99.5% AVAX holders mired in losses: What now?

- Over 99% of Avalanche holders were out of money at press time.

- AVAX remained stuck in the oversold zone even as prices showed a minor recovery.

Avalanche [AVAX] showed great promise during its initial stages, attracting motivated buyers to purchase and retain it. Nevertheless, recent data revealed that most of these buyers and holders were holding their bags at a loss.

How much are 1,10,100 AVAXs worth today?

More out than in

As per CoinMarketCap, Avalanche had a circulating supply exceeding 344 million tokens at press time, with a total supply surpassing 400 million tokens. However, insights from Into The Block highlighted that more than 90% AVAX holders were experiencing losses at the time of publication.

Specifically, the data pointed out that approximately 99.45% of holders, accounting for around 5.45 million addresses, found themselves out of the money, indicative of holding at a loss.

The number of $AVAX holders in profit has reached an all-time low. While the asset has witnessed similar levels before, such as in June & December of 2022, it is the first time that nearly all AVAX holders (99.5%) are holding at a loss. pic.twitter.com/pdH387qHqs

— IntoTheBlock (@intotheblock) August 22, 2023

According to the available chart data, around 28,000 addresses, equivalent to 0.51%, were at a breakeven point. Moreover, the chart illustrated that merely 160 addresses held AVAX profitably.

Adding to this context, a recent report unveiled that additional AVAX tokens were scheduled for unlocking. A sell-off would cause more holders to fall into the unprofitable category.

Avalanche’s volume reflects its poor state

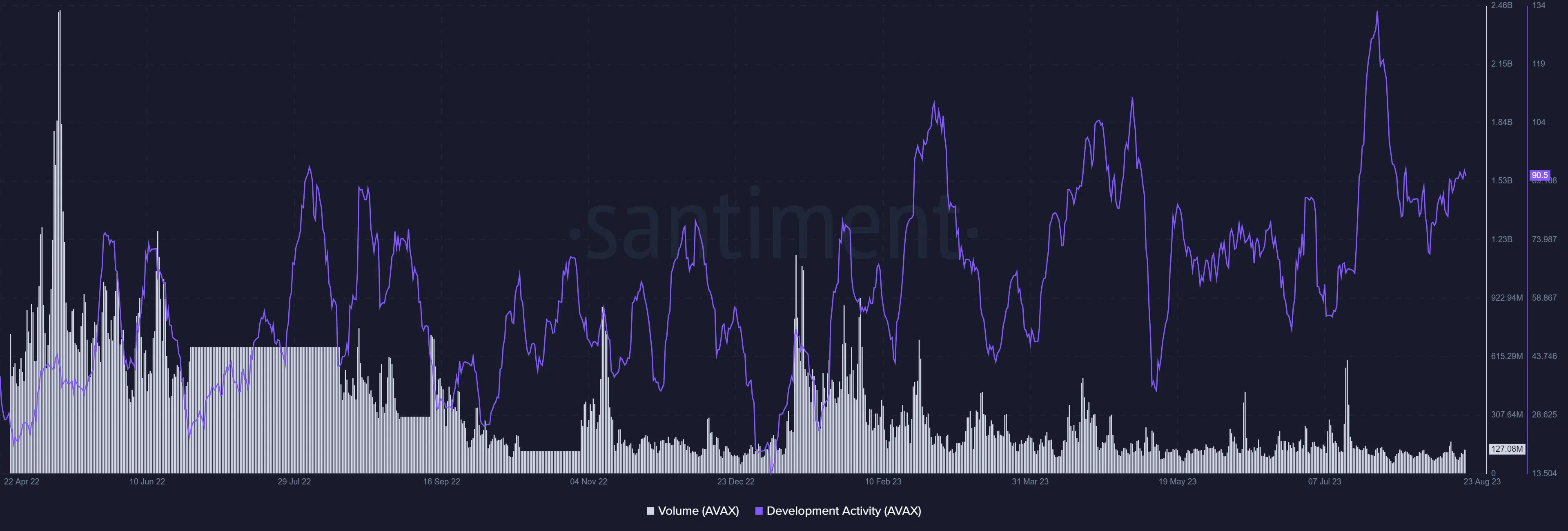

The lack of profitability in Avalanche has also impacted its token trading. According to data from Santiment, the trading volume has been notably lower than in the past year.

The peak trading volume for this year was observed around 12 January, surpassing 1 billion. However, this peak has not been replicated, and as of this writing, the trading volume was approximately 127 million.

Despite the downward trend in trading volume, the development activity on the Avalanche network has been consistently robust. This suggested that the platform’s team was actively at work.

However, it’s worth noting that the trading volume and token price have yet to reflect this positive development activity. As of this writing, the recorded development activity score was around 90.

What’s AVAX up to?

Analyzing AVAX on the daily timeframe revealed that the token reached its peak value of over $100 between November 2021 and January 2022. Subsequently, it experienced a sharp decline, fluctuating between $60 and $80 before plummeting further to its press time level.

Is your portfolio green? Check out the AVAX Profit Calculator

Given the substantial number of addresses facing losses, a significant portion of these addresses likely acquired AVAX during these periods.

As of this writing, AVAX was trading at approximately $10.1, reflecting a marginal increase of less than 1% in value. However, this modest gain has had a limited impact on reversing its ongoing bearish trend, as evidenced by its Relative Strength Index (RSI).