Filecoin forms a bearish breakout – more losses likely?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- FIL breached its July/August price range.

- Open Interest rates wavered in August.

Filecoin [FIL] could record more losses after a recent bearish breakout from its July-August price range. As Bitcoin [BTC] fails to flash any sign of strength near the $29.0k, any drop below the $29k psychological level could set altcoins, including FIL, to further losses.

Is your portfolio green? Check out the FIL Profit Calculator

Sellers want to flip range-low to resistance

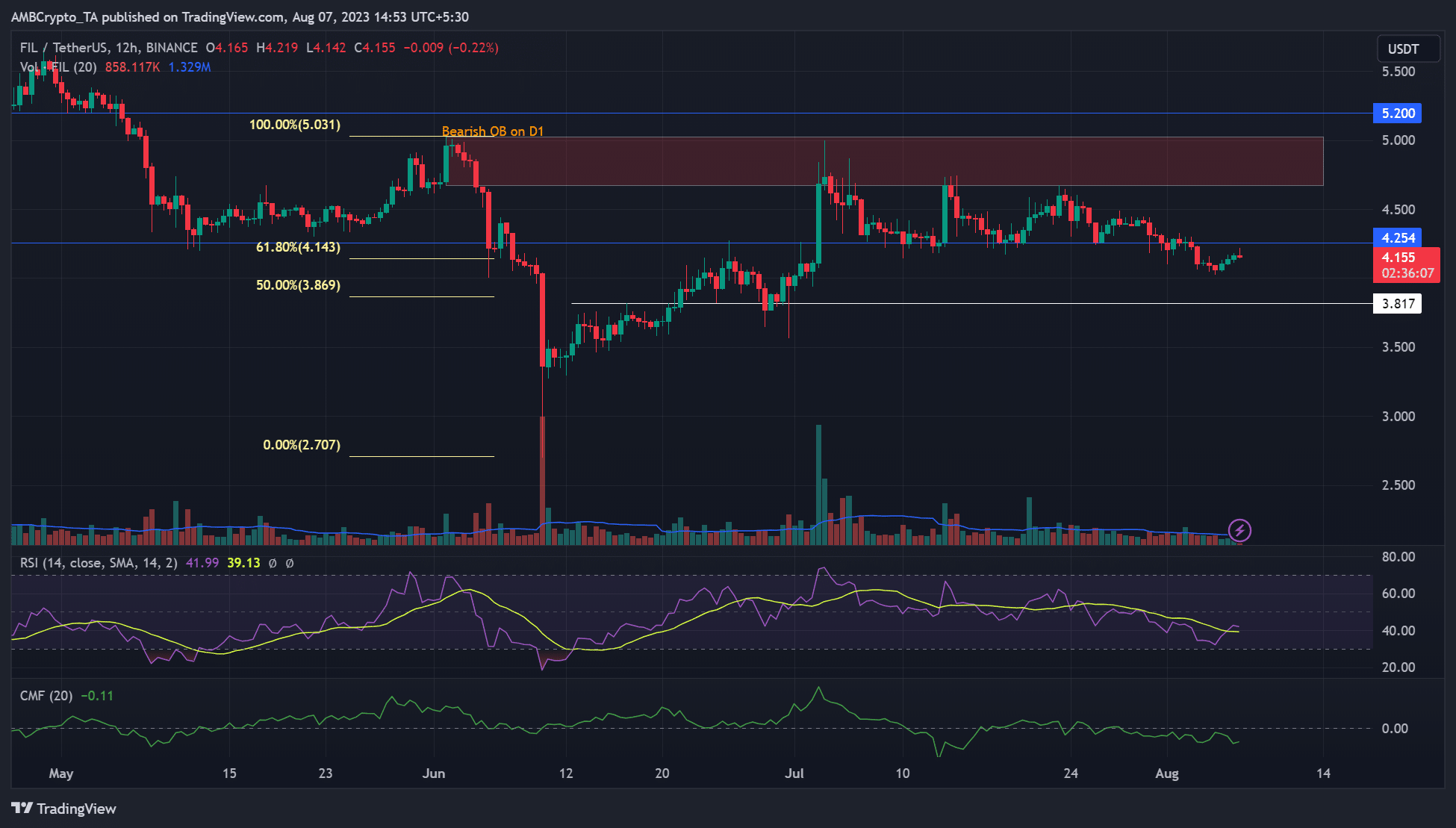

At the time of writing, there was a flicker of red after a slight rebound following the bearish breakout from the $4.3 – $4.7 range. It suggests that sellers were already on site to attempt to flip the range-low into resistance.

Price chart indicators suggest that sellers could accomplish the task. The Relative Strength Index has made lower lows in the past few weeks, denoting a decline in buying pressure and an uptick in selling pressure.

Similarly, the Chaikin Money Flow struggled to mount above the zero-mark threshold and dropped lower at the time of writing. It underlines the steady capital outflows from FIL’s market.

A Fibonacci retracement tool was placed between recent highs and lows. Based on the tool, FIL bears could crack $4 and extend gains at $3.8, especially if BTC price action remained muted. So, the next support will be $3.5 if the 50% Fib level fails to hold the bearish pressure.

Conversely, bulls could see respite if they reclaim the range-low ($4.25). Such a move could re-ignite hopes of retesting the range-high and daily bearish order block (OB) near $5.

How much are 1,10,100 FILs worth today?

Open Interest rates wavered

Based on Coinalyze’s 1-hour chart, FIL’s Open Interest rate declined in late July but wavered in August as it oscillated between $86.5 million and $82 million. It suggests that demand dipped and stagnated since late July – a bearish bias followed by a more neutral sentiment.

The CVD (Cumulative Volume Delta) also steadily declined over the same period, denoting a drop in buying volumes compounding to sellers’ leverage. So further losses could be likely if BTC’s weakening persists.