Optimism faces triple hurdle: Should you short it?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- Optimism hit a key demand zone and attracted bulls.

- Accumulation increased, but network traction lagged.

Optimism [OP] appeared ready for recovery, but must clear some overhead roadblocks. Bitcoin [BTC] dropped to $26k, cracked key trendline support and weakened further. Its weakening could impact OP’s recovery plans and further tip the scale in favor of sellers.

How much are 1,10,100 OPs worth today?

At the time of writing, BTC traded at $26.37k, way below $27k, which could encourage sellers to seek more ground and shorting opportunities.

Possible short set-ups

At the time of writing, OP’s price action was between a supply and demand zone. The supply zone is the weekly bearish order block (OB) of $1.55 – $1.77 (red) and has set OP to reversals even in the second half of July.

The supply zone encompasses two resistance levels of $1.7 and $1.59. Another resistance level exists below the supply zone at $1.50, pitting OP’s recovery against a triple hurdle.

On the other hand, the demand zone, a weekly bullish OB of $1.17 – $1.38 (cyan), was also a price consolidation range in June/July.

Given the weak BTC, there are two possible short setups if OP’s recovery falters at the overhead roadblocks or close below $1.379.

First, shorting upon a reversal at $1.50, targeting a take-profit at $1.379 and stop-loss at $1.55.

The second option is shorting at $1.379, with take-profit at $1.2 and stop-loss at $1.46. The alternative can only be viable if a daily candlestick close occurs below $1.379 to confirm extra weakening.

Meanwhile, the RSI and CMF were below their thresholds, reinforcing bearish bias and sellers’ edge.

OP’s accumulation is on track, but…

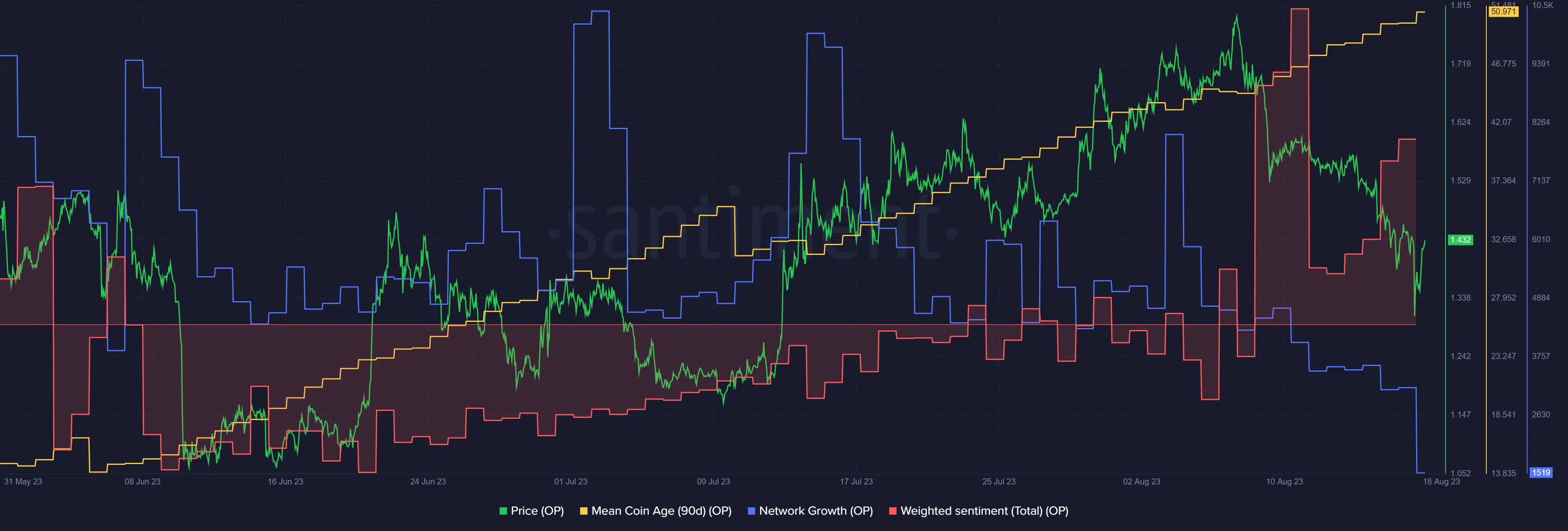

Optimism accumulation remained steady, as shown by the rising 90-day Mean Coin Age (yellow). Besides, the positive Weighted Sentiment demonstrated that investors were still confident in the asset.

Is your portfolio green? Check out the OP Profit Calculator

However, OP’s network lost traction, as the declining Network Growth indicated. It means newly created addresses fell as interest in the asset waned over the last few days.

The conflicting signals call for close tracking of BTC movement for optimized setups.