Here’s how Terra Classic plans to repeg USTC to the dollar

- Terra Classic will stop the minting and re-minting of its Terra Classic USD (USTC) stablecoin.

- The proposal was an attempt to restore the coin’s peg to the U.S. dollar.

Members of the Terra Classic [LUNC] governance community have voted in favor of a proposal to stop all minting and re-minting of Terra Classic USD (USTC) in a bid to restore the stablecoin’s peg to the dollar.

How much are 1,10,100 LUNCs worth today?

Before Terra’s collapse in May 2022, the blockchain network allowed its users to easily swap between USTC and LUNA. However, when the network collapsed, and the stablecoin lost its peg, the system began minting LUNA coins in an attempt to restore the peg.

The more LUNA tokens were minted, the more the price of LUNA fell. This caused USTC’s value to drop further from $1.

As contained in the proposal, to facilitate the re-pegging process, members of the Terra Classic community were encouraged to actively participate in the burning of the USTC tokens.

At press time, the “stablecoin” traded at $0.012, data from CoinMarketCap showed.

LUNC gains traction

With many expecting this move to help restore USTC to its $1 peg, LUNC has seen an increased demand in the last week. Exchanging hands at $0.00006188 as of this writing, the coin’s value has climbed almost 10% in the last week.

Among spot traders, accumulation has grown. Key momentum indicators assessed within a 24-hour window were spotted approaching overbought highs. LUNC’s Relative Strength Index (RSI) was 52.39, while its Money Flow Index (MFI) was 75.62. At these positions, LUNC accumulation outpaced its distribution.

Indications from the coin’s Exponential Moving Average (EMA) confirmed the bullish trend in LUNC’s daily market. At the time of writing, the 20 EMA (blue) was positioned below the 50 EMA (orange), indicating that buyers have forced sellers out of market control.

Realistic or not, here’s LUNC’s market cap in BTC terms

The coin’s Directional Movement Index (DMI) lent credence to the above position, with the Positive Directional Indicator (green) resting above the Negative Directional Indicator (red) at press time. This indicated that amongst the coin’s daily traders, buyers’ strength exceeded that of the sellers.

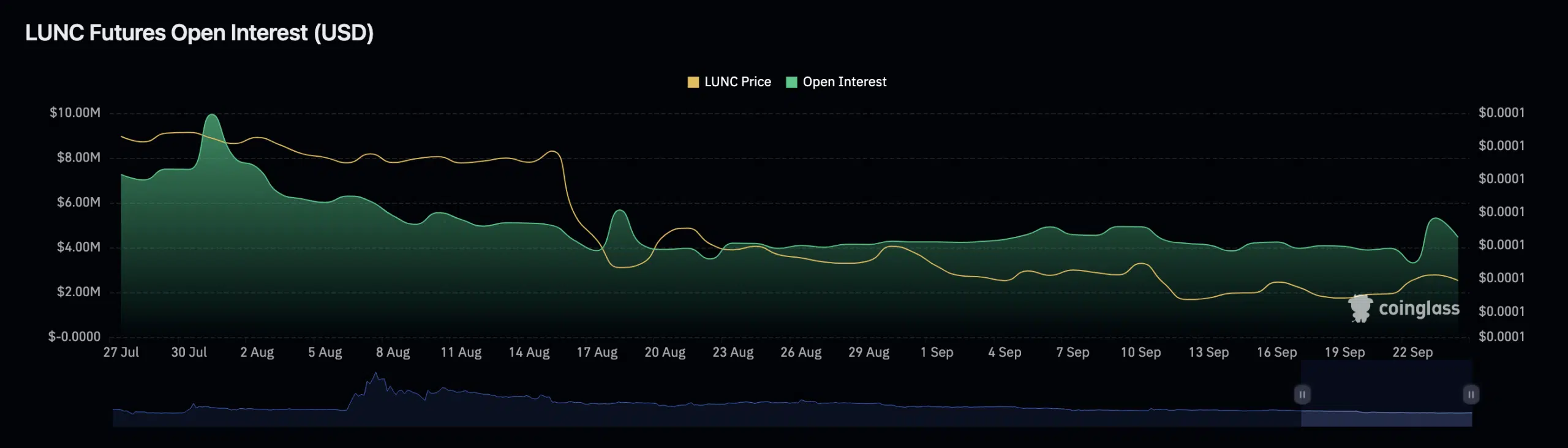

Futures traders want in on the fun

As LUNC’s value rallied in the past few days, the count of open trades involving the coin began to increase, data from Coinglass showed. At $4.46 million at press time, LUNC’s Open Interest has grown by over 30% in the last two days.