Is waning interest the reason for a drop in NFT thefts?

- The number of NFT scams has fallen consistently since February.

- This is due to the persistent decline in general market interest.

The monthly value of stolen non-fungible tokens (NFTs) closed July at its lowest level yet this year, data from blockchain security company PeckShield showed.

#PeckShieldAlert In July 2023, ~$1.73M worth of #NFTs were stolen, marking a 31% decrease compared to the previous month. Within a span of 165 minutes, half of the stolen NFTs were promptly sold on various marketplaces. The percentage of stolen NFTs initially sold on @blur_io… pic.twitter.com/cknsefpfwe

— PeckShieldAlert (@PeckShieldAlert) August 6, 2023

The value of stolen NFTs in July was $1.72 million, down 89% from $16.2 million in February, which was the highest monthly figure for stolen NFTs in 2023. In June, the value of stolen NFTs totaled $2.73 million, representing a 37% drop in NFT thefts in July.

The decline in stolen NFT value is likely due to a number of factors. However, the main reason was the overall decline in interest in the general NFT market. PeckShield added that half of the stolen digital collectibles were sold on various NFTs marketplaces, but primarily on Blur.

Less interest equals less scam

So far, the year has been plagued by a general lack of interest in non-fungible tokens, especially profile-picture NFTs (PFPs). With less transactions involving NFTs completed in the last month, the ecosystem experienced a decline in market capitalization and trading volume.

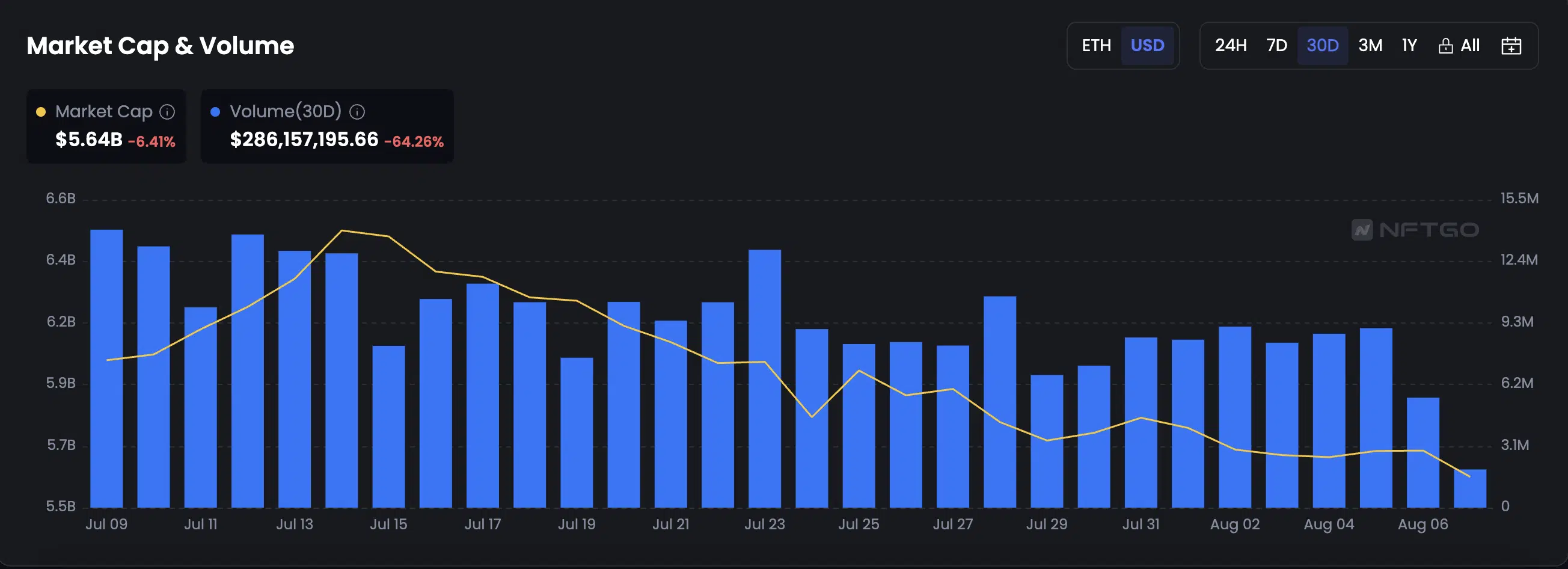

Per data from NFTGo, the NFT vertical of the crypto ecosystem had a market capitalization of $5.64 billion at the time of writing. A month ago, this was above $6 billion.

Also, in the past 30 days, sales volume totaled $286.15 million. This represented a 64% decrease from the sales volume recorded in the previous month.

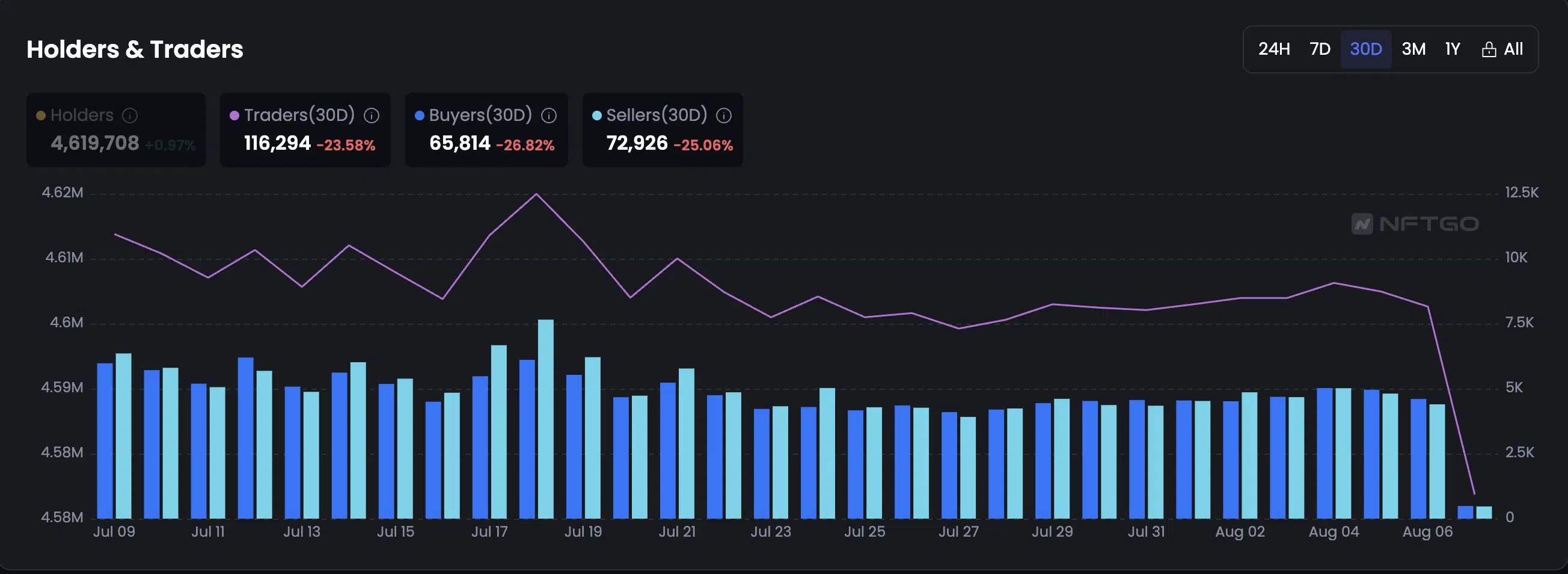

Due to the falling interest in these digital collectibles, the count of market participants also fell during the period under review, data from NFTGo revealed. In the last month, the number of unique addresses that bought or sold at least one NFT from any existing collections declined by 24%.

Regarding buyers in the market, only 65,814 unique addresses bought at least one NFT in the last month. This amounted to a 27% shortfall in buyer count. As for sellers, their count totaled 72,926, seeing a 25.06% decrease.

Blue Chip NFTs were not exempted

NFTGo’s Blue Chip Index tracks the overall performance of NFT collections that are categorized as blue-chip NFTs. This Index is calculated by weighing the market capitalization of these NFTs to determine their performance.

In the last month, Blue Chip Index dropped by 4%, suggesting a general decline in the values of top NFT collections like Bored Ape Yacht Club (BAYC) and Mutant Ape Yacht Club (MAYC).

A look at the floor prices of these NFT collections in the last 30 days confirmed this decline. According to data from NFT Price Floor, BAYC’s floor price dropped by 6%. As for MAYC, it also saw an 8% decrease in floor price within the same period.