Decentralized derivatives show promise, but there’s a long way to go

- The DEX-to-CEX futures trade volume was just 1.4% as of July 2023.

- The derivatives market was dominated by crypto perpetual futures, which contributed over 90% to its TVL.

Over the years, decentralized finance (DeFi) has played an active role in spreading Web3 to a wider market. DeFi mirrors all of the activities commonly associated with the TradFi market, such as asset trading, lending, and borrowing. However, no centralized organization dominates it.

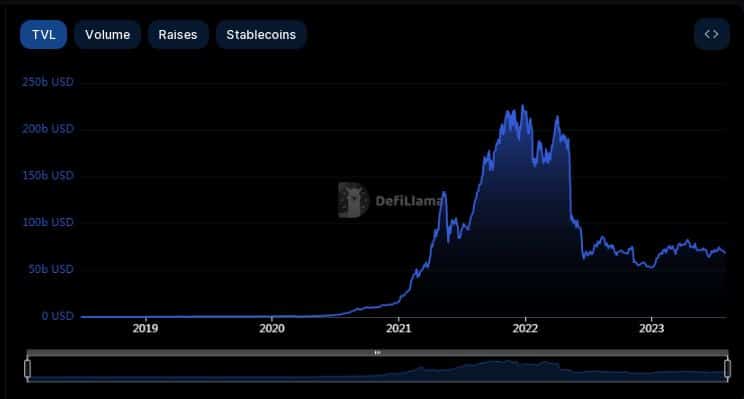

According to data from DeFiLlama, about $66.94 billion worth of cryptos were locked in DeFi protocols at the time of writing. Moreover, revenue from DeFi was predicted to hit a whopping $231.2 billion by 2030.

As the market evolves, one sub-sector of DeFi that will be crucial to its growth story is decentralized derivatives.

The world of decentralized derivatives

Binance published a report that delved into the decentralized derivatives landscape, analyzing the status of on-chain protocols as well as the market outlook.

As widely understood, crypto derivatives allow investors to place bets on price changes of cryptos without owning the underlying asset. Crypto derivatives formed a lion’s share of the market when it came to centralized exchanges (CEX). However, the contribution from DeFi left a lot to be desired.

The DEX-to-CEX futures trade volume was just 1.4% as of July 2023. Moreover, the contribution of derivatives-based products to total DeFi total value locked (TVL) was just 3.7% as per the report.

These indicators undoubtedly signaled the slow pace of growth in decentralized derivatives trading. On the positive side though, it revealed that there was a large addressable market for DeFi to tap into.

Perpetuals futures dominate

For the uninitiated, perpetuals are a type of futures contract, essentially agreements to buy or sell cryptos at a predetermined price and time in the future.

Crypto perpetual futures dominated the derivatives market at press time, amounting to over 90% to DeFi derivatives TVL. Interestingly, this category of derivatives was also dominant on CEXes.

The report underlined that perpetuals were easier to model in a decentralized setup when compared to other products, hence the larger market share.

At the time of writing, dYdX [DYDX] was the largest perpetual futures protocol, clocking trading volumes of more than $1 billion in 2023, the report highlighted.

Similar to CEXes, dYdX works on the order book mechanism, wherein orders are compiled and buyers and sellers are matched in an off-chain environment. Once the prices align, the final transactions are executed on-chain.

The upcoming release of V4 aims to plug the gaps in full decentralization with the entire process expected to happen on-chain.

dYdX vs GMX

Notably, dYdX’s volumes have remained considerably higher than those of second-ranked GMX [GMX]. One of the reasons cited behind the wide gap was the volume-tiered fee mechanism.

In contrast to the flat trading fee imposed by GMX, dYdX provides exemptions to traders within a certain volume threshold. Because the focus has been more on incentivizing volume rather than profitability, transaction fees generated on dYdX were significantly less than that of GMX.

GMX boasts of the highest TVL among all DeFi derivatives, more than $900 million at the time of writing, per DeFiLlama. GMX depends on the shared liquidity model where users have the option of borrowing funds from a pool containing a wide array of assets rather than just a single token.

The report added a caveat that most of GMX’s growth has come in the bear market and its capabilities are yet to be tested in a bull market. Perhaps, having understood this shortcoming, GMX was looking forward to its next iteration V2.

This version would make enhancements keeping in mind high-volume trades.

Apart from these established names, Gains Network [GNS] and the MUX Protocol showed substantial gains in 2023.

Options yet to emerge

Pretty much like futures, options are derivatives products that enable people to buy or sell an underlying asset at an agreed-upon price and date. However, options contracts just give holders the right and are not an obligation to buy or sell.

DeFi options constituted a TVL of more than $1oo million per the report. However, given the complex designs, these financial instruments haven’t succeeded in penetrating deeper into the derivatives landscape.

Lyra was the largest options protocol at the time of writing with a TVL of $37.92 million. The protocol was present in the two L2s- Arbitrum [ARB] and Optimism [OP].