How MakerDAO plans to beat the market

- In a challenging DeFi landscape, MakerDAO saw growth with a rebound in DAI supply.

- Introduction of SubDAOs aimed to enhance governance and expand capabilities.

Despite the DeFi sector’s recent struggles, MakerDAO [MKR] was charting a course toward sustainability and profitability. Central to this journey was the enduring popularity of DAI, the stablecoin issued by MakerDAO.

Is your portfolio green? Check out the MKR Profit Calculator

DAImond in the rust

New data illustrated a resurgence in DAI supply over the past few months. This uptick in DAI circulation boded well for MakerDAO’s financial health, especially in the current interest rate environment.

Maker stood out as one of the most resilient on-chain business models in this context.

$DAI supply has rebounded over the last couple months, and Maker's profitability is looking better and better.

Maker looking like one of the best on-chain "business" models in this rates environment.

(NB: Long $MKR) pic.twitter.com/X71tbBhnRa

— Haseeb >|< (@hosseeb) October 9, 2023

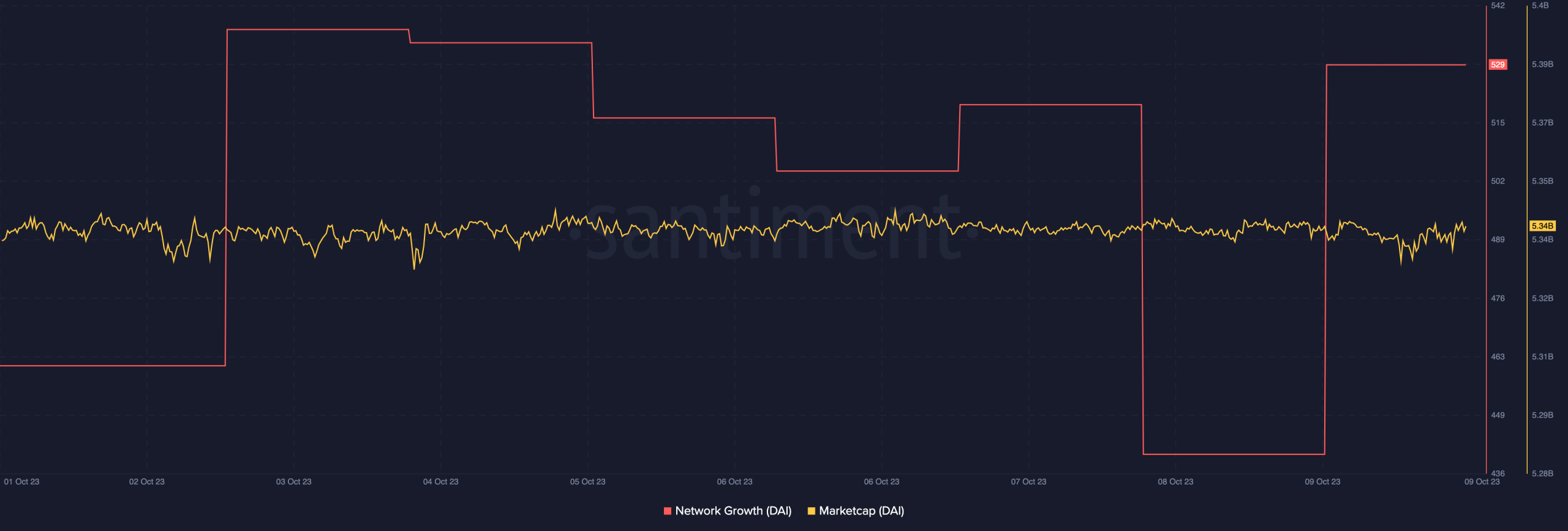

Network growth metrics for DAI were on an upward trajectory, indicating heightened interest among new users. While network growth thrived, the market capitalization remained steadfast.

However, Maker did experience a setback, with the Total Value Locked (TVL) declining by 13.1%.

New plans for MakerDAO

In response to the complex and expanding ecosystem, MakerDAO introduced SubDAOs, a new governance approach.

These SubDAOs would be characterized by their agility, independence, and specialization. They operate autonomously, allowing experimentation and development aligned with specific business objectives.

1)

While broader crypto is in shambles, Maker continues to grow its position as the biggest in DeFiEveryone else shitcoin'd and ponzi'd. Maker built stuff that works & in the last month Dai grew by 400m

Next up is SubDAOs and they will be a gamechanger for growth in crypto pic.twitter.com/2k8caLckyC

— Rune (@RuneKek) September 18, 2023

The MakerDAO community is preparing to launch four SubDAOs, each associated with its SubDAO token distributed via farming to DAI holders.

This innovative move seeks to combine the strengths of MakerDAO’s established presence with the flexibility of nimble, specialized SubDAOs.

Furthermore, SubDAOs will have access to Maker’s Contributor Ecosystem, which comprises contributions from over 30 companies. This includes EVM/Solidity-focused development firms, ensuring that SubDAOs can leverage a pool of talent and resources to achieve their objectives.

Realistic or not, here’s MKR’s market cap in BTC terms

The introduction of SubDAOs not only underscores the DAO’s adaptability but also diversifies its capabilities and offerings. This diversification aligns with the long-term vision for MakerDAO’s sustainability and relevance in the dynamic DeFi sector.

Despite the positive indicators, MKR, the governance token of MakerDAO, was trading at $1373 at the time of writing. The token has maintained price stability but experienced a decline in trading volume over the past week.