What’s slowing MATIC’s path to recovery?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- MATIC buyers continued to advance despite a bearish market structure.

- Positive funding rates could benefit bulls in the short term.

Polygon’s [MATIC] gentle recovery from the $0.5 support level continued to gain momentum over the past day. Even though the higher timeframe structure remained bearish, buyers were slowly pushing prices higher, with MATIC trading at $0.54, as of press time.

Is your portfolio green? Check out the MATIC Profit Calculator

Furthermore, buyers were encouraged by Bitcoin’s [BTC] rapid ascent to the $27k price zone, which spurred new bullish sentiment.

Bulls adopt a conservative approach to recent price reversal

The 12-hour chart for MATIC revealed a conservative but sustained bullish approach to the price rebound. After the soft bounce from the $0.5 support, MATIC posted gains of 10.9% between 12 September and 19 September.

A look at the Relative Strength Index (RSI) showed that the buying pressure rose gradually within the period and stood at 58, as of the time of writing. Similarly, the Chaikin Money Flow (CMF) flipped positive with a reading of +0.04.

These signals pointed to growing bullish confidence in the short term. Given the overall bullish sentiment returning to the market, MATIC bulls could seize this opportunity to rally toward the $0.65 to $0.7 price zone.

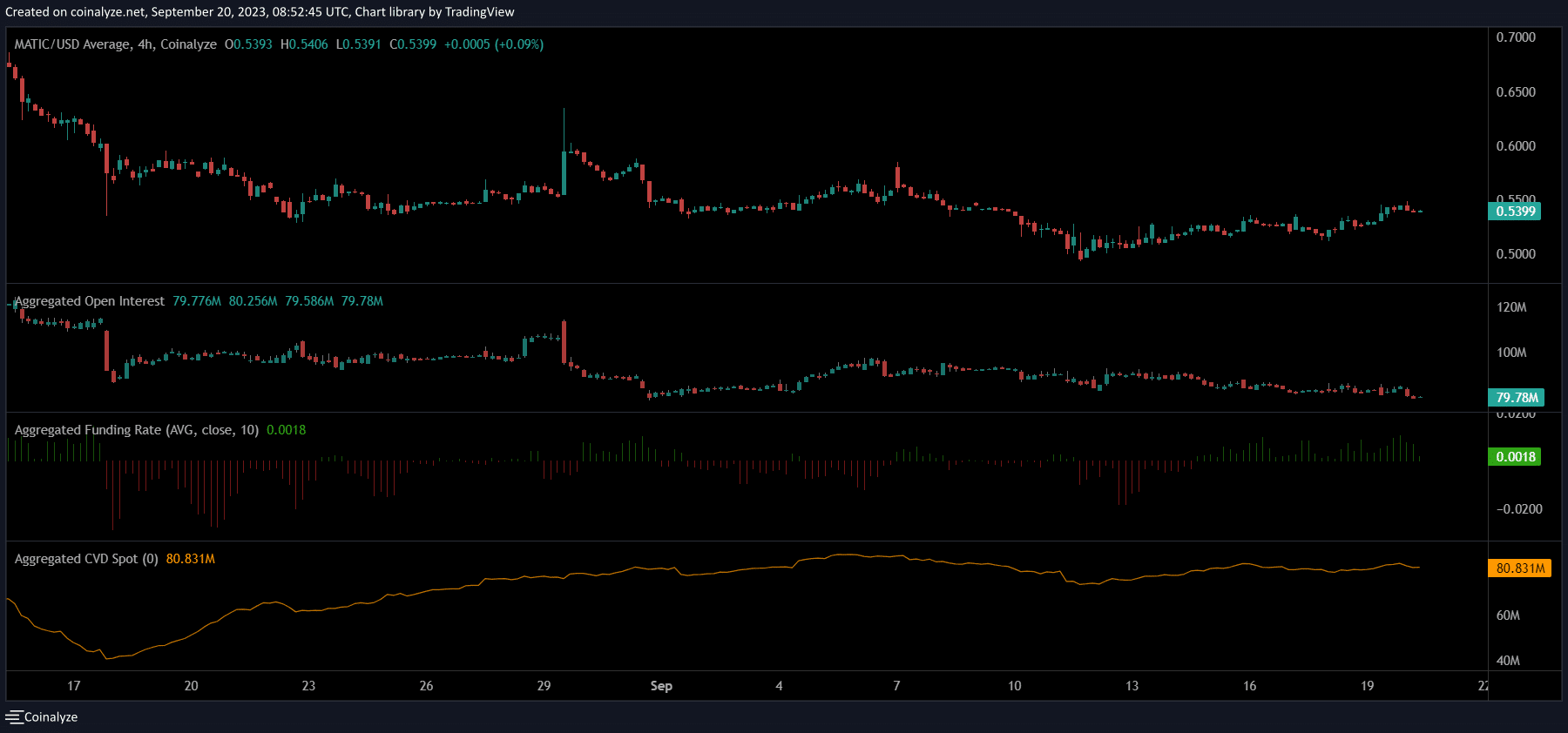

Mixed reactions in the futures market

Read Polygon’s [MATIC] Price Prediction 2023-24

Market participants in the derivatives market adopted a cautious approach to MATIC’s recent bullish moves. Data from Coinalyze showed that Open Interest continued to dip, despite the decent price gains. This inferred a lack of conviction in MATIC’s price rebound.

However, the Funding Rate has been positive since 14 September and the Spot CVD maintained its uptrend. This hinted at good demand for MATIC, which could be pivotal in buyers mounting a sustained bullish push.