DYDX garners interest from seasoned investors: What’s coming next?

- DYDX’s recent rally reversed all losses since the market collapse of last week.

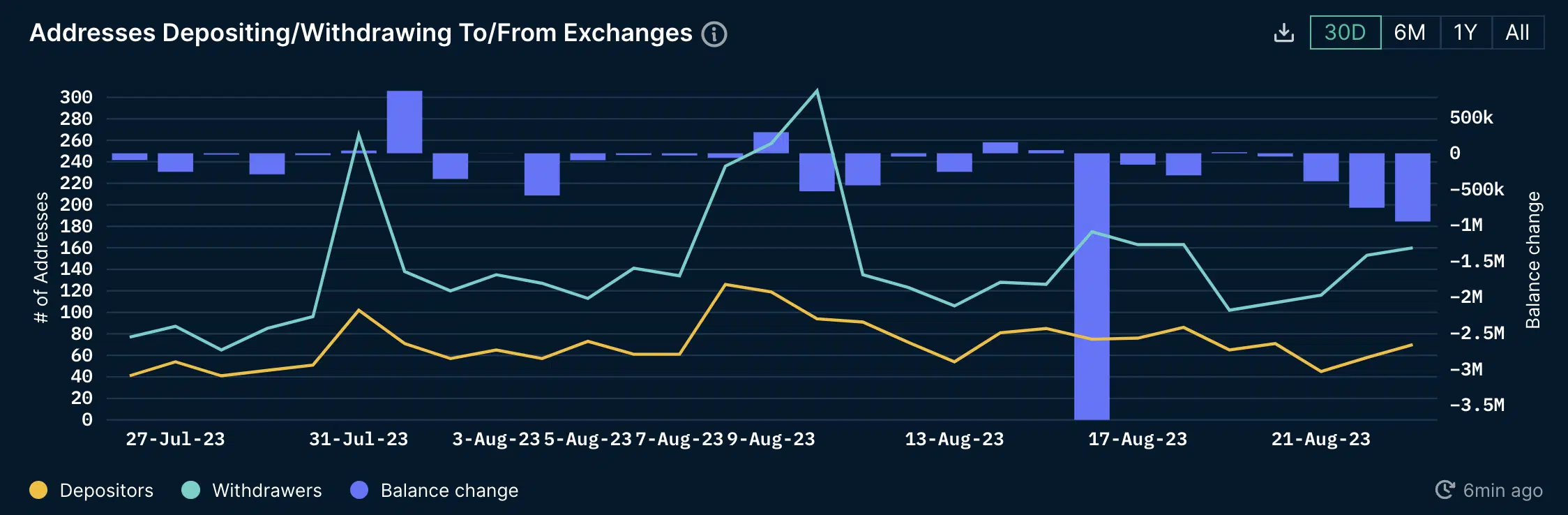

- Withdrawals from exchanges spiked over the last 30 days.

Decentralized derivative token dYdX [DYDX] was one of the top performers in the last seven days of crypto trading, according to data from CoinMarketCap. Much of the growth was powered by the overnight rally of 23 August, during which the token jumped 10% to $2.19.

Is your portfolio green? Check out the DYDX Profit Calculator

Although the price retreated back to $2.15 at press time, the upsurge reversed all the losses made by the asset since the market collapse of last week.

Experienced investors grab DYDX

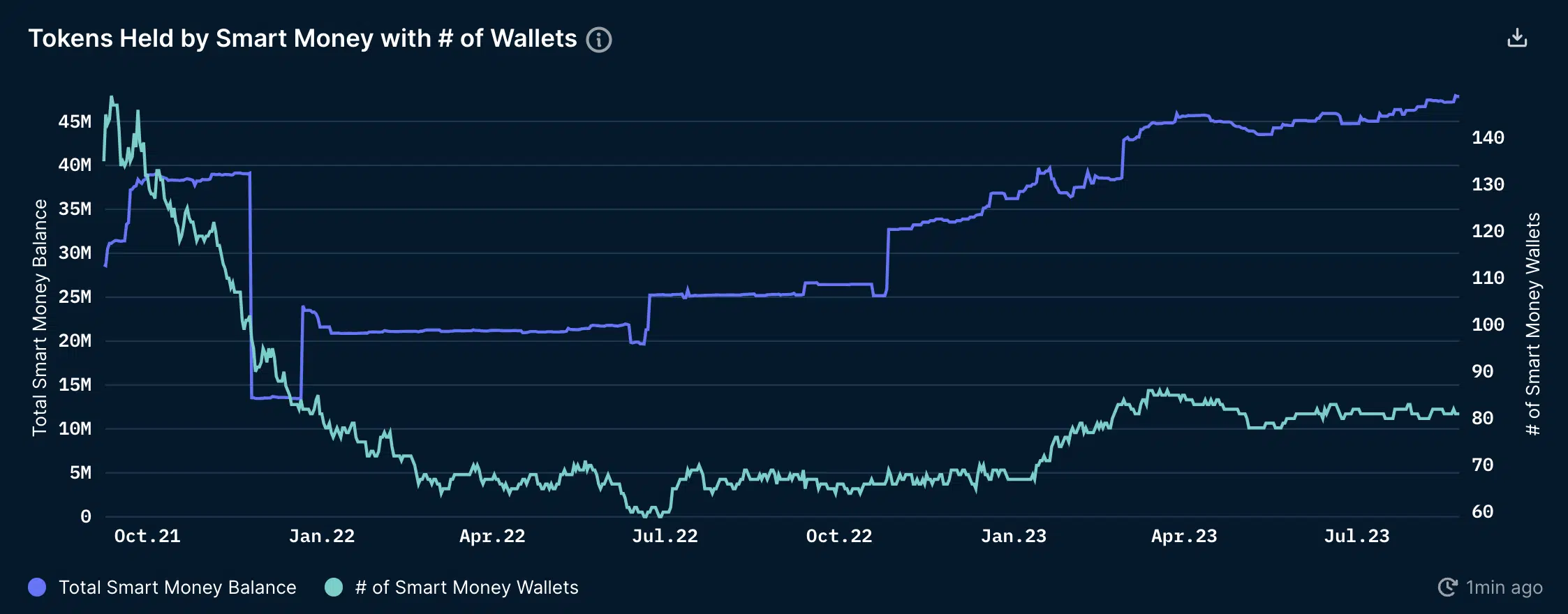

The spike in DYDX’s price was led by seasoned investors of the coin. In a statement shared with AMB Crypto, Nansen analyst Martin Lee said that while the count of smart money wallets holding DYDX tokens has stayed flat over the last two months, they have been steadily adding to their stacks.

For the uninitiated, “smart money” is a term generally used for well-informed and experienced investors, having a better understanding of the market vis à vis retail investors. This cohort has a proven track record of profitability.

Moreover, the analyst stated that withdrawals from exchanges have spiked over the last 30 days. This could imply that bullish traders were HODLing tokens in anticipation of a price increase.

What’s behind the rise?

The demand for DYDX was spurred by hype around the impending mainnet launch of the ecosystem’s standalone blockchain dYdX V4. The chain, being developed using the Cosmos [ATOM] framework, was in the testing phase at the time of publication.

The dYdX foundation recently discussed the prospect of making DYDX the native L1 asset on the new chain. The increased accumulation, therefore, was most likely rooted in this expectation.

Recall that in the current version V3, trades are settled in an L2 (layer-2) system, which publishes zero-knowledge (ZK) proofs periodically to a base layer Ethereum [ETH]. However, going forward, the network won’t depend on any external blockchain or system.

How much are 1,10,100 DYDXs worth today?

The new network also intends to fill the gaps in full decentralization that the existing system has. Every activity, from order book matching to facilitating trades, was expected to take place on-chain.

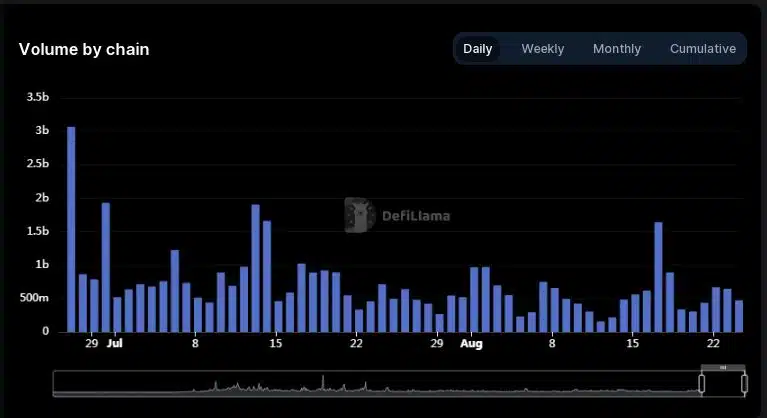

At the time of writing, dYdX was the largest perpetual futures protocol, clocking trading volumes of more than $476 milion in the last 24 hours, per data from DeFiLlama.