Assessing MakerDAO stats as it struggles to maintain market share

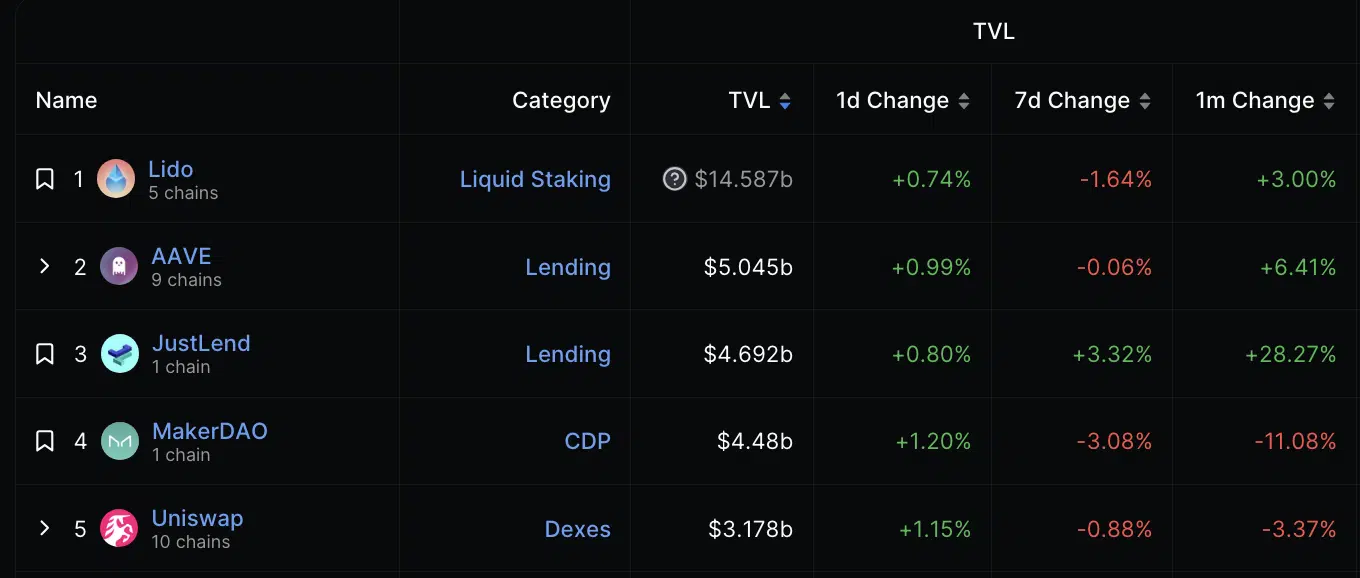

- MakerDAO fell to fourth place in terms of TVL ranking for DeFi protocols.

- MKR’s price surged by almost 25% in the last month.

Decentralized lending protocol MakerDAO [MKR] has slipped further in the ranking of DeFi platforms in terms of total value locked (TVL), losing 11% in the past month.

How much are 1,10, 100 MKRs worth today?

According to data from DeFiLlama, MakerDAO’s TVL currently stands at $4.48 billion, putting it in fourth place behind Lido Finance [LDO], Aave [AAVE], and JustLend.

Aave has benefited from MakerDAO’s undoing

In the aftermath of Curve Finance’s exploit, Aave’s TVL plummeted severely, causing it to briefly lose its spot as the protocol with the second-highest DeFi TVL to MakerDAO.

As liquidity providers and borrowers sought new “homes” for their funds, MakerDAO amplified its Dai Savings Rate (DSR) to 8%, causing the total amount of the DAI stablecoin deposited in the DSR contract to jump from 339.4 million to 556 million, according to Makerburn.com data.

Its wrapped staked Ether tokens (wsETH) deposits climbed, leading to its TVL surge, and it became the second-largest DeFi platform in terms of TVL after Lido.

However, soon after, the protocol passed a proposal to reduce the DSR to 5%, causing a number of whales to remove previously provided liquidity from the DSR pool.

For example, after the DSR was slashed, Tron founder Justin Sun withdrew 206 million in DAI and 235,556 wsETH from the pool, data tracked by Arkham Intelligence showed.

The DSR reduction has since resulted in a steady decline in the protocol’s TVL, putting it four places behind the Lido.

MKR, on the other hand, excels

Despite the steady decline in MakerDAO’s TVL in the last month, the value of its native token MKR has climbed. At press time, the altcoin exchanged hands at $1,410, having grown by 24% in the last month, according to data from CoinMarketCap.

Is your portfolio green? Check the MKR Profit Calculator

An assessment of MKR’s price movements on a daily chart revealed that the token initiated a new bull cycle on 1 September. Its Moving Average Convergence/Divergence (MACD) indicator confirmed this.

As bulls regained market control, they drove up daily accumulation among spot traders. Although accumulation has slowed at press time, key momentum indicators remained positioned above their respective neutral lines, suggesting that MKR accumulation still surpassed distribution.