Sam Bankman-Fried and the spectacular collapse of FTX: Here’s a rundown

- SBF was accused of misappropriating customer funds in FTX’s custody.

- Experts noted that the chances of SBF’s conviction were high.

Once seen as the face of cryptocurrencies, disgraced entrepreneur Sam Bankman-Fried (SBF) awaits his fate as he gets ready for the criminal trial beginning on 3 October for his role in what many experts have dubbed as one of the biggest financial frauds in American history.

Is your portfolio green? Check out the FTT Profit Calculator

The 31-year-old faces multiple charges for his alleged involvement in the high-profile collapse and subsequent bankruptcy of FTX [FTT], which was one of the biggest crypto exchanges in the market during its peak.

Primarily, he is accused of misappropriating customer funds entrusted with the exchange to prop up his crypto trading firm Alameda Research.

A trip down the memory lane

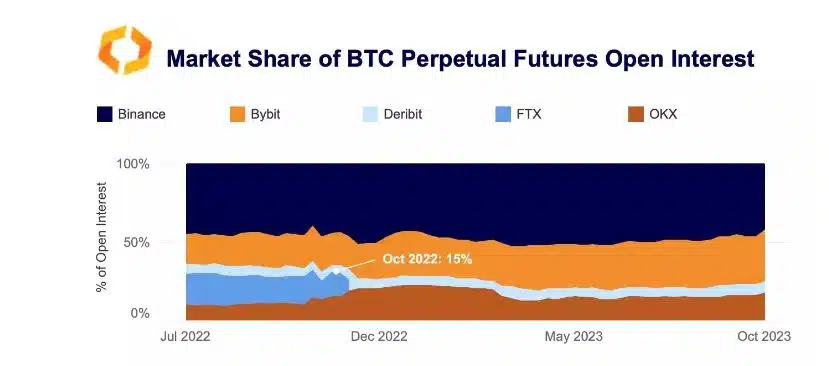

According to crypto market data provider Kaiko, FTX made pointed business moves in order to build a foothold in a market otherwise dominated by global behemoths like Binance and Coinbase.

FTX had one of the lowest and, therefore, most attractive fees among top crypto trading platforms. A report published last year noted that FTX charged a taker fee of just 0.07% and a maker fee of 0.02%, in comparison to Coinbase’s 0.5% for both.

Naturally, lower fees attracted tons of liquidity and individual investors.

Apart from cost advantages, the exchange doled out highly-leveraged and innovative derivatives contracts which attracted risk-seeking traders. In fact, FTX enjoyed an impressive derivatives market share at 15%, compared to just 6% in the spot market.

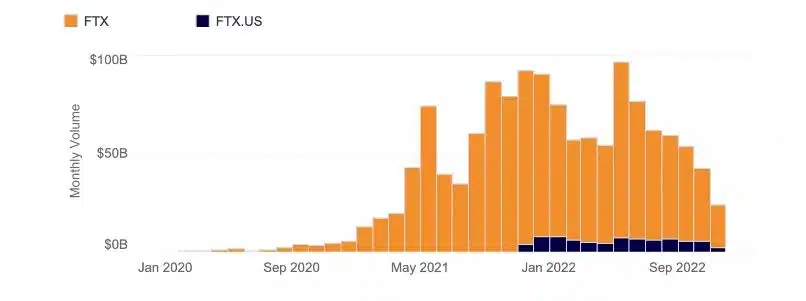

Nonetheless, the exchange registered monthly volume of nearly $100 billion at its zenith, which was on par with Coinbase.

FTX’s rise also resulted in a surge in the fortunes of founder and CEO Sam Bankman-Fried.

Prior to FTX’s collapse, he was ranked the 41st richest American in the Forbes 400 list and his net worth peaked at $26.5 billion. He spent his fortunes on venture investments, luxury real estate, and even political donations.

However, behind the rosy exteriors, was a cobweb of deception and dirty tricks.

The empire comes crashing down

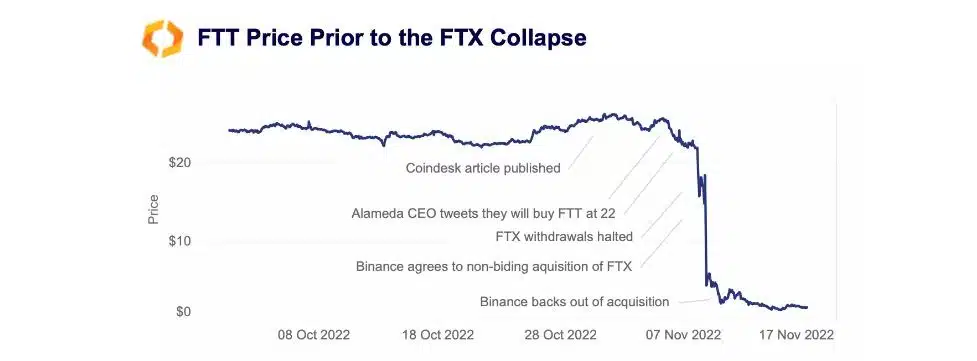

An explosive report by news publication CoinDesk proved to be the undoing of FTX. The investigative story revealed that Alameda Research, FTX’s sister company, was in possession of a significant amount of FTX’s native FTT tokens. So much so, that it had more FTT tokens on its balance sheet than the total market cap of the asset at that time.

What heightened scrutiny was the disclosure that Alameda used FTT extensively as collateral for loans issued by FTX.

Imagine an entity accepting collateral in the form of assets which it mints natively. This raised suspicion that FTX was funneling client’s funds in custody to extend credit to Alameda, a sign of insolvency.

This essentially triggered a bank run on FTX as customers scurried to get their funds out of the exchange. Withdrawal requests worth billions started to overwhelm the trading platform. The world’s largest exchange Binance announced a bailout deal only to back out of it a day later.

Meanwhile, FTT was in free fall, losing 80% of its value in two days. FTT’s collapse led to a rapid unwinding of the exchange, with a multi-billion-dollar hole in its balance sheet.

Eventually, SBF stepped down as CEO of FTX and the exchange filed for bankruptcy protection on the same day. SBF’s empire, which was allegedly built on hard-earned money of unsuspecting traders, came crumbling down.

As of 10 March 2023, his net worth was reduced to just $4 million.

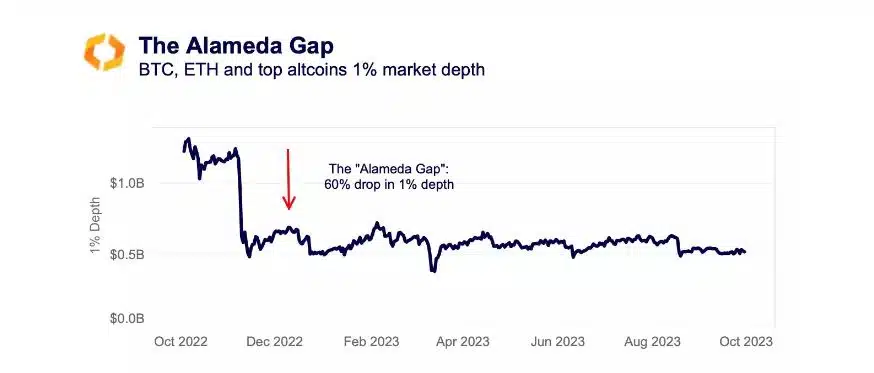

Kaiko’s research highlighted the profound impact of FTX’s collapse on the broader crypto market. Global exchange liquidity has been cut in half, and market depth is still a long way from restoring to pre-collapse levels.

Odds stacked against SBF?

As SBF goes on trial, talks around the outcome of the case have taken center stage. Former official of the U.S. Securities and Exchange Commission (SEC) John Reed Stark listed out three reasons which could lead to his conviction.

Stark noted that testimonies by high-profile corporate insiders, including Caroline Ellison – the former CEO of Alameda Research, to reduce their own criminal sentences, would play a big part in SBF’s implication.

Secondly, the authorities had access to a mountain of incriminating proof against the disgraced tycoon. He particularly praised restructuring officer John J. Ray for his work in gathering all the evidence.

Last but not least, Stark blamed the “blabbermouth syndrome” of SBF for his own downfall. His “public-relations campaign” during which he gave numerous interviews could be used by the prosecution to reveal inconsistencies in his statements, the ex-SEC official said.