Tether reports profit worth $850 million in Q2 2023

- Tether’s operational profits soared past $1 billion in Q2 2023.

- The report also revealed treasuries worth $72.5 billion backing the USDT stablecoin.

Tether, the issuer of the USDT stablecoin, reported a profit of $850 million in the second quarter of 2023. Moreover, its total amount of excess reserves amounted to $3.3 billion.

The $850 million of profit is the retained profit of the second quarter, which has added to increasing Tether’s excess of reserves.

The finding is a part of Tether’s financial attestation for Q2 2023. A Belgium-based accounting firm, the Binder Dijker Otter (BDO), has prepared the attestation.

The company’s operational profits exceeded $1 billion in Q2 2023, marking a 30% increase quarter over quarter. Its improvement in performance this quarter is a part of the general uptick across the cryptocurrency market that was fueled by the recent consolidation of Bitcoin [BTC] around the $30K-price mark.

The report further revealed that its reserves were still highly liquid, with a substantial 85% of its investments kept in cash and cash equivalents.

Tether’s exposure to treasuries

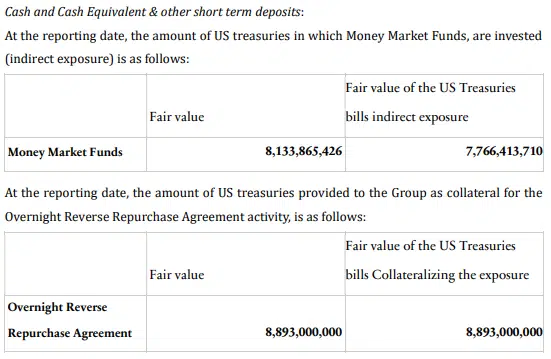

The report also showed Tether’s indirect exposure to U.S. Treasury Bills through money market funds. It is also exposed to the Treasuries collateralizing the Overnight Repo, a form of short-term borrowing for dealers in government securities.

In total, the amount of treasuries backing the USDT stablecoin sat at $72.5 billion.

Profits from Q2 have also been proceeded to “other investments in energy-related initiatives.” However, the company has not included them in its attestation report as the investment doesn’t qualify as an appropriate reserve for circulating tokens.

The report also reveals that Tether’s shareholders will conduct a $115 million share buyback to “strengthen” the company.

Tether CTO Paolo Ardoino said,

“I am immensely proud of our most recent reserves attestation, reaffirming our unwavering commitment to transparency… By continuously improving our reserves attestation process, we aim to set new standards in the industry and inspire others to follow suit.”

USDT is the world’s largest stablecoin and the third-largest cryptocurrency. At press time, it had a market cap of $83.7 billion.