ViaBTC: Navigating price volatility with hedging tools

In the first half of 2023, crypto impressed the world as one of the top-performing assets. Despite its success, the industry remains in its infancy, with a history spanning just over a decade. High volatility is a defining characteristic of the crypto market. The wild price swings create challenges for miners, destabilizing cash flows and hindering their efforts to expand and optimize mining operations.

About Crypto Loans

Poor capital efficiency and massive cash-flow risks pose major crypto-mining obstacles to attracting new investors. Fortunately, some innovative blockchain companies have harnessed hedging strategies from traditional financial markets to develop tools that effectively manage price volatility.

In crypto mining, earnings depend on prices, which rings particularly true for beginners. As newcomers chiefly focus on fast payback, rather than hoarding coins, their profits are subject to daily price fluctuations. At times, bullish crypto events would catalyze prolonged market upswings, instilling confidence in miners about the future value of their mined coins. They still need funds to cover daily O&M costs and power bills.

An O&M Worker Checking BTC Mining Rigs

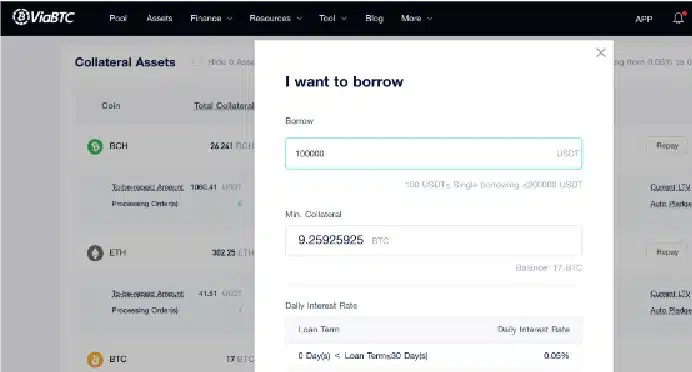

Let’s check out the benefits of Crypto Loans via the following example:

Miner A is mining Bitcoin, with each BTC valued at 30,000 USDT. Having mined 10 BTC, Miner A urgently needs cash to pay for electricity, but he does not want to sell the coins, as he is confident in the future value of BTC. With Crypto Loans, Miner A can collateralize a 100,000 USDT loan from ViaBTC with 10 BTC to cover the electricity bill. Since there is no specific due date, Miner A could choose the repayment time based on his financial situation and the daily interest rate.

Find out more about Crypto Loans at: https://www.viabtc.com/finance/loan

Suppose BTC soared to 50,000 USDT after 10 days. Miner A could then pay off the 100,000 USDT loan to redeem his 10 BTC and sell the coins for 500,000 USDT. Without this loan, he would miss out on the extra 200,000 USDT profit (excluding other fees).

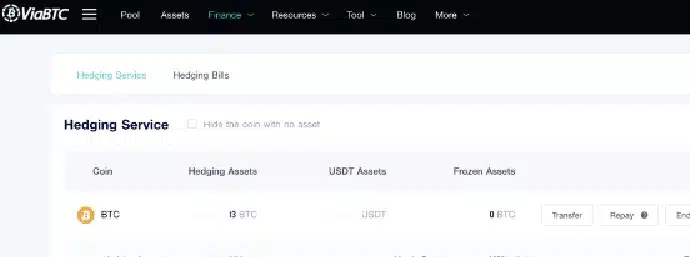

About Hedging Service

In a persistently bearish market, all investments are uncertain. Historically, miners in bearish market conditions could only watch their crypto assets devalue. Hedging Service, however, allows miners to pre-sell the coins that they will mine in the future, which prevents losses due to price fluctuations.

Here’s an example of how Hedging Service empowers miners:

Miner B is mining Bitcoin and producing an average of 1 BTC every day. Suppose BTC is now quoted at 30,000 USDT. Miner B believes the price has peaked and is likely to decline in the near future. To mitigate this risk, Miner B resorts to Hedging Service and secures a 30-day hedging bill of 30 BTC with a small amount of BTC as collateral. Miner B then sold the coins for 900,000 USDT, which are temporarily frozen in his hedging account. He could now keep mining BTC to pay off the bill, and the locked USDT would gradually be released along with the daily repayments.

Find out more about Hedging Service at: https://www.viabtc.com/finance/hedging-tutorial

Let’s assume that the BTC price plummeted to 20,000 USDT after 30 days, i.e., when Miner B settled the account. This translates to an additional 300,000 USDT in profits (excluding other fees).

Of course, hedging is not without risks. Hedging tools come with their costs and complexities. Plus, a learning curve is also required. Furthermore, in a complex, ever-changing market, unforeseen movements may lead to unexpected outcomes, which means that hedging strategies could fail. As such, before attempting to mitigate risks with hedging tools, beginners should, first and foremost, thoroughly understand how these tools work and the risks involved.

Beyond that, beginners should also do more market research to assess blockchain trends and understand market movements. The analytical skills, coupled with hedging tools, enable effective risk management and minimize the uncertainties from market volatility.

About ViaBTC

ViaBTC, founded in May 2016, has provided professional, efficient, safe and stable crypto mining services for over one million users in 130+ countries/regions around the world, with a cumulative mining output value of tens of billions of dollars. This world-leading, all-inclusive mining pool offers mining services spanning more than ten mainstream cryptos that include BTC, LTC, and KAS. Backed by one-stop services covering ViaBTC Pool, CoinEx Exchange, and ViaWallet, ViaBTC strives to offer global users more supporting tools, stabler and more efficient mining services, as well as better product experience.

Disclaimer: This is a paid post and should not be treated as news/advice.