Analyzing Ethereum’s sharp drop in issuance since the Merge

- Since the Merge, ETH has become deflationary with a negative issuance rate.

- Validators on an average have been issued roughly 1,830 ETH/day since the transition, considerably down from 13,000/day before.

Scarcity economics play a vital role in the long-term demand and growth for any financial asset. In the case of cryptos, the fewer tokens in circulation, the greater the likelihood of price increases, provided demand for the asset remains consistent.

Is your portfolio green? Check out the Ethereum Profit Calculator

Ethereum’s deflationary push

Ethereum [ETH], unlike Bitcoin [BTC], doesn’t have a hard cap on its supply. However, its burn mechanism, brought about by the EIP-1559 in 2021, played a pivotal role in the transition towards a deflationary token.

On top of this, the transition from a proof-of-work (PoW) consensus mechanism to a proof-of-stake (PoS) in an event called ‘The Merge’ last year, significantly altered the rate at which new ETH was entering circulation.

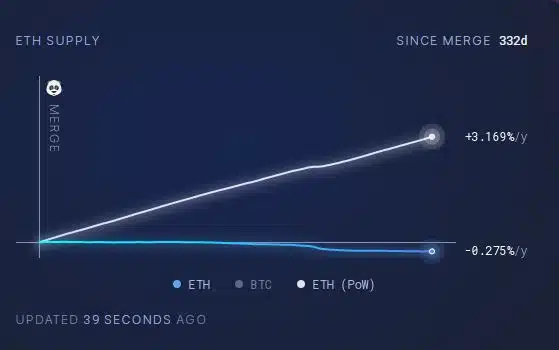

An on-chain sleuth took to social platform X to highlight the difference in the supply growth if the transition didn’t happen. Taking the launch of EIP-1559 in August 2021 as a reference point, the ETH’s annual issuance rate, or inflation would have been 3.169% in the old PoW model. However, the Merge ensured that this inflation was only 1.273%.

$ETH is ultrasound money.

Look at the supply shock since the burn.

Look at the supply growth if there was no burn.

Now imagine how this look during a bull market. pic.twitter.com/aW65JK9Jvi

— Emperor Osmo? (@Flowslikeosmo) August 12, 2023

In fact, if we shift the starting point to the Merge, it was discovered that ETH has become deflationary, with a negative annual issuance rate, according to ultra sound money data. The circulating supply plunged to 120.29 million, representing a drop of 302, 215 ETH since the Merge.

‘The Merge’ factor

Before transitioning to the PoS, miners guarding the Ethereum network were issued approximately 13,000 ETH/day, according to Ethereum.org. This was because the process of mining was an economically intensive activity, which historically required high levels of ETH issuance to sustain.

However, after switching to the PoS, mining became redundant and only staking remained a valid means of block production. Validators on average have been issued roughly 1,830 ETH/day since the transition.

Read Ethereum’s [ETH] Price Prediction 2023-24

Hence, it was evident that the Merge considerably slowed down the ETH issuance rate.

Interestingly, the long-term projections painted a happy picture for ETH. The supply was predicted to hover around the 120 million mark until August 2024. After which, the supply will steadily start declining until an equilibrium is attained.