Lido faces these challenges amidst declining coin values

- Lido’s TVL has fallen steadily in the last month.

- This has been primarily due to the decline in the prices of ETH, MATIC, and SOL.

The total value locked (TVL) in Lido [LDO], a liquid staking protocol for Ethereum [ETH], has seen a gradual decline in recent weeks amid a persistent drop in the prices of ETH, Polygon [MATIC], and Solana [SOL].

According to data from CoinMarketCap, ETH lost 14% of its value in the last month while MATIC fell by 25%, and SOL suffered a 28% price drop.

How much are 1,10,100 LDOs worth today?

As of 13 September, Lido’s TVL stood at around $13.84 billion, down from a peak of over $14 billion in mid-July. Due to the fall in the values of these key crypto assets, Lido’s TVL has fallen by 8% in the last month, data from DefiLlama showed.

Ups and downs of the last week

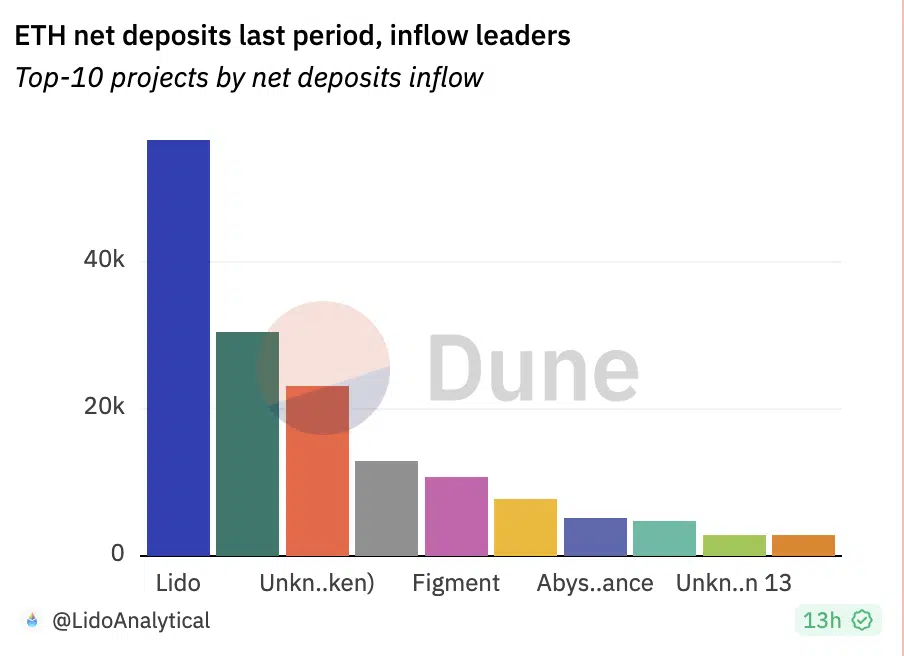

While Lido’s TVL saw a minor 0.38% fall last week, it led as the protocol with the highest net new deposits on Ethereum during that period. According to data from Dune Analytics, ETH deposits on Lido totaled 56,512 over the last seven days.

Over the last week, the protocol’s staked Ether [stETH] Annual Percentage Rate (APR) assessed on a seven-day moving average remained stable at 3.73%. This has trended downward since May, data from Dune Analytics showed. On 12 May, Lido’s stETH APR peaked at 7.17% and has since fallen by 48%.

Further, within the period under review, the amount of wrapped staked Ether [wstETH] deposited for trades across decentralized finance (DeFi) pools fell by 5.72%. Notably, approximately 80% of this decrease came from stETH being withdrawn from the Lybra Finance pool.

Regarding Layer 2 (L2) platforms, data from Dune Analytics showed a 0.18% increase in the amount of stETH bridged to Arbitrum [ARB]. On the other hand, Optimism [OP] and Polygon saw respective declines of 1.42% and 1.20% in the amount of bridged stETH over the past week.

Spot traders do not want to hold LDO

LDO traded at $1.46 at press time, logging a 6.36% price decline in the last week. An assessment of price movements on a D1 chart revealed a fall in LDO accumulation since 8 May.

The altcoin’s key momentum indicators were spotted below their center lines, signalling that spot traders have increasingly sold the token. For example, the K line (blue) of the altcoin’s Stochastic RSI indicator was below 20% at 8.43%. The Stochastic RSI indicator measures momentum and identifies overbought and oversold conditions in the market.

A Stochastic RSI value below 20 typically suggests increased distribution. It shows that an asset has been oversold, and the price will continue to fall until sentiment improves.

Realistic or not, here’s LDO’s market cap in BTC terms

Likewise, LDO’s Aroon Up Line (orange) was at 7.14 at press time. The AROON indicator is used to identify trend strength and potential trend reversal points in a crypto asset’s price movement. When the Aroon Up line is close to zero, the uptrend is weak, and the most recent high was reached a long time ago.

As of this writing, the Aroon Down Line (blue) at 85.71 suggested that the current market downtrend was strong.