Aptos stalls at range-high: Can sellers gain more ground?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- APT has been range-bound since 18 July.

- Aptos partnered with Microsoft, setting APT to rally 10%.

Aptos Labs has reportedly partnered with Microsoft to facilitate, integrate, and scale Web3 solutions. The native token, Aptos [APT], reacted positively to the news and rallied over 10% on 9 August.

Is your portfolio green? Check out the APT Profit Calculator

However, Bitcoin [BTC] recorded a sharp retracement ahead of July’s CPI data, denting APT’s recent gains. At the time of writing, BTC bears and bulls tussled for the $29.5k range-low, and any more losses could embolden APT sellers.

APT bulls and bears tussle for mid-range

APT’s Relative Strength Index climbed above the 50 mark, reinforcing a surge in demand and buying pressure on 9 August. Similarly, the Chaikin Money Flow also crossed above the zero mark – a positive reading illustrating improved capital inflows into APT’s market.

However, price action forayed into the resistance area after Wednesday’s pump. APT has been range-bound since July 18, oscillating between $6.67 – $7.97. The pump faced rejection at the range-high ($7.97).

Above the range-high lies a weekly bearish order block (OB) of $8.2 – $9.4 (red). In most cases, bearish OBs lead to negative price reactions.

In this case, the weekly OB is on a higher timeframe and aligns with the previous range-high in May 2023. That makes the $7.97 – $9.5 a crucial bearish zone. Another likely price rejection in the area could set APT to head lower, presenting two possible short set-ups.

The first set-up is shorting upon a retest of the range-high ($7.97), with take-profit at mid-range ($7.3). Secondly, shorting at the mid-range ($7.3), with take-profit at the range-low ($6.67) – a likely +8% profit. Stop losses will be placed at $8.4 and $7.6, respectively.

A daily candlestick session close above weekly bearish OBs will invalidate the bearish thesis.

Open Interest rates surge

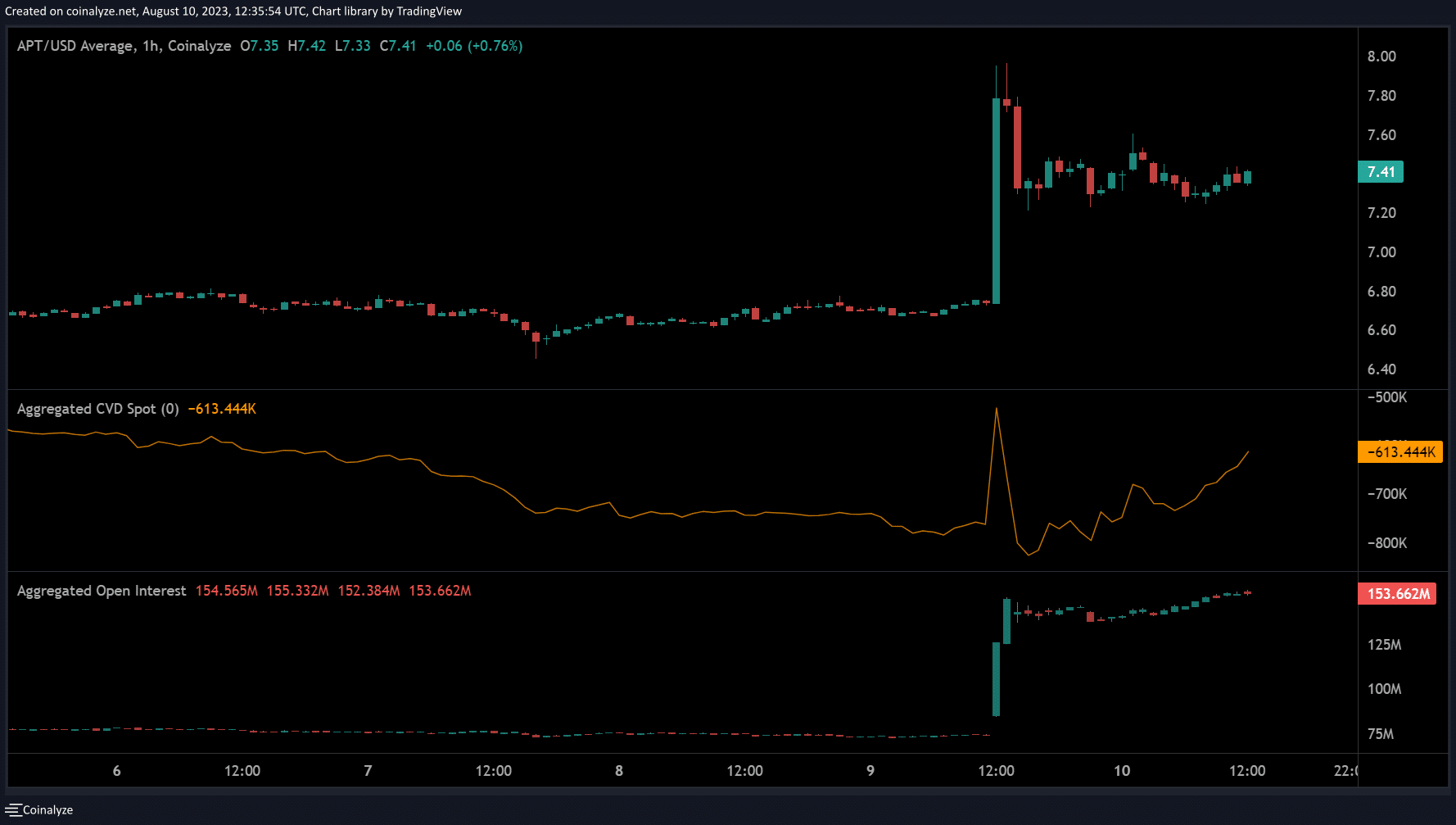

The Futures market data suggested the short ideas above could be far-fetched at the time of writing. Notably, Open Interest rates surged from $75 million on 9 August to over $150 million – more than double demand.

How much are 1,10,100 APTs worth today?

Additionally, the Cumulative Delta Volume (CVD), which tracks sellers vs buyers control, showed a massive positive slop after a little dump. It illustrates that bulls were in control and renders the above short ideas risky.

However, BTC’s price action will dictate APT’s price direction. A drop below or rally above the $29.5k range-low will confirm or invalidate the short ideas.

![Solana [SOL]](https://ambcrypto.com/wp-content/uploads/2025/08/Solana-SOL-1-400x240.webp)