SNX pumps 18% ahead of V3 upgrade

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- SNX was up 18% in the first week of September amidst hype around the V3 upgrade.

- Negative funding rates and declining Open Interest rates could derail the pump.

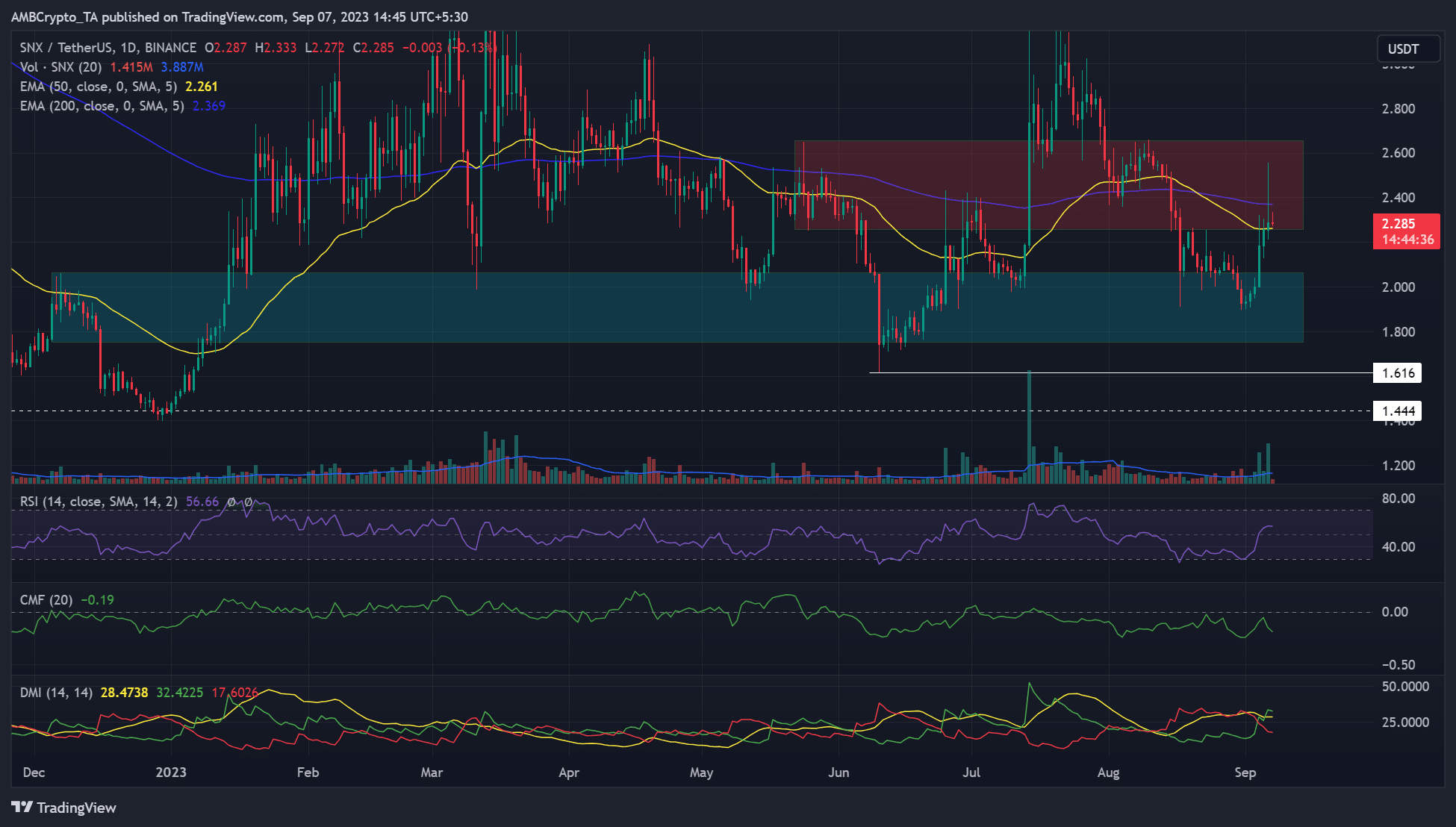

According to TradingView’s monthly chart, Synthetix [SNX] was up 18% in September, based on the press time value of $2.285. As the rest of the altcoin market bled amidst Bitcoin’s [BTC] muted price performance, SNX was an outlier.

Is your portfolio green? Check out the SNX Profit Calculator

The hype and pump were likely stirred by the anticipated V3 upgrade. Notably, the Decentralized Finance (DeFi) protocol reiterated that the V3 upgrade will overhaul the on-chain derivatives.

Range, dump, or extra pump – What’s next for SNX?

The red area marks the July break-out and breaker block of $2.25 – $2.65. The area blocked August’s recovery and could derail September’s pump.

At press time, a long high wick or shooting star candlestick confirmed sellers attempted to block bulls at the $2.25 – $2.65 area. However, the 50 and 100-EMA (Exponential Moving Averages) went slightly sideways, suggesting a likely range formation couldn’t be overruled.

But, the $2.4 and $2.8 were key targets to watch if buyers overwhelm sellers at the $2.25 – $2.65 resistance zone.

Alternatively, sellers could gain the upper hand and sink SNX lower to the previously invalidated weekly bullish OB and support zone of $1.756 – $2.060 (cyan).

Meanwhile, the RSI crossed the 50 mark as of press time, confirming the recent solid recovery and buying pressure. Unfortunately, the CMF faced rejection at zero and retreated southwards, underscoring eased capital inflows.

Funding rates were negative

How much are 1,10,100 SNXs worth today?

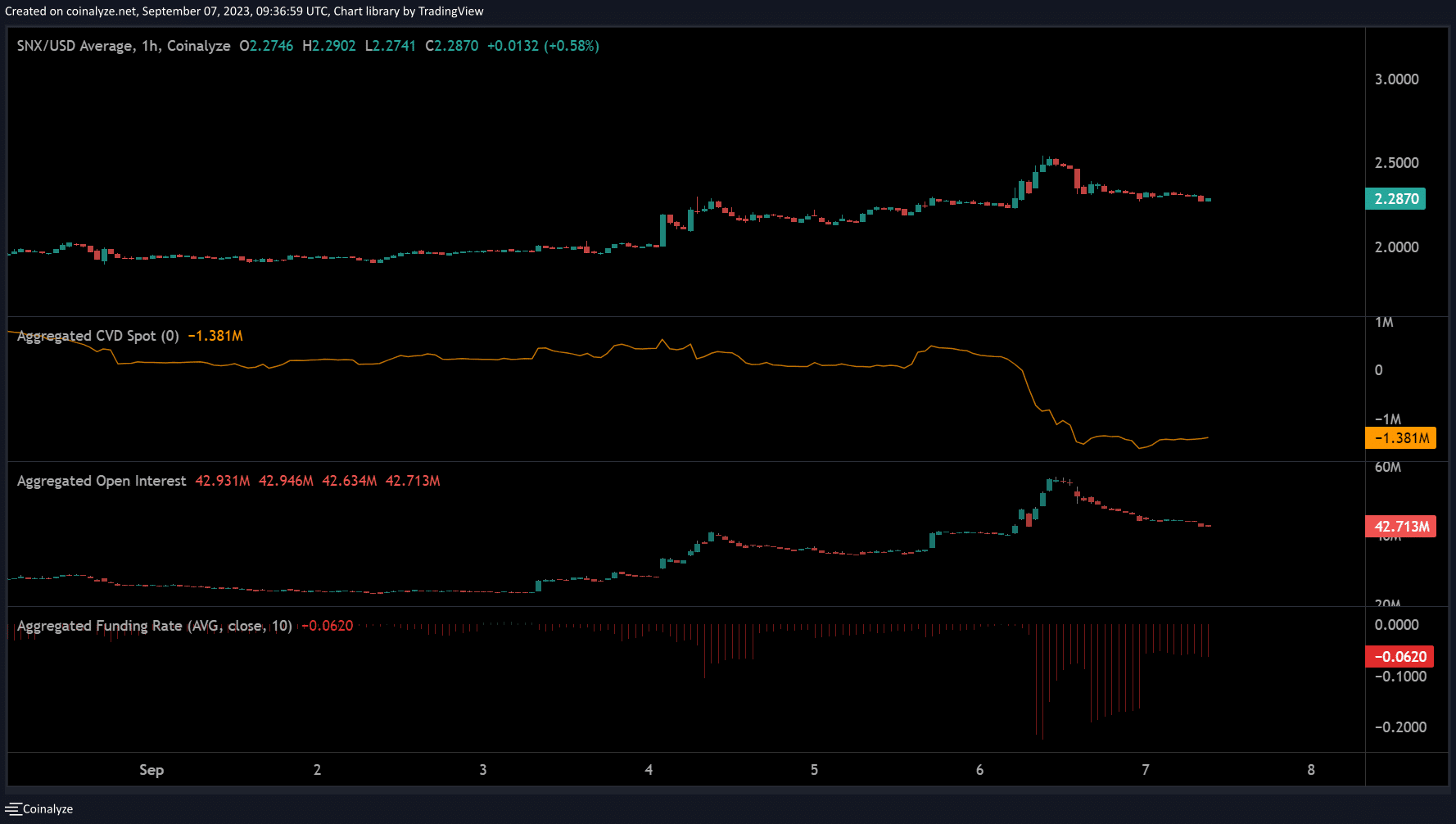

According to Coinalyze’s negative readings on key indicators, SNX’s sustained recovery could face heavy headwinds. Notably, the funding rates were increasing negatively from 6 September.

Over the same period, the Open Interest rates dipped slightly, as did the CVD (Cumulative Volume Delta). However, the CVD made a sideways movement as of press time, indicating neither buyers nor sellers had market leverage.