Shiba Inu aims for Q2 highs – Are more gains likely?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- SHIB reclaimed April levels,> $0.00001, and targeted Q2 highs.

- Buyers had the upper hand amidst surging Open Interest rates.

About a week ago, we explored the possibility of a Shiba Inu [SHIB] buying opportunity if the memecoin retraced to May range-highs. The projection was validated, and SHIB fronted another rally to a critical double roadblock zone above $0.00001.

Is your portfolio green? Check out the SHIB Profit Calculator

As of press time, SHIB’s rally cooled off after hitting another roadblock aligned with the April high of $0.00001188. Can SHIB clear this roadblock, too, and mount above Q2 highs?

The double roadblock at Q2 highs

A look at the daily and weekly charts revealed a crucial blockage that prevented further upside at press time. The roadblock was a weekly bearish order block (OB) at $0.00001059 – $0.00001188 (red).

Interestingly, the above red zone contains a daily bearish OB of $0.00001124 – $0.00001172 (white), making the area a double roadblock. In most cases, price action always registers a negative reaction at bearish order blocks.

SHIB has seen several price mitigations at its bearish OBs, as illustrated by the invalidated blocks marked in cyan. But respective pullbacks have eased at the invalidated bearish OBs or price imbalances/fair value gaps (FVG), marked by white.

If the trend persists, the invalidated OB of $0.00000976 – $0.00001004 (cyan) and the FVG, above it, of $0.00001019 – $0.00001044 (white) are key interest levels for bulls.

With RSI and CMF maintaining positive readings in August, SHIB could attempt to clear the overhead double roadblock and mount above Q2 highs of $0.00001188. To the north, the immediate resistance level was $0.000013.

But any extra retracement below the FVG and the block, $0.00000976 – $0.00001004 (cyan), could ease at $0.00000965.

Buyers had the upper hand

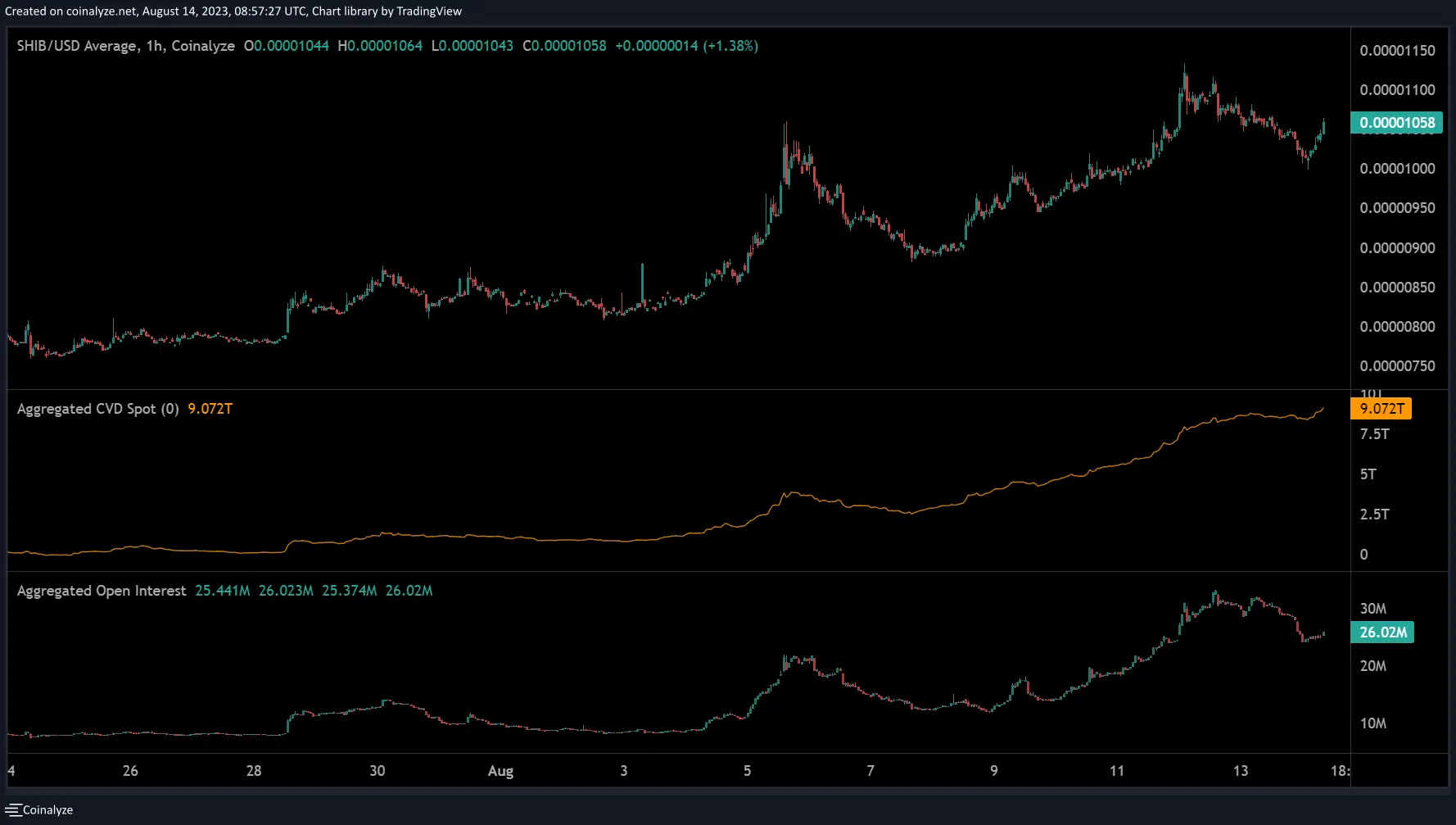

According to Coinalyze, a crypto derivative data tracking platform, buyers still had the edge in the market. Throughout August, the Cumulative Volume Delta (CVD) surged to new highs, illustrating buyers’ control.

How much are 1,10,100 SHIBs worth today?

Similarly, the Open Interest rates have gradually increased from <$10 million to >$20 million over the same period. It shows an increase in demand for SHIB in the derivatives market segment – a bullish bias.

So, if the bullish bias prevails, the recent FVG on the daily chart and the block below were crucial for late bulls.