed peg.

Since launch, AAVE's $GHO has been trading below the $1 Peg. The current Price is $0.987

What could be the potential reason?

(✍️/5) pic.twitter.com/IMwhWp0NHP

— Tom Wan (@tomwanhh) July 30, 2023

According to Wan, GHO was yet to see in-depth integration across decentralized finance (DeFi) protocols. In the statement published when GHO was launched, Aave noted that its users could only mint GHO on its Ethereum V3 market against assets they have already supplied as collateral.

This limits the coin’s usage as borrowers cannot hold the same for yield farming opportunities to make more money. “Instead, they could swap it for other tokens, which could provide them with more yield opportunities,” Wan noted.

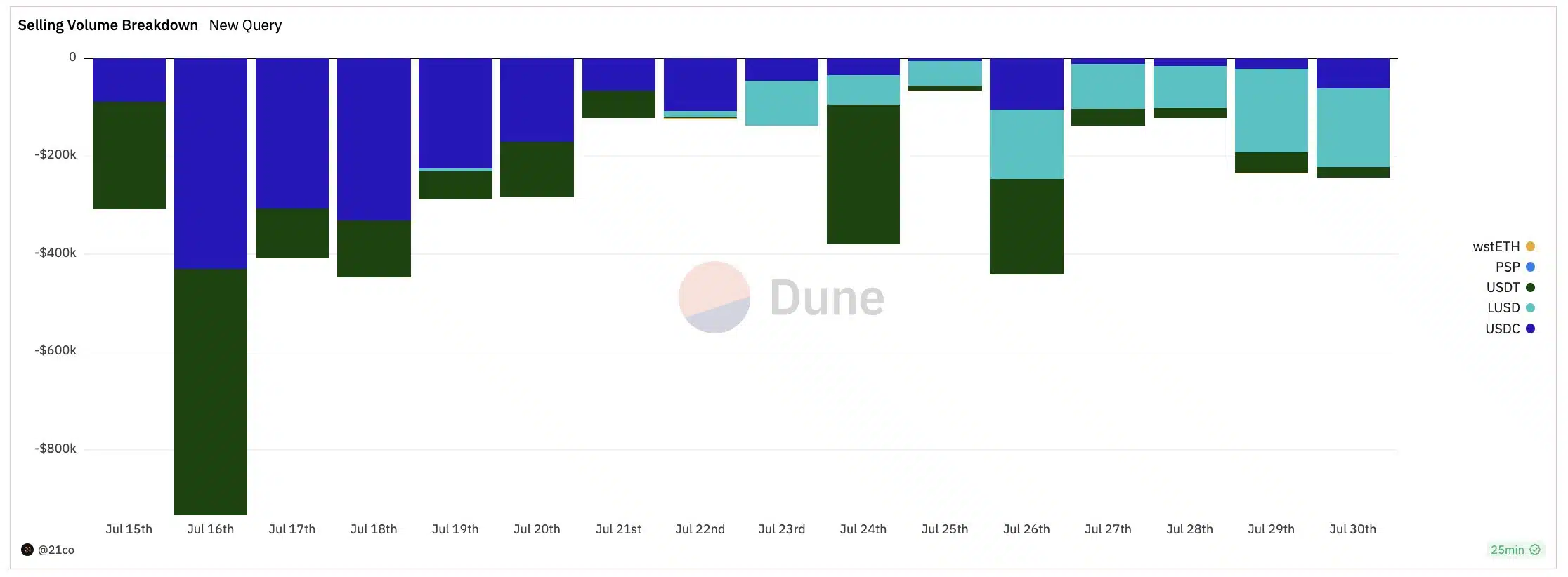

Another reason identified by Wan for why GHO has refused to trade at its $1 peg was the downtrend in demand for the stablecoin. According to the analyst, GHO’s selling volume on decentralized exchanges (DEXes) has exceeded its buying volume. This, Wan noted, “could be a contributing factor leading to the depeg of the stablecoin.”

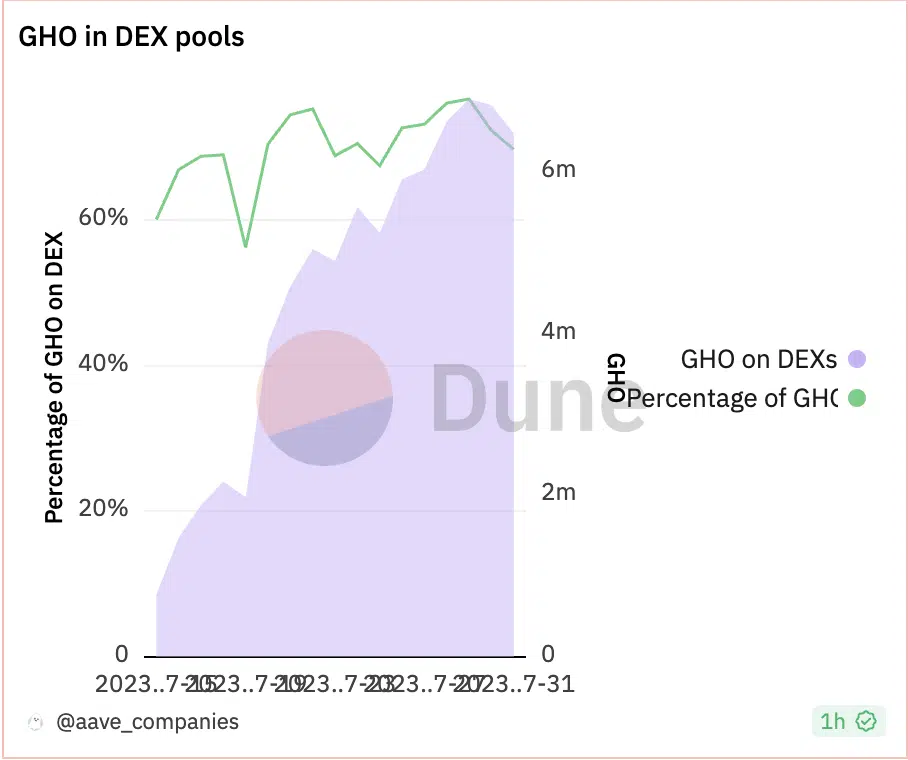

With a drop in demand across DEXes, the coin’s supply on these platforms dwindled in the past few days. At press time, GHO’s DEX pool supply was 69.7%. This represented a drop of 7% since 22 July, when its supply stood at 75.3%.

How much are 1,10,100 AAVEs worth today?

Further, an assessment of the selling volumes of stablecoins across Aave revealed that swappers have mostly exchanged their GHO coins for three stablecoins – LUSD, USDC, and USDT.

This is because Aave users can mint (borrow) GHO at a relatively low-interest rate of 1.5% and then swap the borrowed GHO for USDT, for example. The USDT can then be resupplied on Aave for a 2.6% yield, which results in a gain of 1.1% after paying back the borrowed GHO.